Stock market composition changes by the country. United States is tech heavy. Canada is banks heavy. Australia is commodities heavy. Emerging markets were commodities heavy. They turned tech heavy this past decade with the rise of the likes of Alibaba and Tencent. That can change. It will change.

That is the nature of business. That is the nature of innovation and growth. You don’t know what can come out of where in this globally connected world.

And the composition of a country’s stock market will continue evolving with time. Take the United States stock market for example. It is tech heavy today1 but it was energy and financials heavy in the decade of the 2000s. The next decade could be something else. We don’t know. Nobody does.

So, we participate. Not just in our home country but in countries across the globe. We want to own the means of production wherever they exist and by as much as possible. And we make that happen through business ownership.

But when you own a piece of say a German business as an American saver, you not only have to deal with the ups and downs of the goings in that business but also how the dollar does against the euro. Because all you care as an American saver is how much money you are making in dollars as most of your spending is going to be in dollars.

You do not want the value of your dollars to drop against other currencies. When that happens, the stuff you import gets more expensive (exports get cheaper though). That is on top of having to pay top dollars for things like vacations abroad.

But currencies are always on the move with respect to each other.

So, if that German business you own grows profits in euros by 25 percent, the value of that business should also rise by 25 percent (in euros). Not that simple of course but humor me for now.

But if the euro depreciates by 20 percent against the dollar for whatever reason, you are back to where you started with in dollar terms even though the business you own in theory is flourishing.

Too many numbers? Let me elaborate with some more numbers 🙂 .

Say one euro buys one dollar today. Now say that German business you own made 100 million euros in profits this year. And come next year, it grew profits by 25 percent, so it made 125 million euros.

But then say the euro depreciated against the dollar by 20 percent. So, 125 million euros times 80 percent gets you back to 100 million in dollar terms.

So even when that German business earned 25 percent more money, you in dollar terms are where you were last year because the currency moved against you.

On the other hand, if the euro were to rise by 20 percent, not only did that German business earn 125 million euros in profits, you pocketed another 20 percent on top of that in dollar terms because of currency differential.

Return on Foreign Assets ± Changes in Currency Exchange Rate = Total Return on Investment

But many do not like this currency volatility on top of the volatility inherent with owning pieces of businesses (stocks).

So, the real ‘smart’ ones hedge their exposure to currencies when investing overseas. But you should not and here’s why.

- Currency hedgers are usually concerned about short-run performance. They are tactical investors trying to anticipate currency movements while dashing in and out of investments. That works great if you can forecast the moves right every time but one bad forecast and there goes all your previous gains and some more.

- Forecasting currency moves is a fool’s game. The smartest folks with the absolute best training in finance and international economics do not know what the currencies will do next. The value of a nation’s currency depends upon the prevailing interest rates in that nation relative to other nations, on trade surpluses and deficit of that nation, the economic health of that nation and on rumors and truths about natural resources in that nation. Then there are political and military causes that move currencies. There are health and education outcomes that move currencies. In short, a very complex network of factors that interact with each other to make a country’s currency worth what it is today with respect to other currencies. And they change every day. Forecasting these moves right every time is a near impossibility.

- Currency hedging doesn’t come free. It costs real money and that extra cost will wipe away any benefits of hedging in the long run.

- Speaking of the long run, it in fact hurts to hedge your currency exposure. You invest internationally not only to diversify your portfolio allocation but also to diversify into other currencies and economies. Weaker currencies get stronger and stronger currencies get weaker. And then the weaker currencies get stronger again. That is the nature of how goods and services flow in our global economy and you want to participate and potentially profit from that.

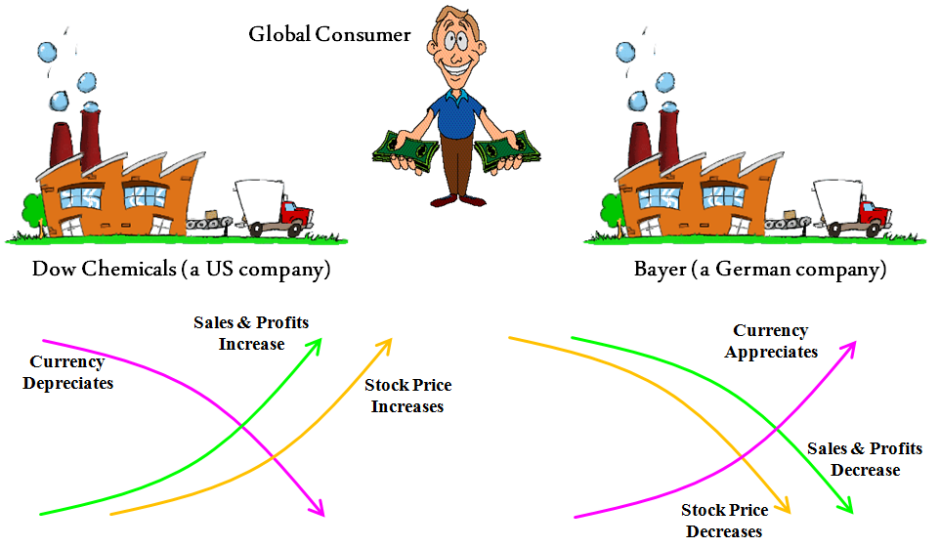

Here’s an example of why you shouldn’t care about currencies much. Say this guy below owns a factory somewhere in India and he needs a certain chemical that’s manufactured by both Bayer (a German company) and Dow Chemicals (an American company). As long as both companies make the exact same chemical, the only thing that determines who gets his business would be the relative exchange rate differences between the rupee, the dollar, and the euro. A company based in a country with a cheaper currency will almost always get that business which then increases that company’s revenues and in turn profits and which then gets reflected in its stock price.

So, a company with a cheaper currency wins and the one with a more expensive currency loses but if you own both in a globally diversified portfolio, that ebb and flow of currency movements washes itself out.

It doesn’t happen overnight, but it does over time. All currencies eventually revert to their natural, long-term means. And you get to profit from that process of reversion as you rebalance your portfolio into investments with temporarily weaker currencies.

So, owning a globally diversified portfolio is ideal but hedging your currency exposure is not.

Thank you for your time.

Cover image credit – Ibrahim Boran, Pexels

1 2022