Mary Hunt profiles three types of people in her book 7 Money Rules for Life on how they handle money and how it impacts their well-being and happiness.

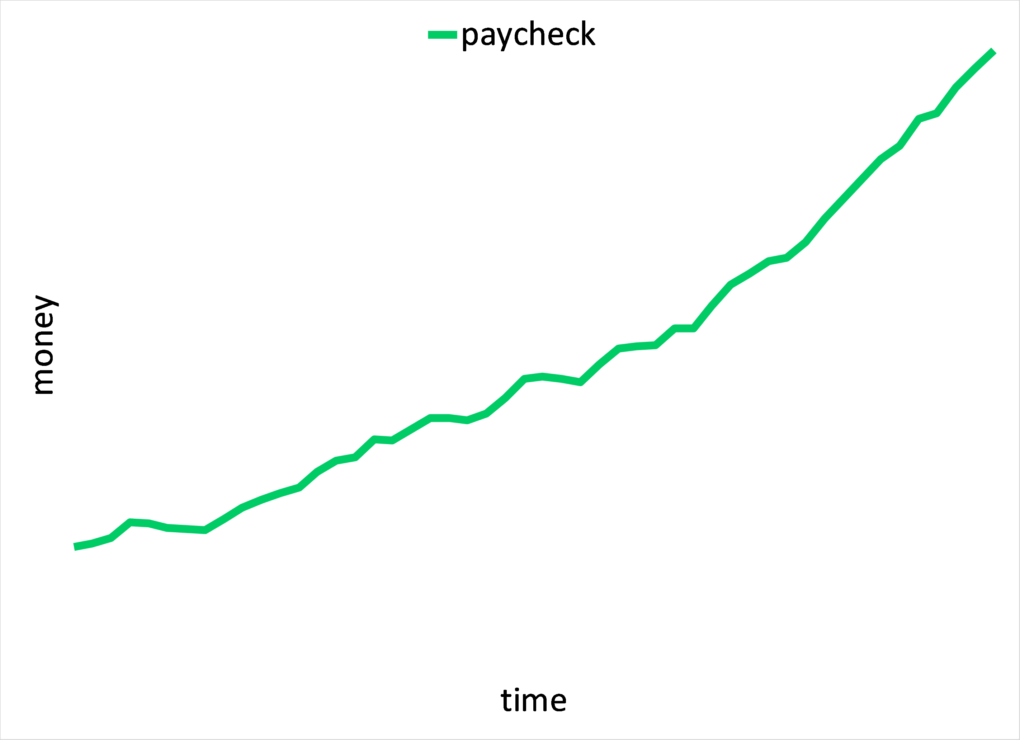

So, say they all made the same kind of incomes since they started working…

Nothing spectacular. Their paychecks rose as the cost of living (inflation) rose. But a big chunk of their paychecks rising came from them honing their respective crafts in a field the economy values.

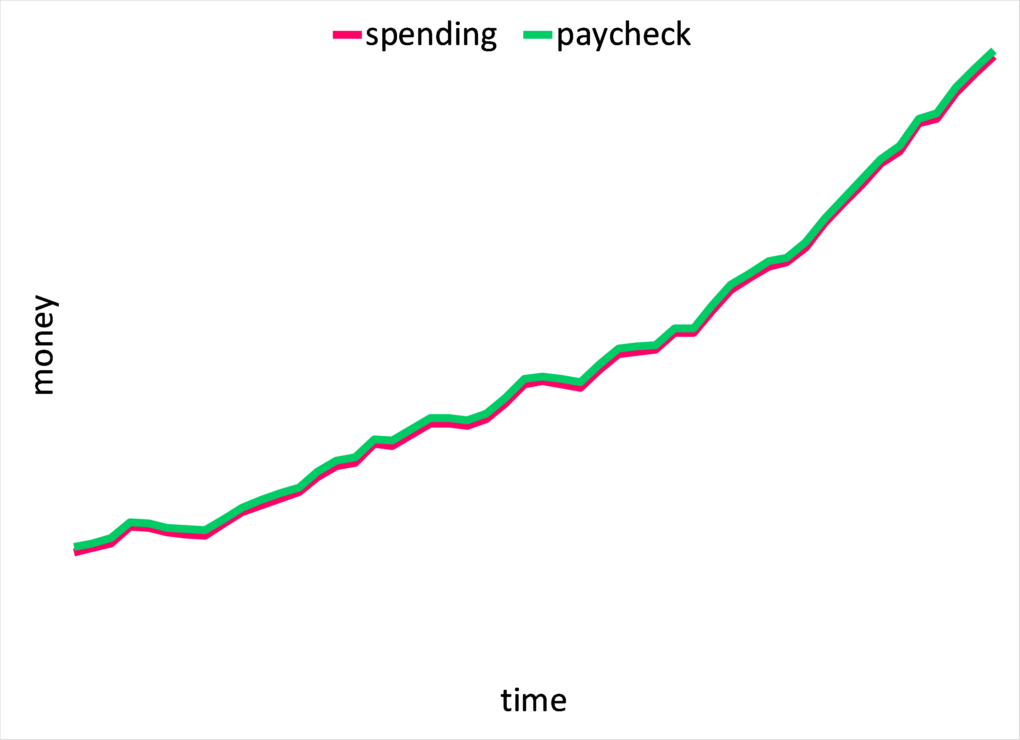

To that income, we now add spending…

This is the first category of people Mary Hunt profiles. Their spending rises as their incomes rise – classic lifestyle inflation. They are doing great in the now and yet are a paycheck away from becoming debt slaves. A good life is hard to give up on.

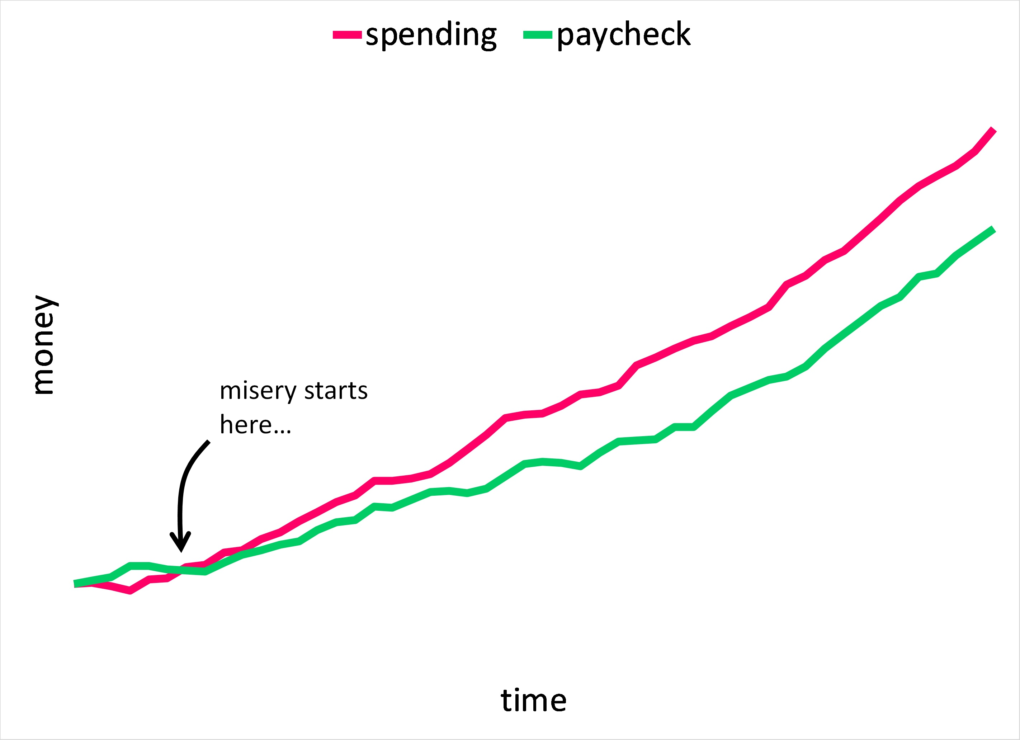

And when the outflow of money is more than the inflow, misery is what we get.

Talk about misery, economist Daniel Kahneman differentiates between what he calls momentary happiness and happiness that is deeper and longer lasting.

Momentary happiness comes and goes. A good night out with friends makes you happy in the then. But the memory of that night eventually fades, and you are back to your initial state.

Lasting happiness, as Kahneman describes, is about life satisfaction. It is built over time through achieving goals and building the kind of life you admire. It is when you get to do your life’s work, free from the financial pressures of doing that work.

So, from the happiness perspective, it is life satisfaction we are after. And if you are lucky, you’ll find your life’s work in the work you are already doing. And if the money is decent, wealth building then becomes a side show. You still need a plan but there is no hurry.

But if you haven’t found your life’s calling, your job number one should be to get to a base-level wealth that generates enough passive income as quickly as possible. And then you can go explore how you want to spend your time.

Charlie Munger once said that like Buffett, he had a considerable desire to get rich – not because he fancied mansions or Ferraris. He wanted independence. He wanted to control his time the way he wished, which is what wealth allowed him to do.

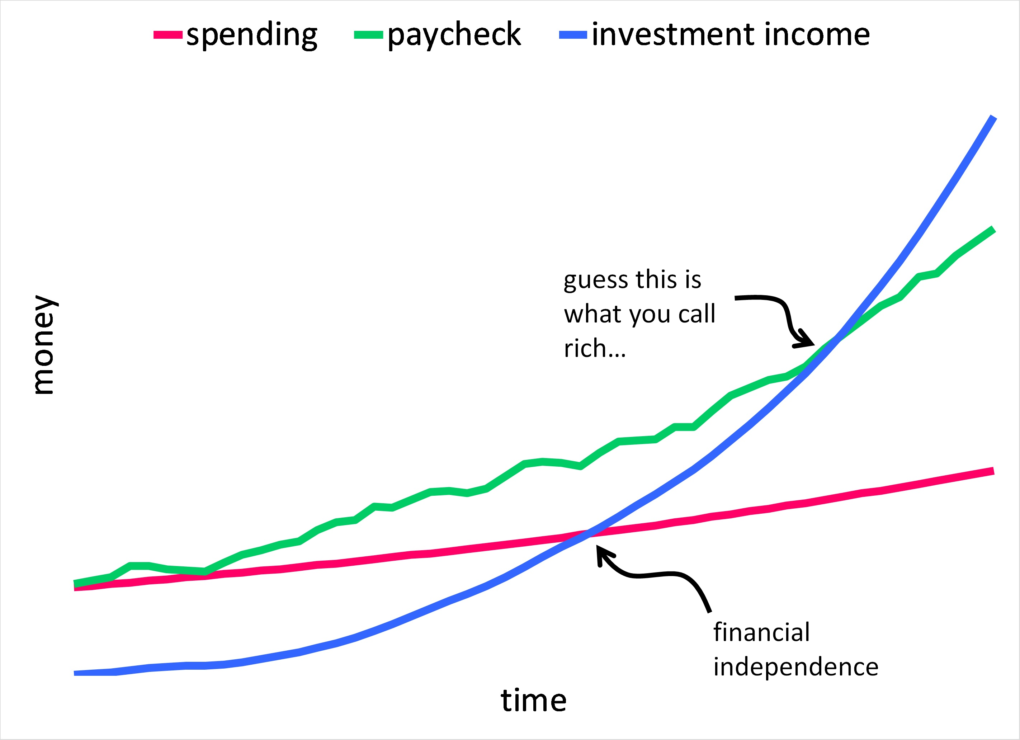

There is this tiny movement of die-hard minimalists who want to bag work in their forties. It goes by the name of FIRE or Financial Independence, Retire Early. Folks in the FIRE camp, though not Munger-rich, have the same Munger mindset. They are the engineer-types, making good incomes but what sets them apart and what sets them free early in life is their ability to sock away half of what they make into savings and investments.

This is what Mary Hunt describes as the third category of people. Though they set themselves up to retire early, they are not the types who give up on work. These are driven folks. Most continue working but now they get to work on their own terms. It circles back to that happiness construct around life satisfaction and having a sense of control.

Use money to gain control over your time, because not having control of your time is such a powerful and universal drag on happiness. The ability to do what you want, when you want, with who you want, for as long as you want to, pays the highest dividend that exists in finance.

Morgan Housel

And it is not like you have to commit to a lifetime of pinching pennies to get to financial independence. You can get there even after baking in a good deal of lifestyle inflation as shown by the gradually rising red curve above.

What you do not want are dramatic ups and downs in spending as your income changes. That is a stressful way to live not to discount the untold amount of psychological damage it does to kids growing up in that environment.

So, where is the most difference you can make on your journey towards financial independence? More income for sure helps but only when spending is kept in check.

NYU professor Scott Galloway talks about a friend of his who runs a 700-person division at a large investment bank. He makes somewhere between five and nine million dollars a year. Between paying for New York city taxes, alimony to his ex-wife, home in The Hamptons and a master of universe lifestyle, he spends almost all of it. He describes him as poor.

Prof. Galloway‘s father on the other hand, between his Royal Navy pension and income from Social Security makes $58,000 a year but spends forty-eight. He describes him as rich. He has got passive income greater than his burn. That is the definition of rich.

Rich is a function of not having to worry at night that the music might stop. And if the music were to stop, you can support your lifestyle without working.

So where is the biggest dent you can make with spending? Housing of course takes up the lion share. Then cars and then comes the other itty-bitty stuff.

Personal finance experts love to rail against spending on the itty-bitty stuff that in the grand scheme of things is inconsequential while the biggest boondoggles of the monthly spend remain unaddressed.

And a lot of it comes down to being able to differentiate between needs versus wants.

Let us go back to housing for example. In the 1950s, the average new home was a thousand square feet. By the 1970s, that home size grew to 1,700 square feet and these days, it is around 2,600 square feet. All this while, the average family size dropped from 3.5 people in the 1950s to 2.5 people today.

So, we have less people living in almost 3x the amount of living space. That is a lot of extra spending that could instead be used as a fuel to shorten the path to financial independence. That does not even count for all the more we pay on everything – property taxes, insurance, electricity, water plus all that time spent cleaning and maintaining that extra space.

Big homes also mean more stuff so a perpetual drain on our wallets from all angles.

And cars? How did we normalize buying $50,000 cars?

Most of the needless spending we get seduced into doing is all due to our attempts at keeping score. We want to live, drive and dress better than our neighbors or whoever we get into this comparison game with.

Comparison is the death of joy.

Mark Twain

Carol Graham in The Pursuit of Happiness talks about what constitutes the economics of happiness. Stable marriage, good health and enough income is what it takes to be happy.

What? Is income ever enough? Why would making more money not make us happier?

That is because the relationship between money and life satisfaction is not linear. Income matters to well-being only up to a point. Beyond that, other people’s incomes start to matter more. So, a rise in other people’s income hurts our happiness. That of course is dumb.

The truth is that folks with enduring personal finance success are inclined to not give a hoot about what others think about them. And this is where our focus in life should be if happiness and life satisfaction is our goal.

On the surface, personal finance looks like a field that helps you optimize money. Once you peel back the layers, you see that it’s actually a field that helps you optimize happiness. Money is simply the tool it uses to do so.

Morgan Housel

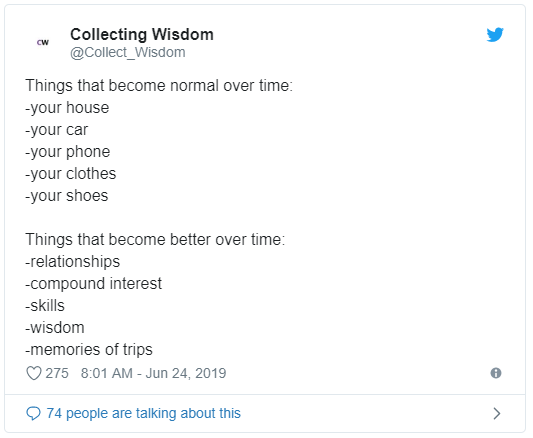

And finally, this tweet. It says in a few words that I’ve been trying to say all along.

A big part of happiness is reaching FI (financial independence), and FI is mostly a function of being happy with what you have, spending less than you make and letting time and compound interest do the heavy lifting. Plus, relationships and experiences but never things.

Thank you for your time.

Cover image credit – Pixabay