Stock market composition changes by the country. United States is tech heavy. Canada is banks heavy. Australia is commodities heavy. Emerging markets were commodities heavy a few years back. They turned tech heavy with the rise of the likes of Alibaba and Tencent.

That can change and it will change. That is the nature of capitalism. You don’t know what can come out of where in this globally connected world.

Which means we must participate, not just in our home country but in countries across the globe. We want to own the means of production wherever they exist. And we make that possible through ownership stakes in businesses.

But when you own a piece of say a German business as an American investor, you not only have to deal with the ups and downs of the goings in that business but also how the dollar performs against the euro. Because all you care as an American investor is how much money you are making in dollars as most of your spending is in dollars.

But currencies are always on the move with respect to each other. So, if that German business you own grows profits by 25 percent, the value of that business should also rise by 25 percent on the German stock exchange.

But if the euro depreciates by 20 percent against the dollar for whatever reason, you are back to where you started in dollar terms, even though the business you own is flourishing.

Too many numbers? Let me explain with more numbers 🙂 .

Say one euro buys one dollar today. Now say that German business you own made 100 million euros in profits this year. And come next year, it grew profits by 25 percent, so it made 125 million euros.

But then say the euro depreciated against the dollar by 20 percent. If you do the math, 125 million euro after 20 percent decline in the value of euro against the dollar means that business made 100 million in dollar terms.

So even when that German business earned 25 percent more money, you in dollar terms are where you were last year because the currency moved against you.

If the euro on the other hand were to rise by 20 percent, not only did that German business earn 125 million euros in profits but you also pocketed another 20 percent on top of that in dollar terms because of the euro appreciating against the dollar.

Return on Foreign Assets ± Changes in Currency Exchange Rate = Total Return on Investment

But people don’t like this added currency volatility on top of the volatility inherent with owning stocks. So, the ‘smart’ ones hedge their exposure to currencies when investing overseas.

But you should not and here is why…

- Currency hedgers care about short-term performance. They are tactical investors trying to anticipate currency movements while going in and out of investments. That works great if you can forecast the moves right every time but one bad forecast and there goes all your past gains and more.

- Forecasting currency movements is a fool’s game. The smartest folks with the absolute best training in finance and international economics do not know which way the currencies will move. The value of a nation’s currency depends upon the prevailing interest rates in that nation relative to other nations, on trade surpluses and deficits of that nation, the economic health of that nation and on rumors and truths about natural resources in that nation. Then there are political and military causes that move currencies. There are health and education outcomes that move currencies. In short, a complex network of factors that interact with each other to make a country’s currency worth what it is today. And that changes every day. Forecasting these moves right every time is a near impossibility.

- Currency hedging does not come for free. It costs real money, and that added cost will wipe away any benefits with hedging in the long run.

- Speaking of the long run, it in fact hurts to hedge your currency exposure. You invest internationally not only to diversify your portfolio but also to diversify into other currencies and economies. Weaker currencies get stronger and stronger currencies get weaker. And then the weaker currencies get stronger again. That is the nature of how goods and services flow in our global economy and you want to participate and profit from that.

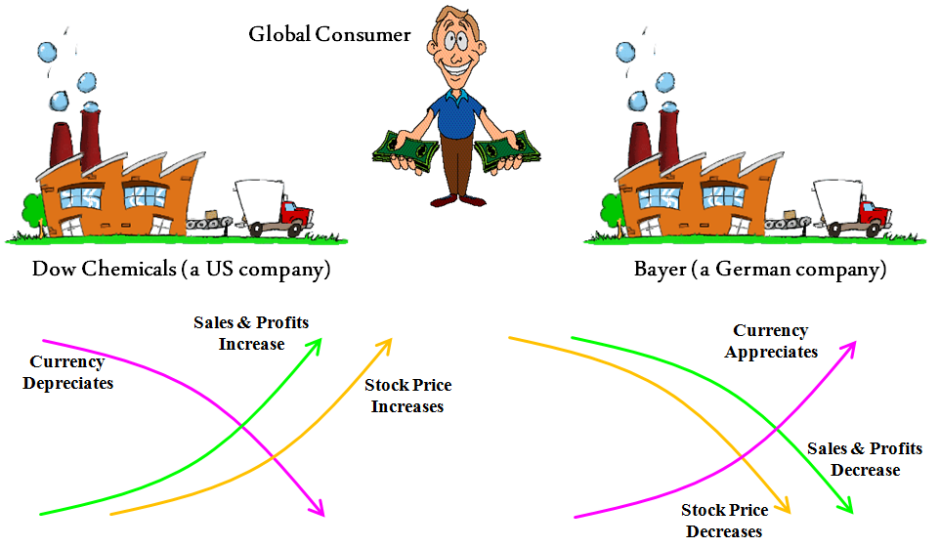

Here is an example of why you shouldn’t care about currencies. Say this guy below owns a factory somewhere in India and he needs a certain chemical that is manufactured by both Bayer (a German company) and Dow Chemicals (an American company). As long as both companies make the exact same chemical, the only thing that decides who gets his business will be the relative exchange rate differences between the rupee, the dollar, and the euro. A company based in a country with a cheaper currency will almost always get that business, which then increases that company’s revenues and profits, and which then gets reflected in its stock price.

So, a company with a cheaper currency wins and the one with a more expensive currency loses but if you own both in a globally diversified portfolio, that ebb and flow of currency moves washes itself out.

It doesn’t happen overnight, but it does in the long run. All currencies eventually revert to their natural, long-term average. And you get to profit from that process of reversion to the average as you rebalance your portfolio into investments with temporarily weaker currencies.

Owning investments across the globe is great but hedging the currency exposure is not.

Thank you for your time.

Cover image credit – Ibrahim Boran, Pexels