Before the Great Depression of 1929, the United States experienced a mini, almost forgotten depression towards the tail-end of World War 1 (1920-1921). That mini depression was partly caused by the government slashing its expenses to balance its budget considering the wartime debt the country took on.

That plus rapidly rising prices brought upon by pent-up demand caused by the returning soldiers forming families meant inflation was running hot. That then forced the relatively nascent Federal Reserve to jack up interest rates in the middle of a deep recession. Which then caused the mini depression.

Somewhat similar decisions were made during the actual Great Depression of the late 1920s. The Federal Reserve then failed to act as the lender of last resort to the failing banks.

Plus, the mistake of raising interest rates amid that calamity is what turned that depression into the Great Depression.

At a 2002 conference to honor economist Milton Friedman on his 90th birthday, Ben Bernanke, an avid student of the Great Depression who will later go on to run the Federal Reserve had this to say:

Regarding the Great Depression…we did it. We’re very sorry. We won’t do it again.

Bernanke that day acknowledged publicly what many economists have long believed – the Federal Reserve’s mistakes at the time contributed to the worst economic disaster in American history.

So, with that as a backdrop, every time an economic mess ensues, the central bank in this country and banks around the world jump into action by backstopping whatever caused that mess.

And that generally means spending by increasing the money supply in some form or the other. Some say this is socializing losses and privatizing profits but that is the system we have for now. No one wants a repeat of the Great Depression.

But when that new money floods the system and starts chasing a fixed amount of stuff, prices rise (inflation ensues).

And that is when we see gold bugs come out of the woodwork to prop up the ‘only’ bastion of inflation-hedge that exists, according to them.

But is gold an inflation-hedge? The data proves otherwise.

It must be an investment then? But what is an investment? Or better yet, how do we value an investment?

The value of an investment today is the sum total of all the profits that investment is going to produce out into the future, discounted to the present at an appropriate discount rate.

And since gold does not produce profits, it is not an investment. It cannot be an investment. That is regardless of what price it trades at today or will trade at in the future.

Plus, it costs money to buy (everything does) but then it costs even more to store and protect.

And when it comes time to sell that supposed investment, all we are looking for is for someone to come along and pay a price higher than what we paid for it. That is a classic Ponzi-like situation. Gold’s investment thesis is all belief with no underlying anything.

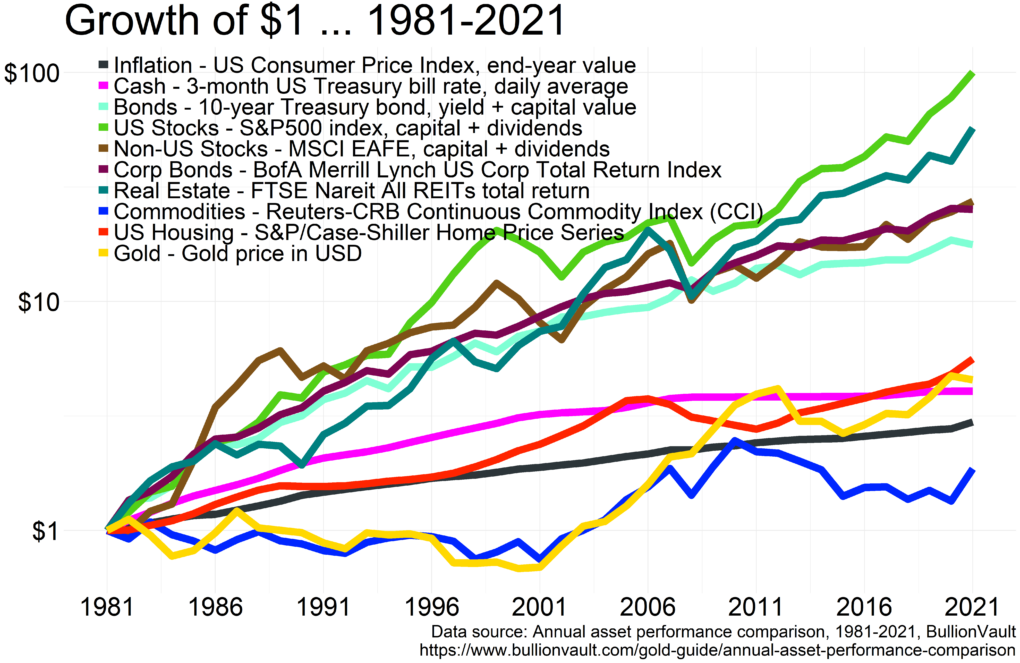

One more quick glance at the plot above (the y-axis is log-scale) and we see a clear segmentation between two sets of curves. The top set is what I would categorize as investments. They include stocks, bonds, and real-estate investment trusts (REITs) which are like stocks that happen to own cash flowing rental real estate.

The bottom set of curves are mostly consumption items. They include cash, commodities, gold (a subset in the commodities space) and housing. Cash and commodities barely matching inflation is expected. But housing? We are told our homes are investments.

They are not. And they should never be allowed to become investments.

Homes as investments stagnate economies, induce sprawl and cause misery all around. And they can eventually end up as somewhat Ponzi-like situations because expensive housing impacts family formation.

And when we don’t have new people replacing the old, we run out of people who’d buy the homes we own. You want to see a live example of how that eventually plays out, just look at Japan. And South Korea. And Hong Kong. And China and someday the whole-wide world.

Back to housing in the data above, that is looking at housing in aggregate, not that one piece of property in San Francisco. And beyond a certain price point, even San Francisco becomes unsustainable. We cannot make life for businesses harder, which is what expensive housing does.

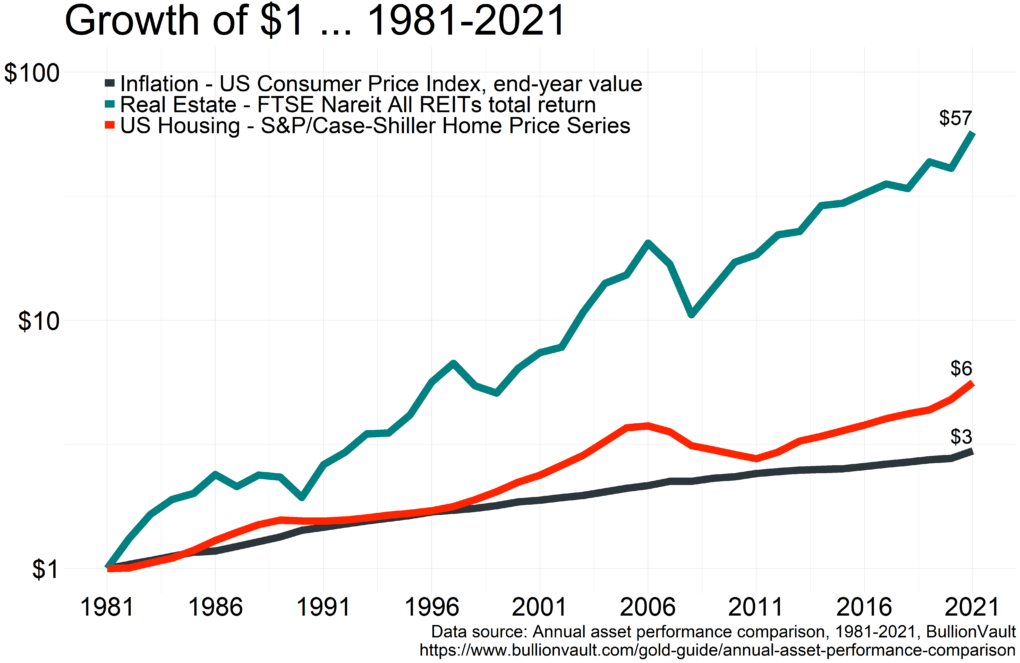

There were far too many curves in the data above but just to reiterate that point, I have separated out inflation, the performance of REITs and housing.

So, a big difference.

But why do REITs outperform housing by so much? The underlying asset is similar (not the same) so what explains the difference?

I think one big reason that REITs outperform housing is because REITs are businesses (stocks) that just happen to own rental real estate. But structurally, they are still run like businesses.

REITs don’t fall in love with the properties they own. The numbers must work. Either there is a return on an investment or there is not. Mostly rational actors making rational, business-like decisions.

We don’t act the same with our homes because we don’t just treat our homes as investments. We fall in love with them. And we tend to overdo everything once we have fallen in love.

Also, REITs don’t just own apartments. They also own warehouses, datacenters, office parks, hospitals, shopping malls…literally, any building you are likely to be in besides an owner-occupied home. If you see a structure, assume there is a REIT behind it.

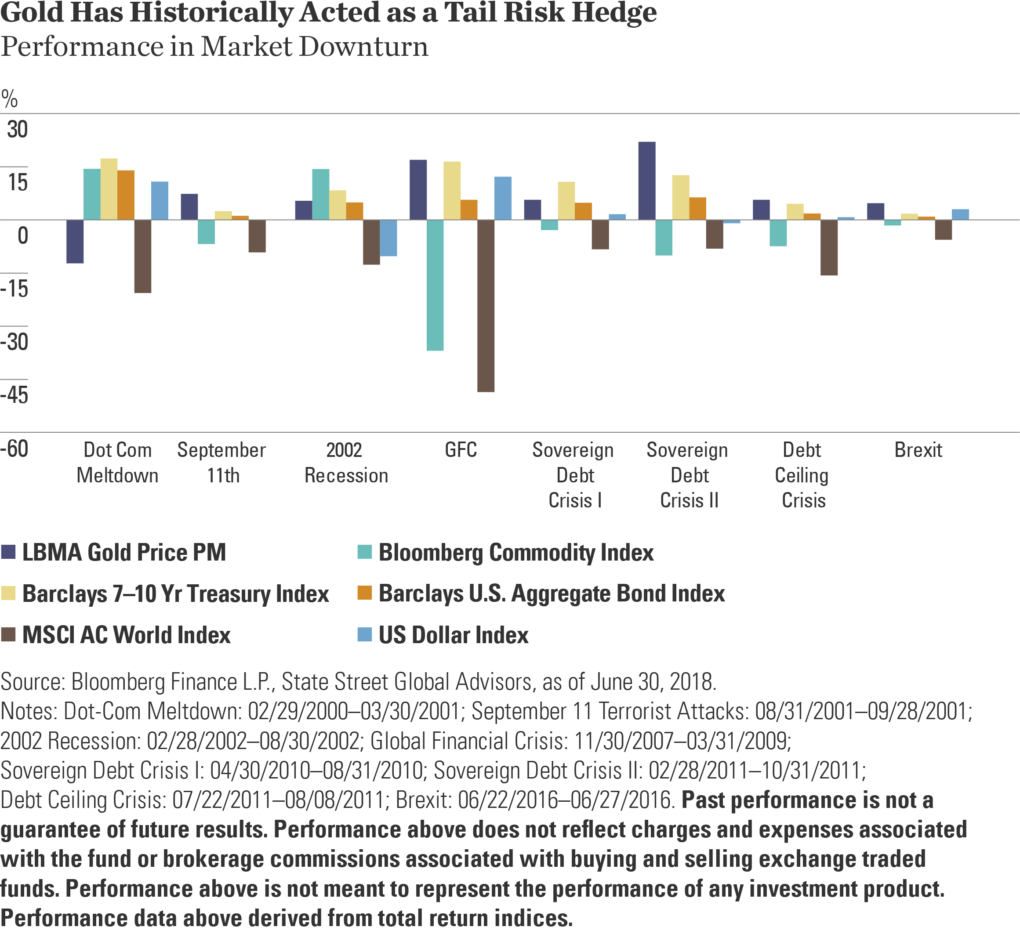

But back to gold, if it is not an inflation-hedge, if it is not an investment, it must then be an ideal tail-risk hedge, right?

A tail-risk hedge is relying on an asset of last resort. That is, when and if our financial system fails, the only thing that’ll be left standing is gold, so the theory goes.

And the data above seems to imply that gold as a tail-risk hedge works. I don’t buy it because tail-risks literally mean an end of the world-type situation which none of the episodes described above were or came to be.

And what are you going to do with that bar of gold when the world ends? Nothing. Nobody would care for it.

And how much of your total money are you willing to stake in gold? Five percent? Ten percent? If the remaining 90 percent goes to zero, does it even matter?

No amount of opining on gold would be complete without citing a few of the choicest quotes from the goat himself.

I will say this about gold. If you took all the gold in the world, it would roughly make a cube 68 feet on a side. Now for that same cube of gold, it would be worth at today’s market prices about $9.6 trillion dollars – that’s probably about a third of the value of all the stocks in the United States. For $9.6 trillion dollars, you could have all the farmland in the United States with $200 billion output per year, have about 16 Exxon Mobils, each generating $40 billion of profit per year and still have a trillion dollars of walking-around money. And if you offered me the choice of looking at some 68 foot cube of gold and looking at it all day, and you know me touching it and fondling it occasionally…Call me crazy, but I’ll take the farmland and the Exxon Mobils any day.

Warren Buffett in a 2011 letter to the shareholders of Berkshire Hathaway

Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.

Warren Buffett in a 1998 speech he gave at Harvard University

Gold is not only a bad ‘investment’, but it acts as a terrible choke on an economy. Gold as an asset will never produce anything. Money, once converted into gold, gets locked up forever with very little of it recirculating back into the economy.

Free flow of capital is vital for economic growth and prosperity. Access to capital helps entrepreneurs turn their ideas into products and services that benefit all of us. The businesses that are launched grow, create jobs and they generate the much-needed tax revenues for all stakeholders.

Gold does none of those things but then it is not completely useless. It is a noble metal (resistant to corrosion) with wide-ranging applications in industry and medicine. It is unfortunate that the hoarders and the ‘investors’ have deemed it an asset class with the rest of us left scrambling to find alternatives to this very valuable commodity.

The other utility that gold possesses is of course consumption in the form of jewelry. It is again unfortunate but then it looks so darn pretty.

So, buy those gifts for the ladies in your lives but don’t think for a moment that you are investing.

Thank you for your time.

Cover image credit – Farddin Protik, Pexels