The wonders of free market capitalism are all around us. We are in the business of backing the businesses that lets capitalism work its magic through your savings, a win-win for all.

We believe in long-term ownership of investments. We use these investments to build a pension plan around your life goals.

And we manage that plan like how a pension plan would. Your plan will evolve as you pass through the many life stages but big sudden changes based on short-term market events is what we don’t do.

And won’t do.

We invest as if the Efficient Markets theory holds. Markets though are seldom efficient – in the short run. But over decades long timeframes that we care about, the price and the value of an investment must converge. And we invest with that in mind.

Talk about value, we must be able to derive a value for any investment we populate your plan with. Assets must produce cash flows or have a prospect of producing cash flows. Anything that does not conform to that, we deem that as speculation.

And we won’t speculate with your money.

On investing in real estate, you likely own a home. That’s plenty exposure already. Plus you’ll own quite a bit of real estate indirectly through your investments and through publicly-traded REITs that may belong in your plan.

And we’ll continue to explore direct real estate investing but it is a business. So we’ll have to run it like a business. But we are in the business of putting other businesses to business so unless the deal is more than spectacular, we are not doing it.

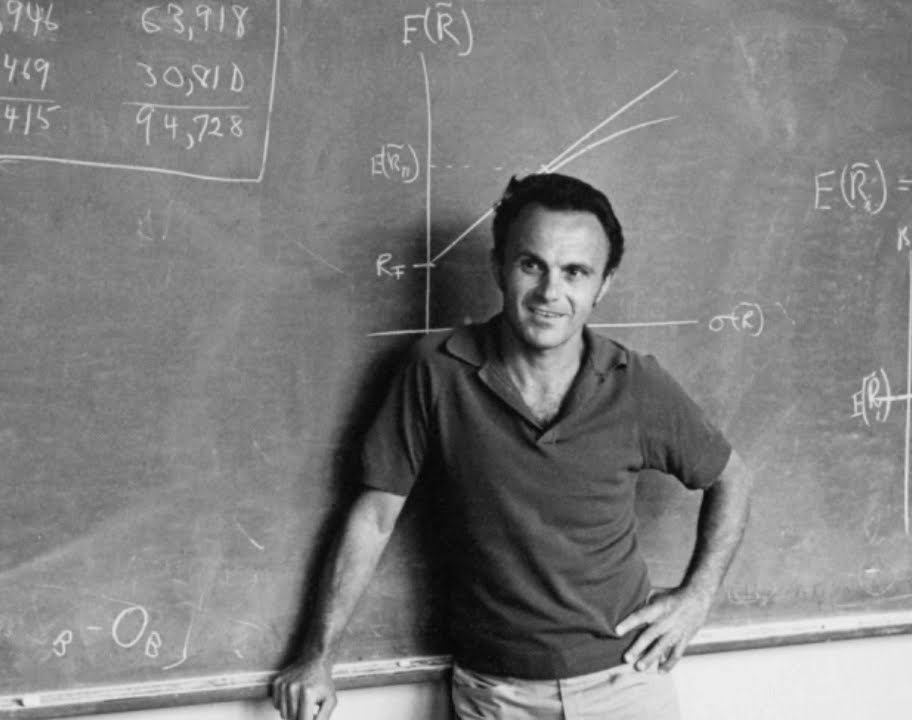

On risk, we take the kind of risks that we can statistically model for. Modern Portfolio Theory (yes, fancy technical), a risk-return optimization framework is the backdrop we use to manage your plan. There’ll be tweaks along the way but never any big deviations.

Markets will suck from time to time and sometimes they’ll suck for years.

And since you’ll be an active participant in the markets, your portfolio will suck along. That is the nature of the game.

But you must stick around and continue to feed your plan because that eventual recovery, if you were to persevere, is what will shorten your time to financial independence.

Process is what we control. Outcomes are seldom in our control. Getting the process right is where most of our efforts lie. We then let the global stock and bond markets do the work.

But your understanding of the process is critical for the long-term survival of your plan.

Talk about process, we don’t compartmentalize. Every account talks to all other accounts you own as a family unit. We weave all of that into a simple, easy to understand, one-page plan. No gobbledygook, no obfuscation, no confusion. All you need to know about your money in a mere 5 minutes.

Over time, this plan becomes a living, breathing document that you’ll get regular updates on. It’ll be a blueprint of your financial life.

We don’t hold your investments. A 3rd-party custodian that you’ll own accounts at, holds all your investments. That’s to avoid any potential fraud-type situations aka Bernie Madoff.

The custodian we use has all the asset protection features you’ll likely ever need.

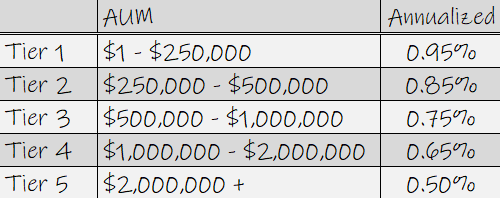

We are your fee-only financial planners. We charge based on Assets Under Management (AUM) that reside at the custodian we use. We have no incentive to pitch any product or service. We have designed all of it to be as conflict of interest free as we can make it.

Advice and planning is our focus whether that be setting up your retirement plans at work, evaluating life insurance needs, employee benefits, stock options and RSUs, college savings, HSAs, help with estate planning & taxes – everything is part of the deal. Your cost…

And depending upon your situation, your all-in costs can only be lower than what’s quoted above.

Thank you for your time and thank you for trusting us with your precious savings.