Benjamin Graham is considered the father of value investing. In his seminal book the The Intelligent Investor, he lays out approaches on how to pick stocks that are selling for less than their stated value. Graham‘s most famous student, Warren Buffett took some of the learnings and applied it to a style called Cigar-Butt investing where he bought discarded stocks that had one last puff left and were selling below fair price. He would buy these short-term mispriced stocks, wait for the market to reprice them and sell, making a quick buck in the process.

But discarded stocks are discarded for a reason. Cigar-Butt style businesses are not the kind of businesses you want to hold for the long-term. And real wealth lies in long-term ownership of quality businesses bought at fairer prices while waiting for cash flows these businesses generate to flow to you. Buffett later revised his approach by mixing Graham‘s teachings with teachings of other investing greats and used his business savvy to build Berkshire Hathaway into what it is today – a company so remarkable, a company so shareholder-friendly that there is none around.

One of Graham‘s key metric to picking stocks was the price to book ratio. The more physical assets a business has, the more its book value. And the lower the price you pay per dollar of book value, the better a buy.

But had you followed that, you would have missed out on all the Microsofts and the Googles and the Apples of the world because these asset-light businesses do not have much book values. Their value is in their products, in their people, in the systems they have built, in the market footprint they cover, in the brand they maintain, all these are not part of the book value calculation.

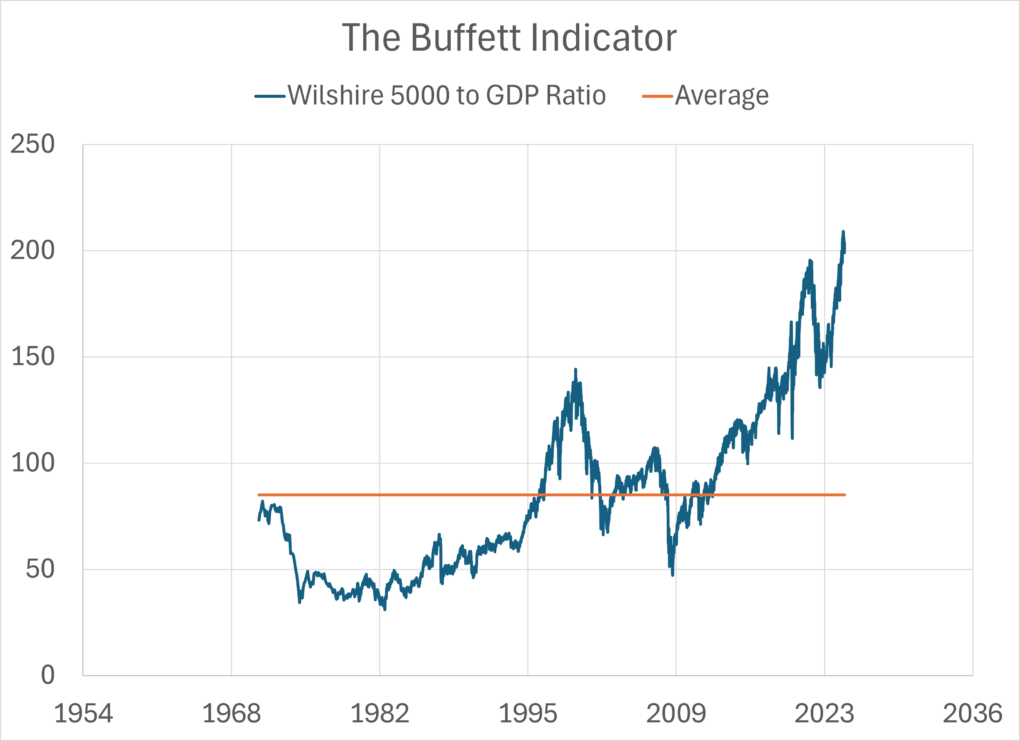

So, metrics evolve as business landscape change. There is this thing called the Buffett Indicator that tells us how expensive or cheap the market as measured by the Wilshire 5000 index is compared to the GDP of the United States. The higher the ratio, the more richly valued the stock market is.

But that is again an increasingly flawed metric because…

- GDP or Gross Domestic Product in economic terms is considered a flow that measures the total value of goods and services produced in an economy in a given year. The stock market on the other hand is a stock metric that measures the total market value of all businesses since their inception. They are two different things and comparing them is almost meaningless.

- U.S. businesses these days get more of their sales from outside the U.S. than they did in the past. GDP does not include those sales. That means the numerator which is the market value of all Wilshire 5000 companies reflects a larger addressable market than what the denominator, the GDP captures.

- And the quality of businesses has changed. Wilshire 5000 in 1975 is not the same as Wilshire 5000 in 2025. They have two totally different kinds of businesses. Manufacturing was a bigger part of the economy and hence the stock market back then whereas now, the top businesses are asset-light and uber-profitable.

The other famous metric that is increasingly unreliable is the price to sales ratio. Price again is the market value of a business and sales is the annual revenue that a business generates in a given year. But how can we compare the price to sales ratio of an automobile business from the 1970s to a software business today?

These metrics hence should be taken in context. Markets are not static. And it is safe to assume that markets are long-term efficient. They take all these into account and price businesses accordingly.

But the best part for us is that we don’t need to guess whether it is the right time to invest or not. We have a 50-year horizon and that is plenty of time for things to sort themselves out.

The only thing we should do is to live a great life while continuing to feed our plans. And knowing that you have a plan and are making progress helps. It makes your life structured creating that mental space that you can divert to other important things in life. And it relieves you from worrying about things that don’t need worrying about.

Thank you for your time.

Cover image credit – Andres Ayrton, Pexels