What you feel is a good investment because of what you see and hear is seldom a good investment. A good investment is usually the one you don’t hear much about. Or if you do, you only hear disgust and shame.

Because when an investment feels disgusting to own, its perceived risk is higher and because of that, the availability of capital (money) flowing into that investment gets scarcer. It becomes an undercapitalized situation. No one wants to buy into its stock or bond.

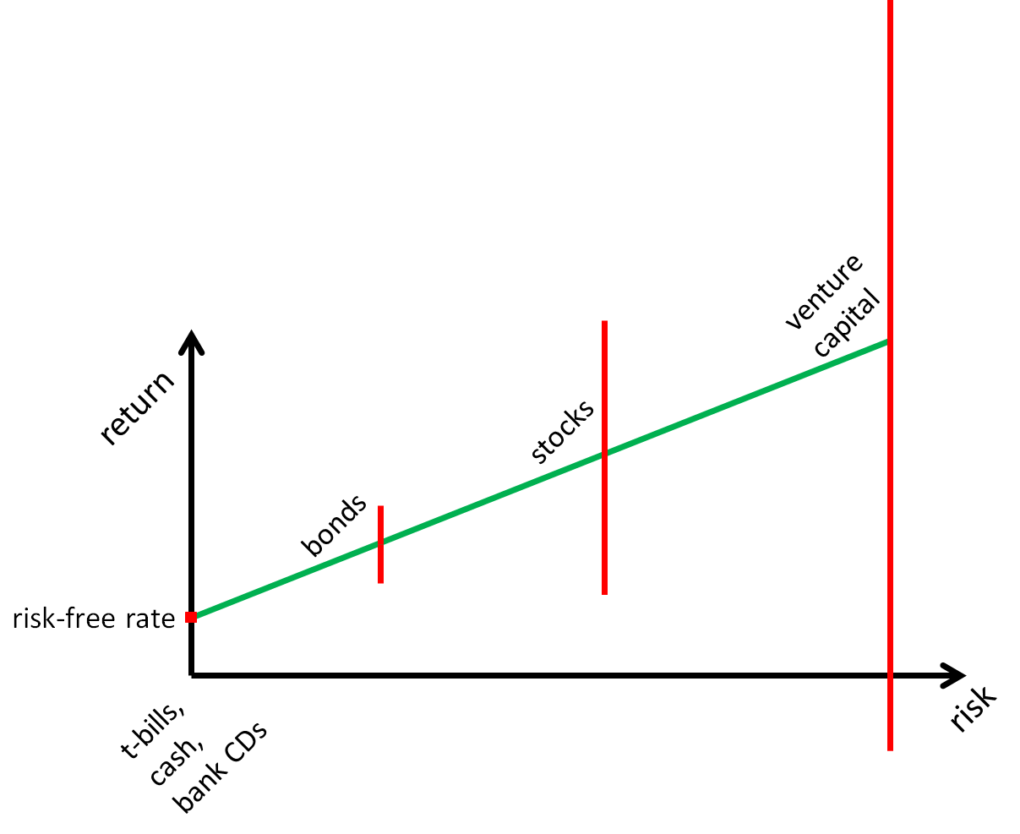

To attract capital, that investment needs to offer a better rate of return. Expected return hence for that investment is higher because the risk is higher. That is another way of saying that future cash flows for that investment are discounted at a rate higher than that for a perceivably less risky investment.

Risk is about the range of expected future outcomes (returns). Bank CDs are the safest. Bonds are riskier. Stock investments are the riskiest. The venture capital bar is added for completeness sake but is not considered investable unless you are running a pension fund or an endowment.

Bull markets in stocks see returns on the higher side of the average (green line), bear markets on the lower. And when a hot new theme like artificial intelligence comes about, stock prices in that corner of the market tend to go nutty. Everyone wants to buy into that theme because it is perceived as a guaranteed money-maker. Investor capital follows by the truckload, and it quickly becomes an overcapitalized situation.

Richard Bernstein of Richard Bernstein Advisors describes this as being in a town with a thousand banks and one borrower. And when you are the only borrower and you have all these banks competing for your business, you are going to set the interest rate. And you are going to make out like a bandit because you are going to set those rates to be as low as possible.

Turn it around and now say you are the only banker in a town with a thousand borrowers. You are going to mint it because you get to set the interest rate on each and every loan. And you are going to set them as high as possible.

So, when it comes to the hot themes of the day, it is hard to argue that they are starved for capital. There are a thousand banks flooding the market with capital.

And it is simple supply and demand of capital that sets the long-term return on investment. So, if you want to score big or if you don’t want to be left holding the bag, you want to look for situations no one wants to invest in.

The question you should be asking hence is that everyone knows about artificial intelligence. It is going to change the economy. And quite a lot of that and more is likely already priced in.

So where is that opportunity where you get to be that one banker against a thousand borrowers? That is likely staring in your face in some corner of your plan and that is where you’d want to invest.

Thank you for your time.

Cover image credit – Jplenio, Pexels