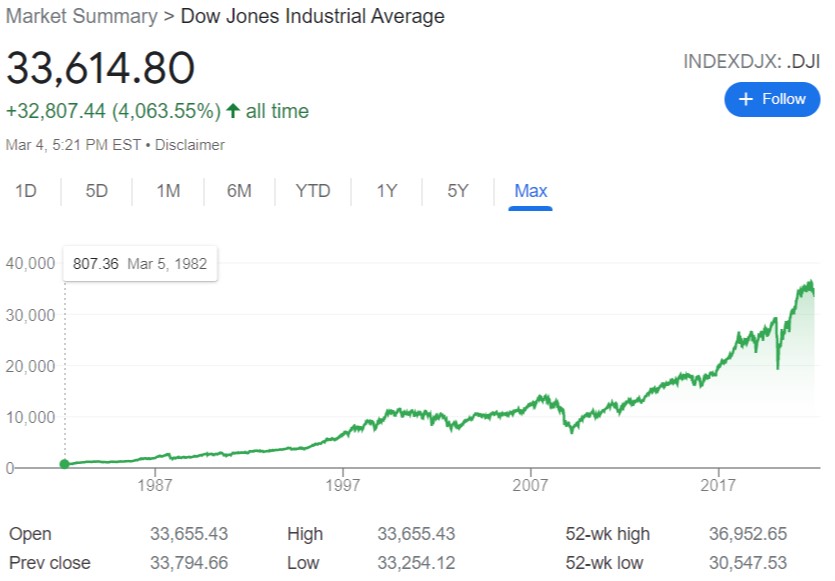

A wise woman once said that when in doubt, zoom out. So zoom out I did. This is what a 40-year chart of Dow Jones Industrial Average looks like…

Add in reinvested dividends and we are looking at an easy double of that.

Or if we want to get exotic, here is what the Indian stock market did in a typical investor’s lifetime.

There are peaks and valleys and sometimes those valleys don’t recover for years. That is the nature of the game.

We can control the depth of those valleys by adding bonds. The ride will be smoother. We won’t make as much but that is not always the goal.

But if we can afford the occasional hits to our savings and measure our time horizon in decades, a big tilt towards stocks is what we need.

Some perspectives hence are warranted the next time markets show their usual manic-depressive side…

- If you’ve owned stocks since the 2000s or the nineties or the eighties and if you held on, you did well. Just peek at what your portfolio has done over the very long-term. That outsized gain you see is the very reason you were investing in the first place.

- You can’t dance in and out of the markets to avoid downturns. Because you cannot predict when they will come but you do know how absolutely crushing a blow it will be to your long-term wealth if you miss just a few of the market’s best days. So think long and hard before making any hasty decisions. Best yet, follow the plan blueprint that you have been following since saner times.

- Your goals don’t change that often and nothing about any short-term events changes the fundamentals of capitalism. There is a reason you own a heavy dollop of stocks. Volatile as they are, but the equity risk premium stocks deliver over other investments in the long run is what is going to get you to your goals.

- Not everyone can take the heat and maybe you are one of them. But think about what else you are going to do with your savings. When you own stocks, you own cash-generating businesses. The world runs on businesses. If you still cannot take the heat, there is no harm in restructuring your investments for a less volatile portfolio, assuming you can still meet your plan goals.

Our best defense against doing anything rash with our money is to know what we own and why we own it. Once we have conviction, blissful ignorance is the best strategy.

And who would not want to own a piece of this?

My litmus test for whether the world economy will create value over time is asking the question – Did more people wake up this morning seeking to solve problems and make life better for others than do the opposite? And the answer is still firmly “yes”.

Morgan Housel, Collaborative Fund

This is a decades long game. Sticking to our plans in times of turbulence is our only option.

What am I doing with my surplus cash? I am buying. I am always buying.

My daughters are buying. And they’ll always be buying.

So should you.

Thank you for your time.

Cover image credit – Wendel Moretti