The money that you have been contributing to your 401(k) plans has not been taxed yet. You have deferred the taxes that were due for years but at some point, the government wants its share. And that tax applies to all the money that is in the plan but not all at once.

The earliest you can start taking money out of your plan is when you turn 59 1/2. Thank the government for adding the 1/2 year to make things unnecessarily complicated but once you turn 59 1/2, you can take money out of your pre-tax accounts like 401(k)s and IRAs penalty free. If you take money out before that, you pay a 10% early withdrawal penalty. Taxes are still due on the money you take out.

You can take as much of your money out from your plan in a given year but whatever you take out, it is counted as income on which you pay the required tax. You will receive a 1099-R that will state the amount you took out that you will then file with your tax return.

You can choose not to take the money out at 59 1/2 years of age and let it continue to grow tax deferred. But the government isn’t going to allow you to defer taxes forever. You must start taking money out of your pre-tax accounts when you turn 73 or at the latest by April 1st of the year after you turn 73.

I would not wait till April 1st of next year once I reach age 73 because then I would have to take two RMDs that year (the first by April 1st for the previous year and the second by December 31st for that year). That would be bad, taxwise.

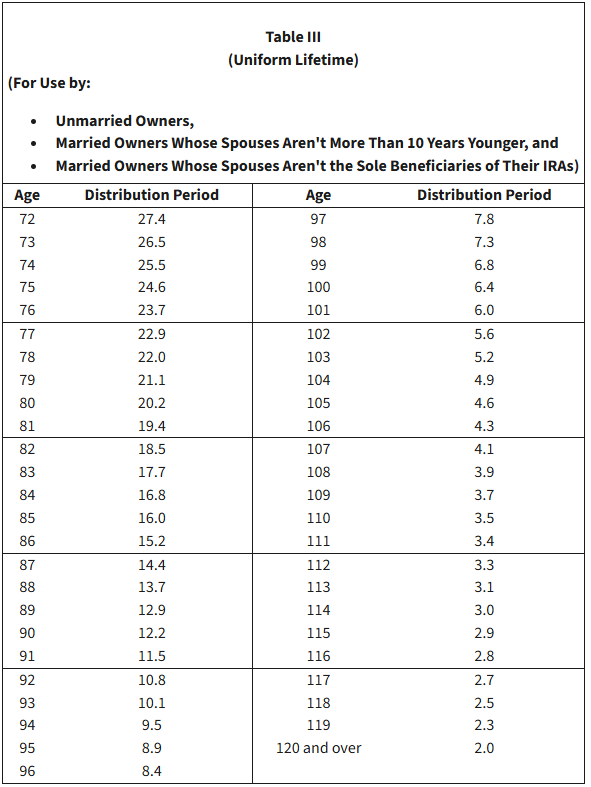

The minimum amount you must take out is called the Required Minimum Distribution (RMD) and it follows a set schedule defined by the IRS. You take that money out, pay the required taxes and move on.

So, say you are 73 and the balance in all your pre-tax accounts as of December 31st of last year is a million dollars. You’ll then divide that number by 26.5 which means you must withdraw a minimum of $37,735 from your accounts that year.

If you don’t take your RMDs on time and in the right amount, the penalty is bad. For every dollar you don’t take out when you were supposed to, the IRS charges a 25% penalty tax. That would be an additional tax of 25% of $37,735 = $9,433 on top of the income tax you’ll pay on $37,775. So do it right and do it on time.

And come next year, when you are 74, and say the IRA balance, even after taking the prior year distribution, stays at a million dollars by December 31st of that year, your RMD would be the million divided by 25.5 (which comes to $39,215) and so on for every year after that.

You’ll have to calculate your RMD for each IRA and employer-sponsored plan like a 401(k) separately. When you take RMDs from your IRAs, you can withdraw them from any account you choose.

For example, if you have two IRAs and one has an RMD of $10,000 while the other has an RMD of $20,000, you can take the entire $30,000 from one of the IRAs or you can take a certain amount from each, it is up to you as long as the total adds up to $30,000.

Employer plans like 401(k)s work differently. You must take each RMD amount from the specific account it was calculated for. So, if you have three different 401(k)s, you’ll have to take three different RMDs from each one of them separately.

That is why it is best to consolidate all 401(k)s and IRAs into a single IRA to make the RMD estimation and tax planning easier.

But imagine this scenario. Husband and wife, both working and have amassed a million dollars each in their pre-tax accounts in their forties. If left untouched with no new contributions, that money would conservatively grow to $5 million each. So, taking RMDs when they turn 73 means $10 million/26.5 = $377,358 in RMD income that year. Add to that income from other sources like dividends and interest and we are likely talking $500,000 in total income, keeping them in the same high tax bracket they were trying to avoid.

To add salt to that tax wound, they have no deductions left. They have no mortgage interest to deduct or new 401(k) contributions to reduce their taxes once retired. Not to discount that tax rates are certain to be higher in the future than they are today.

So, for all these reasons, tax planning strategies like Roth contributions and conversions, gift giving and estate planning increasingly become a big part of good financial planning to minimize lifetime taxes instead of taxes in any given year.

Thank you for your time.

Cover image credit – Anastasia Shuraeva, Pexels