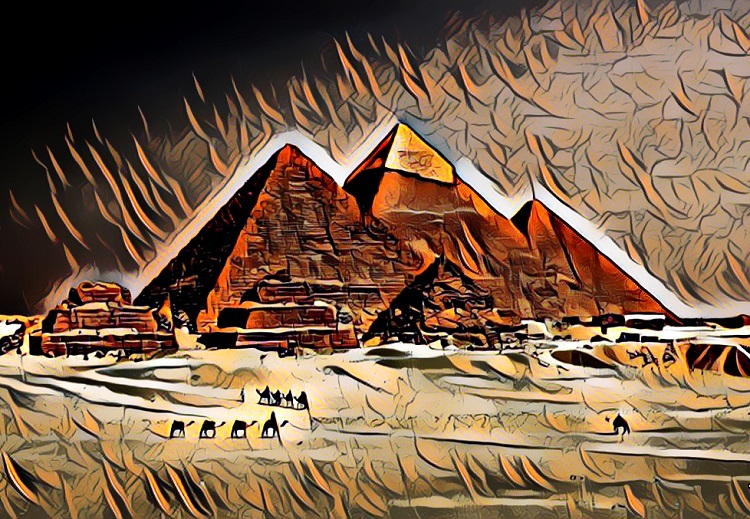

Abraham Maslow describes in his groundbreaking 1943 paper a pyramid of needs that must be met in more or less a sequence before human beings can realize their full potential.

Food, clothing, and shelter form the base of that pyramid.

Friends, relationships, self-esteem, and a need to belong form the next set of rungs.

The tip of that pyramid of needs relates to self-actualization, a process by which we achieve our full potential. That comes with honing our craft, that comes with spending our time doing what we love, that comes with spending our life’s energy in pursuing what we are here on this planet for.

Self-actualization takes a backseat when you are merely trying to put food on the table or a roof over your head. Maslow summarizes it with this quote on what an ideal society should look like…

What a man can be, he must be.

Abraham Maslow

Scandinavian countries have taken this to heart, and they actively work to get their citizens to that self-actualization phase. The rest of the world, not so much.

Take Norway, for example, and compare it to say the United Arab Emirates. Both big exporters of oil with about the same per capita production rate.

But Norway along with the rest of Scandinavia come out at the top on any measure of happiness there is because the governments there actively work to make life better for their citizens.

And Norway is as prudent as prudent can get. They have seen the future. They know this thing (oil) will someday run out so what do they do with all that oil money? They deploy it into a sovereign wealth fund for their citizens which as of the day of this writing1, is the largest in the world. The fund invests in stocks and bonds of businesses around the globe.

And because of that, a child born today anywhere in Norway is entitled to a quarter million dollars to his or her name. And that amount keeps growing. Those babies are set and so is the rest of the citizenry that are afforded a quality of life that only millionaires in America can afford. You can read about it more here.

But back to the topic at hand, the economy has its own version of the pyramid with businesses, both public and private, forming the top of that value chain.

Without businesses, there is no economy. Without businesses, there are no jobs. Without businesses, there are no productivity gains. Without businesses, there is no innovation.

Yes, you can make it work through a patch work of government-run enterprises as has been tried in the old Soviet-bloc and in what we see today as a ‘shining’ example of running its course in countries like Venezuela and Cuba, but they don’t work.

They won’t work because there is no profit motive. Human beings are not designed to work without a profit motive.

And without a profit motive, there is no business. And without a business, there is no economy.

Businesses hence form the top of the economic value chain and the stock market, as flawed as it is many a times, is the best way to own a piece of that value chain. Lucky for us. Imagine clicking a button and being able to own a piece of Apple or Google or ASML – all through the wonder that is the modern-day stock market.

The next rung in that value chain is occupied by bonds. When we buy bonds, we become a lender to governments and businesses, but ultimately, still businesses. Governments rely on tax revenues to pay back the money they borrow and without jobs, there are no tax revenues and it’s the businesses that ultimately create those jobs.

And you lend money to a business with the expectation of getting paid interest as well as a return of your principal at the end of the loan term.

But if that business does not make money, you are not getting your interest or your principal back. That business, hence, must out-earn in profits what it pays in interest to the bondholders, or it does not survive.

And because you own a piece of that business through the stock market, the stock of that business must out-earn the interest paid by the bond issued by that business.

So why would we then own bonds? Because they are short-term safer (less volatile). Bond investors get paid first regardless of the goings in the business before stock investors get anything. Bonds are less risky than stocks by design, but they won’t earn you as much as stocks.

Then there is real estate. Now in theory, it must earn even less than bonds. I am talking about real estate in aggregate, not one specific piece of property in San Francisco.

Employees make money for a business, but they also cost money. You can only afford that rent or that mortgage on that home because the business you work for clears enough profits to pay the bondholders a little, the stockholders a big chunk and then whatever is left is what eventually flows to the owners of real estate through your paychecks.

And businesses in general tend to cut the employee slice as thinly as possible. That is by design.

So, you better hope that the city you work in does everything possible to make sure the cost of living remains as reasonable as possible. Raise it too much and businesses will actively work to reduce the impact of that cost by moving jobs around. They might not say that in your face, but they are working behind the scenes to make that happen at every chance they get.

This is of course thinking in aggregates but when you own a portfolio of businesses spanning the globe, you must think in aggregates.

So, if you want to own the top of our economic value chain, stocks are it. They’ll give you ulcers from time to time but that is the price you pay to own the profitable top.

Stocks are indeed for the long run. Not every stock but stocks in aggregate.

Thank you for your time.

Cover image credit – David Mceachan, Pexels

1 December 31, 2023