There is no clear definition of a bull market except when the stock market seems to be uninterruptedly going up year in and year out and you sense a feeling of euphoria all around, that can be called a bull market. But that is a bad deal for you because what is the point of making 20% on a measly $50,000 investment balance you are likely to have at the beginning of your career.

And that is not the least of the bad things because from now on, with all future contributions that you’ll make in your plan, you’ll be buying the same set of investments at a 20% mark-up. Who likes to pay more for anything and especially for a thing that you will keep buying over and over again for decades?

But if that 20% bump in return came later after a lifetime of diligent investing, now that is a completely different ballgame. We are talking about real money here because a 20% bump on $5,000,000 is life changing whereas a 20% bump on $50,000 is barely worth it.

You want the big gains to come later with itty-bitty gains during the early and middle phases of your career. I mean you want the markets to go nowhere while you are working and feeding your plan with fresh savings. And then right when you are about to retire, you want the biggest, baddest bull market in history to allow for all that accumulated dry powder to explode higher.

That is the ideal and only a lucky few get to live it. Lucky not just from the perspective of timing but lucky from the perspective of persevering through it. Let me explain why.

Say you happen to land your first job in January of 1966 when the Dow Jones Industrial Average stood at a mere 1,000 points. It would continue trading below that mark for the next seventeen years. Imagine watching the market go nowhere for seventeen long years?

The Dow once again breached 1,000 points in December of 1982 before breaking out, never to look back. That would come to be the setting stage for one of the greatest bull markets in stock market history.

So, if you entered the workforce in 1966 and started to stuff your investment accounts with fresh savings, you bought more and more of business profits at constant to down prices.

And when the market turned, you were technically done. I mean your savings did all the work while you chilled.

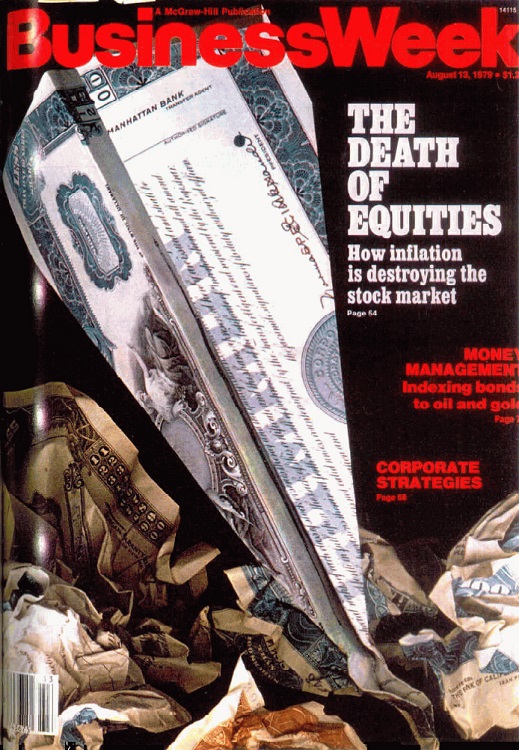

But with headlines like below towards the later stages of that extended bear market, how many folks do you think remained invested? And how many at that kept feeding their plans for the entirety of that period? Bet not many.

Because to stick with your investments for that long of an underperformance with recurring crashes in the interim requires conviction. And conviction comes with knowing what you are investing in and why.

But without conviction, you won’t be around to stick with your investments and follow through on your plan. Because you’ll bail at the worst possible time and then it is mostly over.

And guess what was in vogue as an investment back then? Gold. Everyone wanted to invest in gold. When stocks treaded water, gold did like twenty times in ten years during the 1970s.

Source: Macrotrends

But gold is not an investment. It can never be an investment. No commodities are investments.

And you’d think people got into gold before that big run-up? Not a chance. They got in right when that cycle was about to end. And that cycle likely ended forever.

Why do I say that when the price of gold is a lot higher today than in the seventies? Because we have not factored in inflation yet.

Source: Macrotrends

So, if you bought gold thinking it is an investment, you’ll be sad today.

But back to the topic at hand, what appeared to be the worst of times to invest when the stock market treaded water was in fact the best of times. And had you stayed invested and continued to plow new money into the markets, you got rich.

How do I know? Because the next underwhelming phase in the stock market came during the decade of 2000s. The stock market as measured by the S&P 500 did not go anywhere for the entirety of that decade. That is not to discount that you also had to endure through two big market crashes in the interim – the Tech crash of the early 2000s and the subprime crash of 2008.

But had you stayed invested and continued to plow new savings into the market, well, you know the story.

Also, that underwhelming stock market performance only applied to the S&P 500 index that was dominated by the growth stocks of the era. Value stocks did fine. Small cap stocks did okay but international stocks is where all the action was.

That story flipped again in the decade of 2010s. Growth stocks did great but value and international stocks underperformed. That cycle will turn again, we just don’t know when. Nobody does.

Yet we must prepare for it. We must prepare for all possible scenarios because outcomes are never in our control, but the process is. And good planning requires getting the process right. Outcomes then fall in place on their own.

Thank you for your time.

Cover image credit – Becerra Govea, Pexels