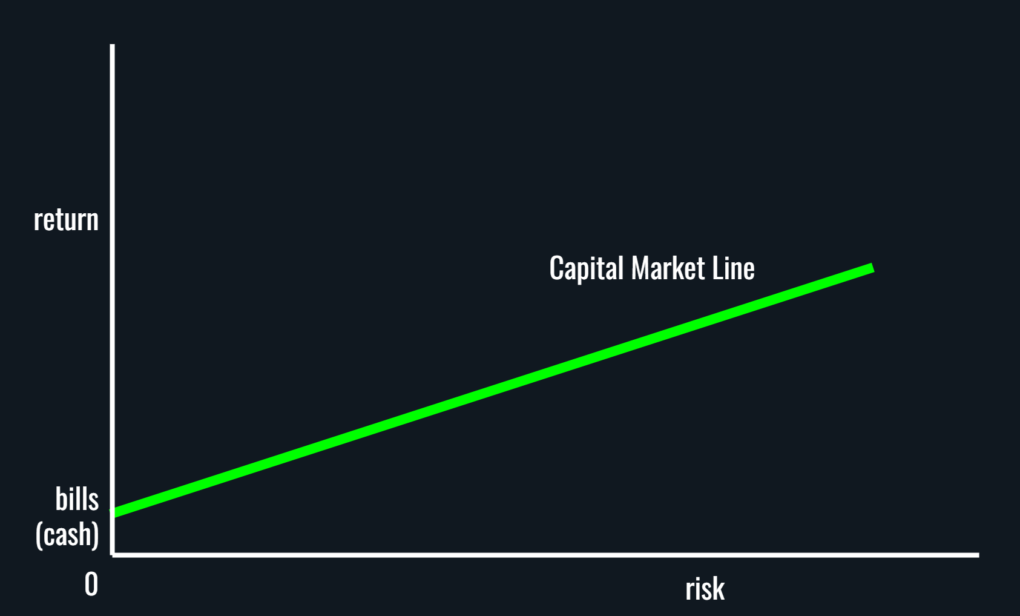

Bonds are safer than stocks. Cash is safer than bonds. Investing in startups is not for the faint of heart. On a risk-return spectrum, we see an upward sloping line as we go from safe investments on the left to increasingly riskier ones on the right. Finance nerds call this the Capital Market Line.

But even within bonds, there is a spectrum of what is considered safe. Short-term government bonds, also called Treasury bills, with maturities of less than a year are a baseline of safety. They carry no credit risk because they are U.S. government-backed bonds.

And they have no timeframe risk as these bonds have maturities ranging from four weeks to fifty-two weeks. They make a great alternative to holding cash in a savings account so use them liberally for your emergency reserves.

What intuitively comes next on that risk-return spectrum? The same level of risk as in government-backed Treasury bonds but with an increasing timeframe for which you are required to hold these bonds. So where is the risk?

The risk comes into play when market interest rates change, and you need to cash out of the bonds before they mature. No one is going to buy your five percent yielding bond if the prevailing market interest rate is six percent. You will then have to discount the bond (lower the price) to a point where the yield matches the prevailing interest rate and hence the risk.

And because these bonds are riskier as in you have to hold them for a longer timeframe, you expect to earn more on them.

The next set of investments on that Capital Market Line with steadily rising risk profiles are municipal bonds, high-quality corporate bonds, emerging market bonds and junk bonds. Along with the timeframe risk, there is now a potential default risk where the borrower (you lend money when you buy a bond) could renege on his promise to pay. So as a bond’s credit quality worsens, its risk again rises.

This describes the bond side of the Capital Market Line.

Stocks are long duration assets which means you need to own them for a long, long time to reap enough rewards for taking on the added risk. And stocks are riskier than bonds because direct and indirect cash flows (dividends and share buybacks) that stocks deliver are more unpredictable than interest income from bonds. A business only pays dividends or does share buybacks when it earns a profit and profit is never guaranteed.

Plus, in the event of that business going bankrupt, bondholders get paid first before stockholders get anything.

So naturally, stocks are riskier and because they are riskier, you will demand more from them than bonds. And hence they lie to the right of most bonds on the Capital Market Line.

And even with stocks, we have domestic stocks, international stocks, emerging market stocks, small company stocks and so on, all on that Capital Market Line with steadily rising risk and return profiles.

To the extreme right, we find things like private equity and venture capital. That is assuming we can get a broad enough exposure to them as an asset class which is not the case yet, so they remain uninvestible. Anyone pitching them to you means you won’t see your money again.

That completes the Capital Market Line.

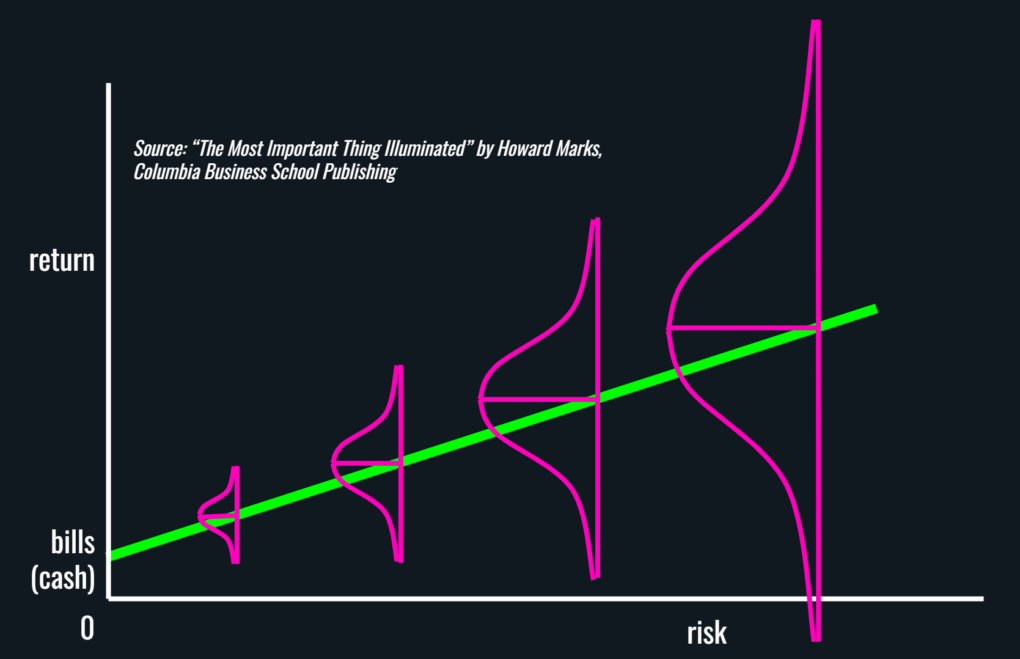

But just because you took on more risk with your savings does not mean you are owed a reward because if riskier investments were guaranteed to earn more, investors would bid up the prices of those investments to a point where no excess return exists.

The correct formulation then is that to attract capital, riskier investments have to offer the prospect of higher returns1 and not a guarantee.

And that is when we get into the world of ranges or distributions instead of point estimates to re-form that risk-return relationship.

The revised Capital Market Line hence…

Point estimates for a given category of investments don’t make sense because returns do not precisely land on a straight line. They bounce around that line depending upon the timeframe and hence we need to think about them as distributions instead of points on a line.

But all this discussion is before taking inflation into account. There is no free lunch in investing so beating inflation with safe investments is a pipe dream that seldom comes through. Not all risks are rewarded but educated risks while considering all possibilities is how we beat inflation and set ourselves up on a path to financial independence.

Thank you for your time.

Cover image credit – Alexandre Zanin, Pexels

1 Howard Marks. “The Most Important Thing Illuminated“, Columbia Business School Publishing.