Stocks are volatile. And a big reason they’ll remain volatile is because of where a stock’s value comes from.

The value of a stock today is the sum of all the cash flows (dividends) a business (stock) will deliver to its shareholders in perpetuity, discounted to the present at the appropriate discount rate.

Not to get fooled by this apparently trivial setup, small changes in i and r can have profound implications on the value of a business.

Every business returns profits to its shareholders in the form of dividends, D.

Not all businesses will. Some won’t be able to get to profitability but hold a decent number of them spread across industries and the dividend stream continuing in perpetuity is a given.

r defines the growth rate of those dividends. That is tied to business profits and profits tend to grow long-term. They don’t grow in a straight line and hence the implied volatility.

The discount rate, i quantifies risk. The greater the risk to profits, the higher the rate of return you’ll require. You expect to get paid for the extra risk you are taking with a riskier investment. Your expected rate of return hence rises for that investment.

Expected rate of return is the discount rate. So, when the discount rate rises, the value of a stock falls because the discount rate is in the denominator. And when the discount rate falls, the value of a stock rises.

That is why small changes in interest rates cause stock prices to change. Because discount rates are not derived in a vacuum. They rely on prevailing interest rates and if they rise, discount rates rise as well. If you can safely earn eight percent on a Treasury bond, why would you buy stocks? Stocks, hence, have to offer better than eight percent.

So, when interest rates are higher, discount rates are higher, and stock prices are lower. That is how you get the higher rate of return when you buy stocks because you get to buy them at the cheap.

So, with r and i constantly changing, the intrinsic value of a stock changes too. And hence the inherent volatility with stocks. There is no way to avoid it.

That makes up the growth side of your portfolio.

With bonds and using the same equation above, cash flows from bonds are the interest payments you receive. We’ll continue calling them D.

But D for bonds is fixed. They don’t grow once a bond is purchased (r = 0).

The discount rate i for a bond is the interest rate set when you purchased that bond. Unless you decide to sell that bond before it matures, the discount rate doesn’t change and so doesn’t the bond’s value.

Bonds preserve capital. They hence make the capital preservation part of your portfolio.

If you want complete preservation of capital, growth cannot come. If you want growth, you must accept volatility. You must accept it because that is the only way to outrun inflation in the long run.

So why do we see investments that claim to preserve capital but also provide growth? LJM Preservation and Growth Fund was supposed to do that. Then it went belly-up overnight. Jeff Malec in a piece at Seeking Alpha, LJM – The Autopsy does a great job describing what happened and leaves us with this excerpt.

In the span of 48 hours in and around that spike, LJMIX had lost 82% of its more than $700 million in investor assets, failing to strike an NAV for several days as the manager, clearing firms, the exchange, and regulators tried to sift through the trades. It was the investment manager equivalent of a suicide, overdosing on the tempting drug of an investing free lunch.

Free lunch? Capital preservation and growth doesn’t exist. It is an oxymoron. Capital preservation means eliminating downside. Eliminating the downside means eliminating volatility but then you don’t get the upside. We just did the math.

Risk and return are inextricably intertwined. In almost every country where economists have studied securities returns, stocks have had higher returns than bonds. Further, if you want those high stock returns, you are going to have to pay for them by bearing risk; this is a polite way of saying that in the course of earning those higher returns, your portfolio is going to lose a truckload of money from time to time. Conversely, if you desire perfect safety, then resign yourself to low returns. It really cannot be any other way.

William Bernstein, The Investor’s Manifesto

One way I don’t see volatility with my own money is that I don’t peek at my accounts as often. It is not easy these days. That stock market app on your phone is the worst thing that will happen to your money.

Yet not everyone can take the stock market heat. So, we bring some bonds into the mix to turn down that heat. The right ones in the right proportion act as ideal ballasts against stock market volatility. They won’t make you the same money, but they’ll help you remain at peace.

Because what you don’t want to have happen is that you abandon your plan at the worst possible times. And worst possible times will come.

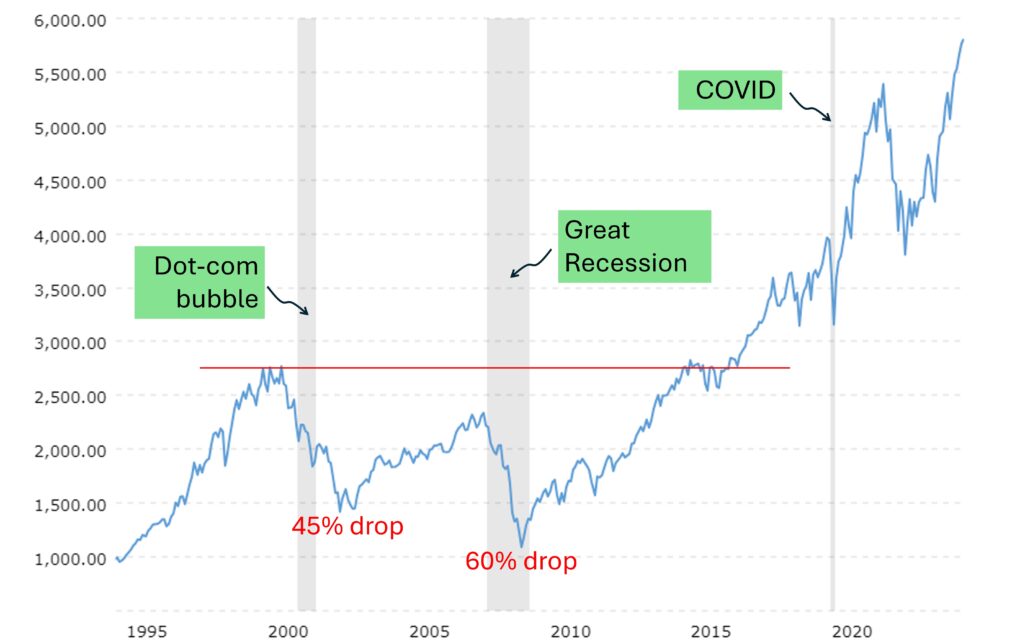

Source: Macrotrends

The stock market people haven’t seen them lately, but times were rough after the Dot-com crash. It took 15 years to get back to breakeven and let me tell you, it was not an easy ride.

So, you don’t need the craziness if you don’t need it. Because the goal in the end is not to die rich but to have lived a great life. And if stock market volatility interferes with that, that is no good.

Thank you for your time.

Cover image credit – Mike, Pexels