If you are into weight training, you know that if you want to increase muscle mass and strength, you must lift heavy. Heavy to a point of discomfort. Heavy to a point of pain. Not that I would know but that is what I’ve heard.

The same applies to investing. You must be willing to endure occasional discomfort and sometimes pain on this journey to financial independence.

And unless you are doing something crazy with your money, most of that pain relates to plain vanilla asset price volatility.

So, what determines an asset’s price? But before that, what is an asset? Or to be even clearer, what is an investable asset?

An asset is anything you own. But for an asset to be investable, it must produce cash flows or have the prospect of producing cash flows.

A painting is not an investable asset. The car you own, though considered an asset, is not an investable asset. The gold jewelry you own is not an investable asset. Cryptos, NFTs and anything that anyone cooks up and brings to the market with never any prospect of producing cash flows are not investable assets.

A share in a business on the other hand is an investible asset. So is a bond issued by that business. The home you own is an asset. They all directly or indirectly produce cash flows or have the prospect of producing cash flows.

And what determines an asset’s price? Take that share in a business you own that trades on a stock exchange. Millions of market participants at any given time are crunching their own numbers and their collective opinions about that business’s value gets reflected in its share price we see quoted on that exchange.

The quoted price is mostly right but not always. That is knowable only in hindsight. In the long run though, the price and the value of that asset will converge. And we should invest with that in mind.

Talk about valuing an asset, the basic building blocks are the same, be it a stock or a bond or real estate and this is how we derive its value. We first estimate an asset’s future cash flows. And since we hate waiting for those cash flows to hit our bank or brokerage accounts right away, we value them less the longer we have to wait.

That is, we devalue or discount the cash flows that arrive way out in the future more than the ones that show up say, next year.

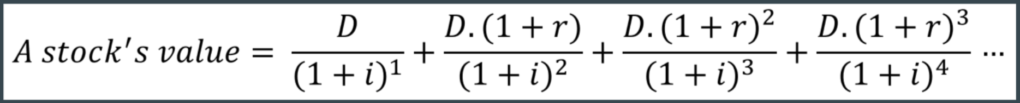

We’ll use valuing a stock as an example.

Though inherently simple, there is a lot going on here. Ignoring the book value (the value of buildings, machinery etc.) of a business to make the math simple, stocks as we know are long duration assets. They are perpetuities in theory with cash flows expected to go on forever. That is what the three dots at the end signify. The cash flows continuing forever is not true for every stock but for a portfolio of stocks, that assumption should hold true.

And by design, stocks are ideal as long-term investments. You don’t start a business and expect it to turn a profit next year.

So, every time you put new money into your 401(k), you are indirectly providing capital to a new or existing business to try something new, to explore a better way of doing the old thing, to invest in research and development that someday finds cure for cancer, to make us into a space faring civilization etc. etc.

All that takes time.

So, don’t go near the stock market expecting a return in a year. In fact, don’t go near it if you expect something out of it in less than five years.

But back to the valuation model, the D is the first year cash flow (dividend). Stocks eventually in some form or the other pay out all the accumulated profits back to the shareholders in the form of dividends.

And as the profits generated by the businesses you own grow, the dividends grow and that is captured by the dividend growth rate, r.

Then there is the discount rate, i. Discount rate is many things. It is the opportunity cost of what else could you have done with the money that you are using to buy stocks. Discount rate hence is the return you expect from your investments.

But your return in a way becomes the cost of capital for those businesses. Safe, blue-chip businesses have lower discount rates and hence a lower cost of capital. A start-up on the other hand, has a higher discount rate and a much higher cost of capital.

Plus, when you think of opportunity cost, you also need to think about risk. Dividends are not certain. The growth rate of those dividends is not certain as well.

And depending upon the type of business you own, the certainty of dividends and the certainty around the growth rates of those dividends vary.

Johnson & Johnson is in a different league of dividend payers than say, Juniper Networks. Which one would we ascribe a lower discount rate to? Johnson & Johnson of course because it is deemed safer with predictable dividends.

And discount rate being in the denominator means for the same set of cash flows, we’ll ascribe a higher value to Johnson & Johnson as a business than Juniper Networks.

A bit more on opportunity costs. It is one thing to be gung-ho on stocks when bonds pay nothing. Because there are not many viable options to invest your savings. That has been the world for so long that we have a hard time imagining there could be alternatives.

But when interest rates on super-safe Treasury bonds rise, now we have choices. Why would we invest in stocks when Treasury bonds yield say 8 percent with zero risk. That is not to say that we are there yet, but you get the point.

So, the discount rate, even for Johnson & Johnson rises when interest rates rise. And when discount rates rise, the value of a business falls.

Some takeaways hence…

- If you are starting out, the fastest way to get to a net worth of $100,000 is through increased income via career growth or entrepreneurship and not through investment returns. The same applies if your net worth is under a million dollars. Markets will do whatever they’ll do but the two things you can control are how much you make and how much of what you make, you can save. The rest is all noise. So, focus on where you can make the biggest difference.

- Investment superstars come and go but mean reversion is here to stay. Do not be enamored by anything or anyone that has shot the lights out of what normal investing should normally yield. If the risk-free rate is 5% and you earn 30% on an investment, do not be shocked when that eventually mean reverts. Free lunches are few and far between.

- Never, ever, ever, ever, never, ever be completely in or out of the markets. All it takes is 5 minutes of Googling to realize that market timing has never worked and will never work. The only thing you can and should do is adapt your plan to what your gut can handle. It is one thing to fill out a risk tolerance questionnaire and assume that you can handle double-digit declines in your portfolio’s value. It is an entirely different ball game when you are experiencing it. So, take notes and implement changes when necessary.

- Naval Ravikant, the founder of AngelList, says that investing favors the dispassionate. That is, markets tend to efficiently separate emotional investors from their money. So don’t let Mr. Market take advantage of your anxiety, greed and fear. The only way to get around that is through a well-crafted investment policy statement customized for your plan. And then when Mr. Market goes through its usual manic-depressive phase, you go revisit that plan to see if changes are necessary. If not, sit tight and don’t peek.

- Of course, think long term. John Bogle, the founder of Vanguard, once said that the daily machinations of the stock market are like a tale told by an idiot, full of sound and fury, signifying nothing. Nothing about the businesses you own changes much from one year to the next. Capitalism is here to stay and business ownership is where the bulk of the riches lie. Either you can be a cog (worker) in that wheel or own a piece of that wheel. Own that piece at every chance you get.

- And last, there are three ways to go broke, a la Charlie Munger – liquor, ladies and leverage. No comments on the first two but leverage will eventually kill. It works like a charm when all is going well and then you go broke overnight. Use it sparingly.

Thank you for your time.

Cover image credit – Julia Larson, Pexels