You’d see these clickbait stories every now and then. They let you dream about the easy riches you would have earned had you wagered on this or that stock. Dreams are great but acting upon them is Chernobyl deadly for your money. Let me explain why.

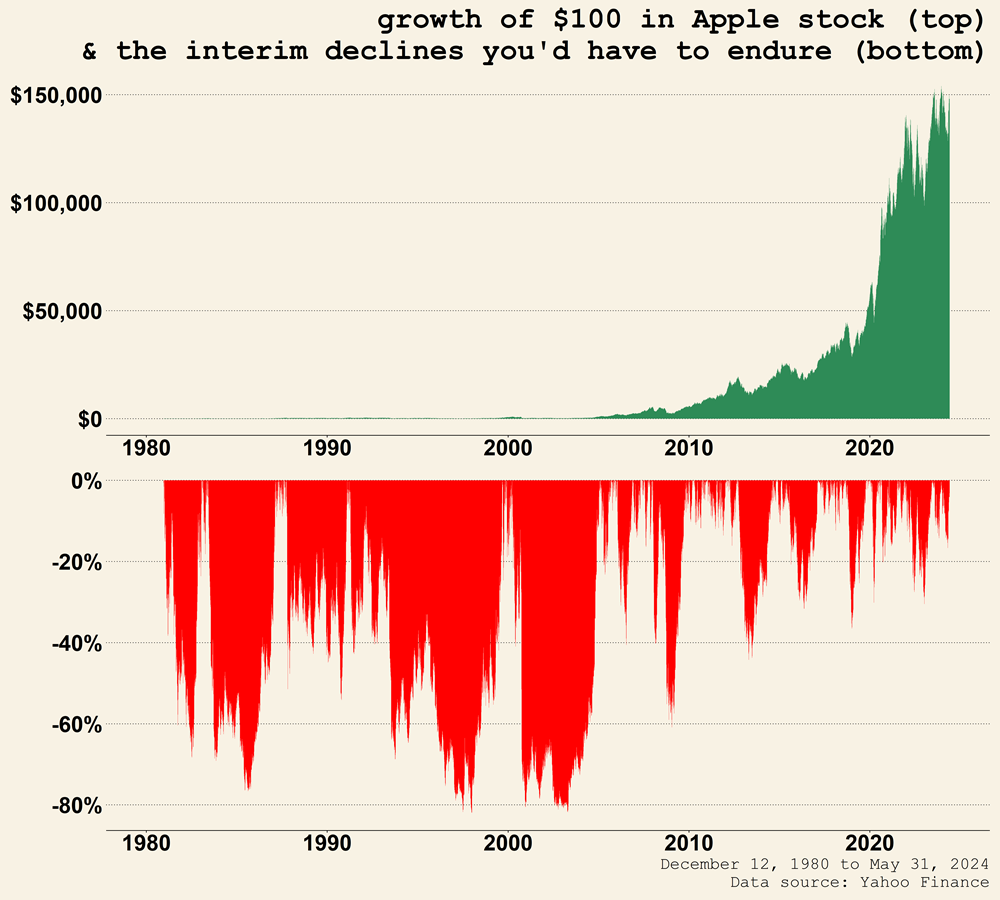

Apple today is a three trillion-dollar business. A one-time investment of $100 in Apple stock when it went public is worth $150,000 today.

But I bet none made anywhere close to that kind of money investing in Apple stock. In fact, I am willing to bet that a vast majority of Apple investors lost money or significantly underperformed a global market portfolio during their ‘ownership’ phase.

How is that possible? How could anyone have lost money investing in one of the best stocks ever?

Because what none of these stories talk about are the horrendous, business extincting stock price declines you’d have to live through and still come out at the other end holding the shares.

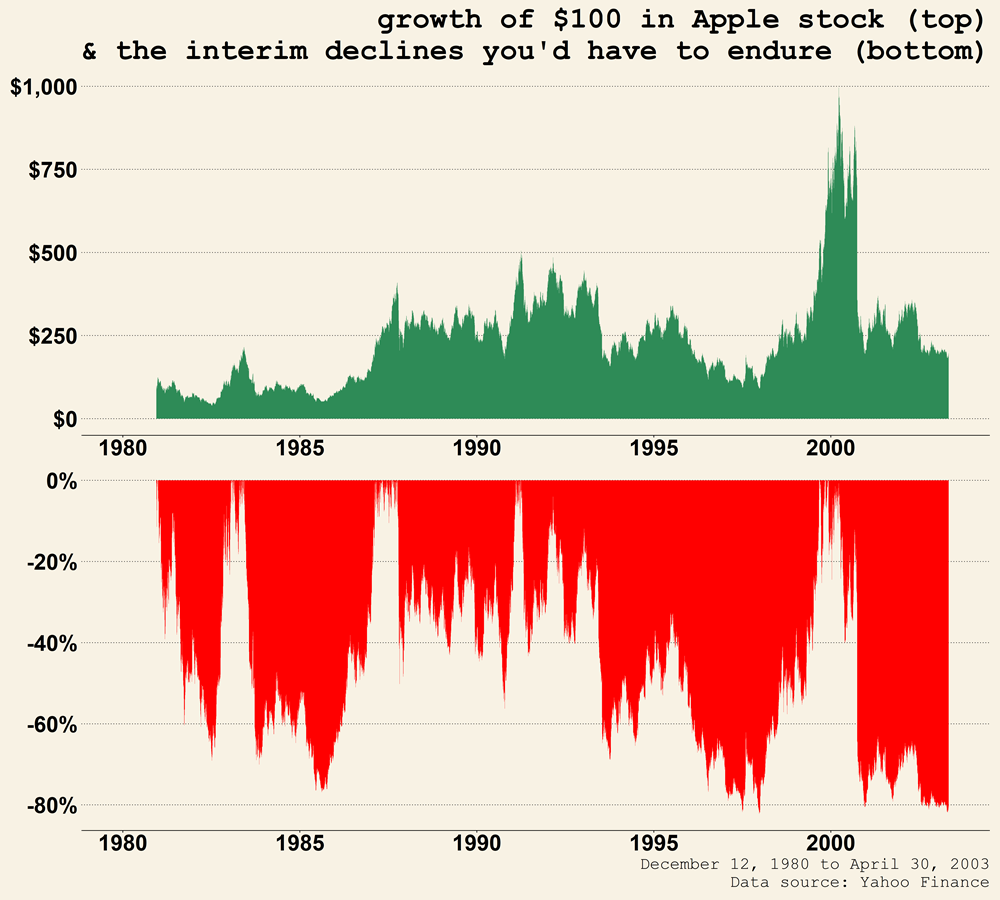

Let us talk more about Apple. The company went public on December 12, 1980, and within months, it lost 60% of its value. You do see drawdowns (declines) in red in the plot above, but you don’t see much about the $ value performance for the first half of the company’s existence. Zooming in for a better picture…

Two things stand out:

- You barely made any money for the first 23 years of being an investor in Apple stock.

- To add salt to that wound, you’d have to live through numerous forty, fifty and a few eighty percent declines in the interim.

What does a stock price decline of eighty percent mean? It is a way of the market telling you that there is a significant risk that the business might not survive.

And that almost came through with Apple. You think you would have hung on through all of that? Not a chance unless of course you get struck with amnesia right after buying the shares (more on this later).

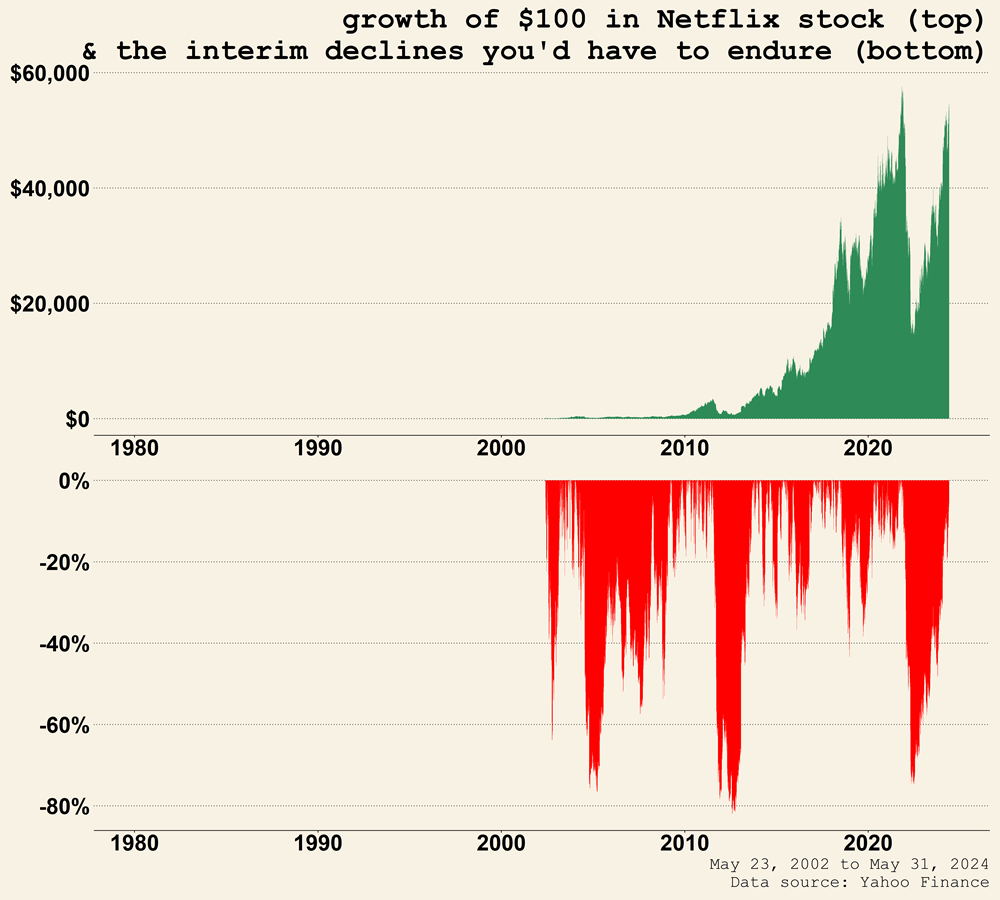

It is the same story with shares of Netflix.

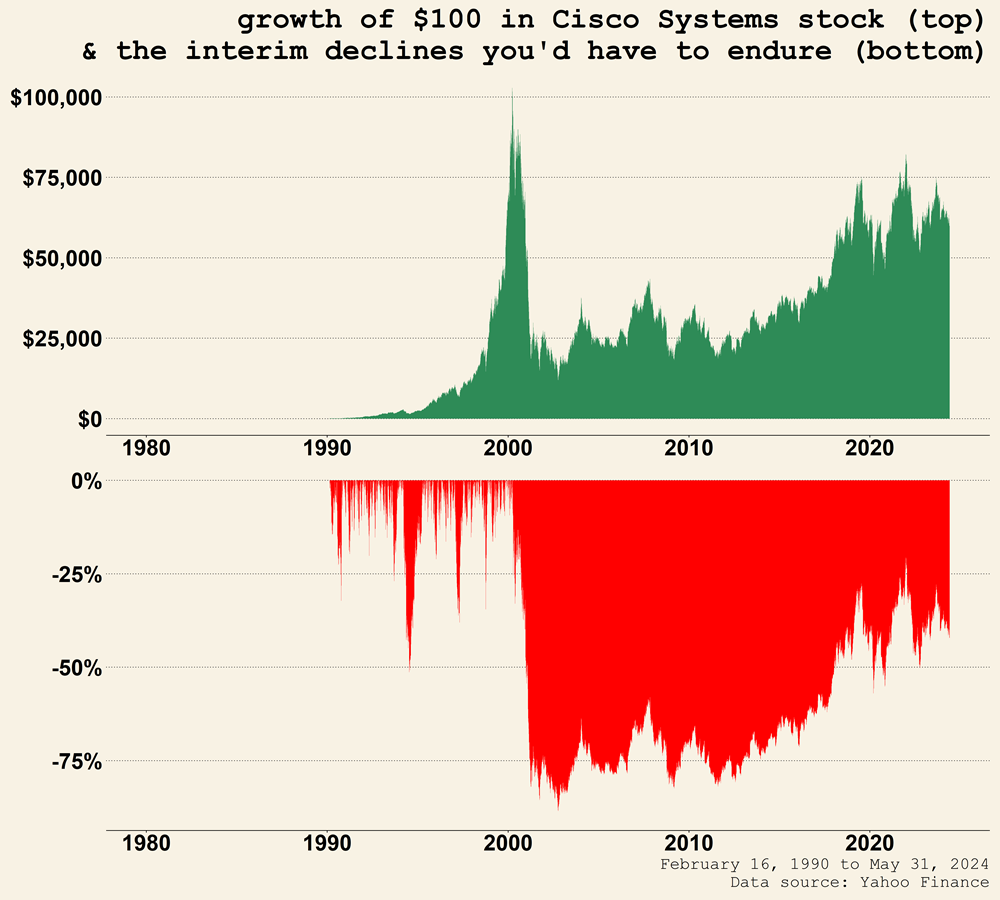

Nvidia is all the rage these days but so was Cisco Systems back in the day. Similar growth themes were embedded in Cisco Systems stock as they are in Nvidia today.

Cisco went public on February 16, 1990, and in a mere span of ten years, it became the most valuable company in the world. Had you invested $100 in Cisco stock at its IPO, you’d have $100,000 ten years later.

Then the Dot-com bubble burst and Cisco has yet to reclaim the highs set twenty-five years ago.

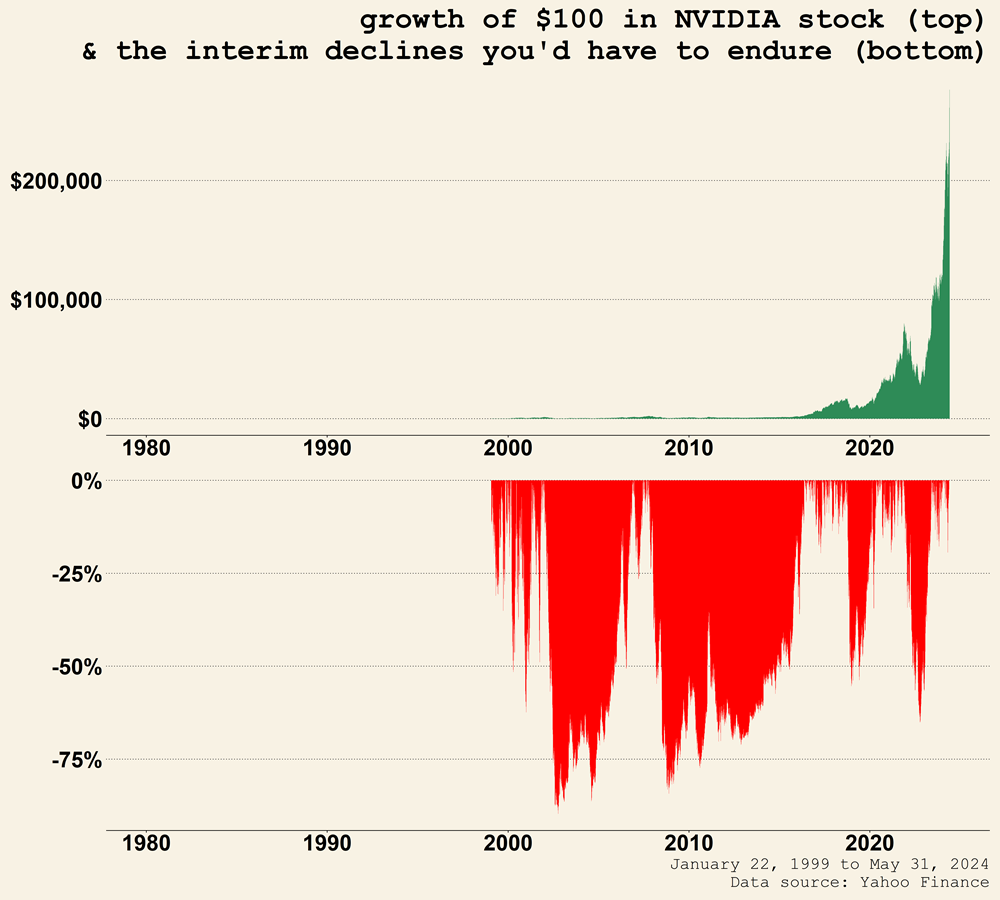

Talk about Nvidia, you get the same story of living through gut-wrenching declines and then getting extremely lucky to have the growth in AI intersect with their products.

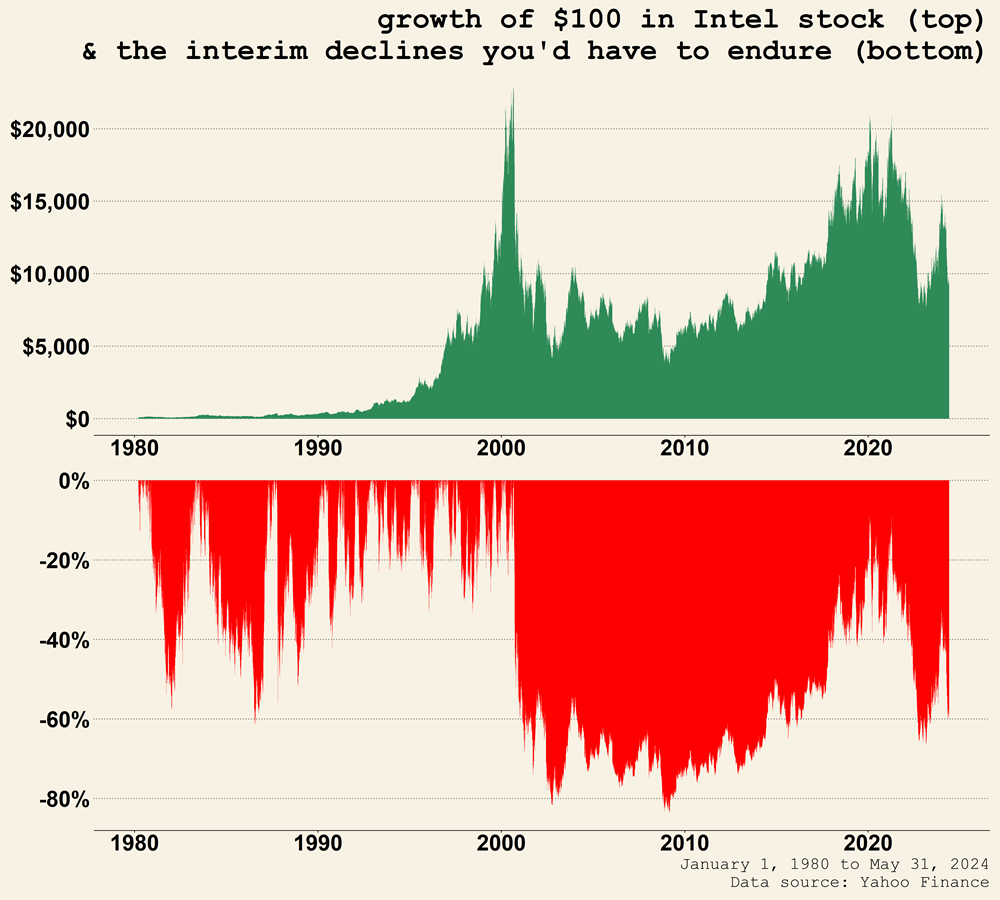

Or you could have been an Intel investor instead. Same sector eyeing the same set of opportunities but a completely different outcome.

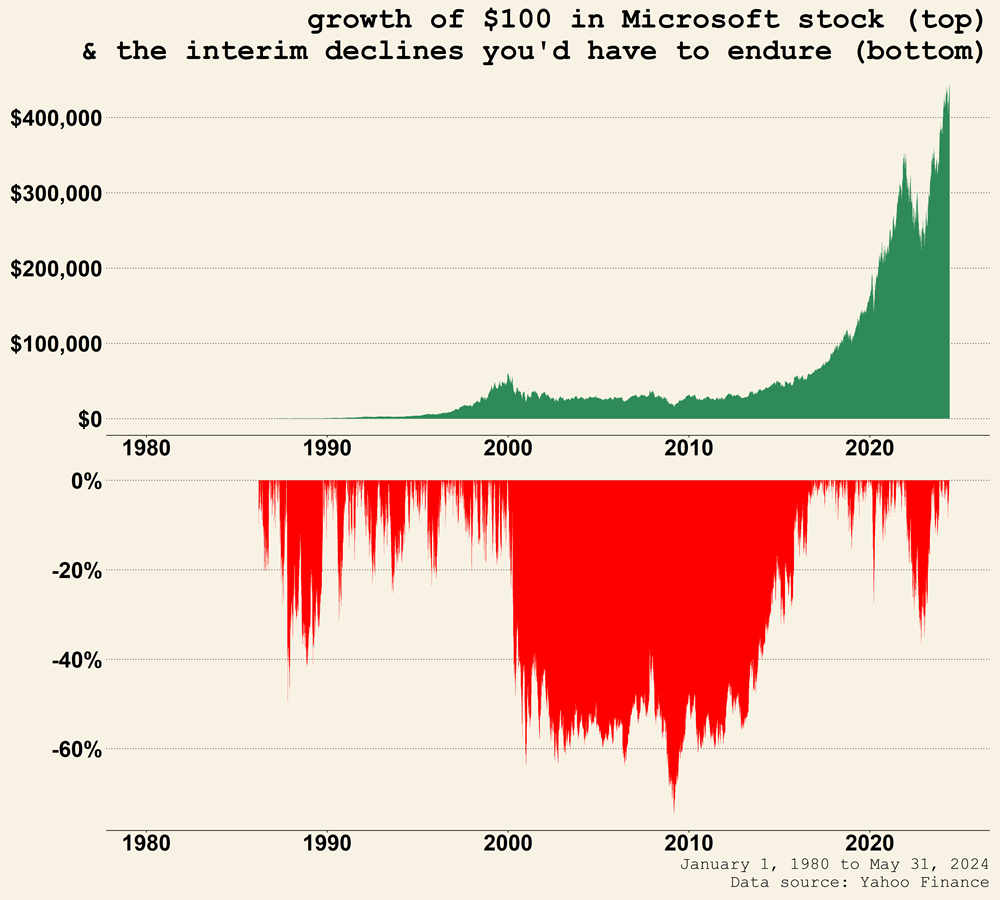

Microsoft is riding high on the AI wave as well. But had you bought Microsoft stock in March of 2000, you’ll be sitting on dead money for 15 years. That is a literal eternity in the world of investing.

The point of all these stories is that armchair quarterbacking looks great until you are in the middle of experiencing what it takes to own these stocks.

So, who is likely to hang on? An extremely lucky person who bought the ‘right’ stock and forgot. Not trying to forget but actually forgot.

Here is an excerpt from a news story dating back to the Dot-com days that talks about the role luck plays in not only happening into owning the hottest stock of that era but also forgetting to have owned it.

The man, who lives in Boston, said he purchased 3,000 shares of stock in 1987 on the advice of a cousin. Sometime during the 1990s he sold 2,000 shares of the stock to pay for his children’s college tuition and forgot about the remaining 1,000 shares.

Some 13 years later, the value of 1,000 shares had ballooned to nearly $4 million.

The forgotten shares were discovered by the treasury’s Abandoned Property Division. By law, brokerage firms must turn over to the state stocks which show no activity by their owners after three years.

Forgotten Stock Makes Man Millionaire, ABC News, November 30, 2000

And all of that before discounting the fact that most companies experiencing big drops in market value never recover. While stocks in aggregate outperform other investments over the long run, most individual stocks don’t. I’ve talked about this study by the Arizona State University professor Hendrik Bessembinder before but let me reiterate some of the key points again…

- Of the nearly 26,000 companies that went public between 1926 and 2019, only 42 percent of them created net wealth for their shareholders. The remaining 58 percent (15,000 businesses) destroyed wealth in all their existence.

- Five firms accounted for 12 percent of the total wealth created in the stock market.

- Eighty-three firms (0.3 percent of the total) accounted for 50 percent of all wealth created.

- And 1,000 stocks (4 percent of the total) created all the net wealth above what Treasury bills would have paid you.

Coming into one of these stocks that go on to multiply manyfold in a relatively short amount of time is a lottery type outcome. In fact, it is worse because with a lottery, a winner is declared rather quickly. It is black and white, and it is quick.

But individual stocks that go on to deliver lottery type outcomes can take decades. And you have to persevere through the interim roller-coaster of heartaches and ulcers.

So, when you hear these what-if seductive stories, remember that there is a huge amount of survivorship bias built into them. Do not let these stories sway you away from your plan.

Cover image credit – Jon Collier, Flickr