Mary Hunt in her book, 7 Money Rules for Life profiles three types of folks on how they handle their money. She then goes on to highlight the implications of not getting money right, not only on their well-being but also happiness.

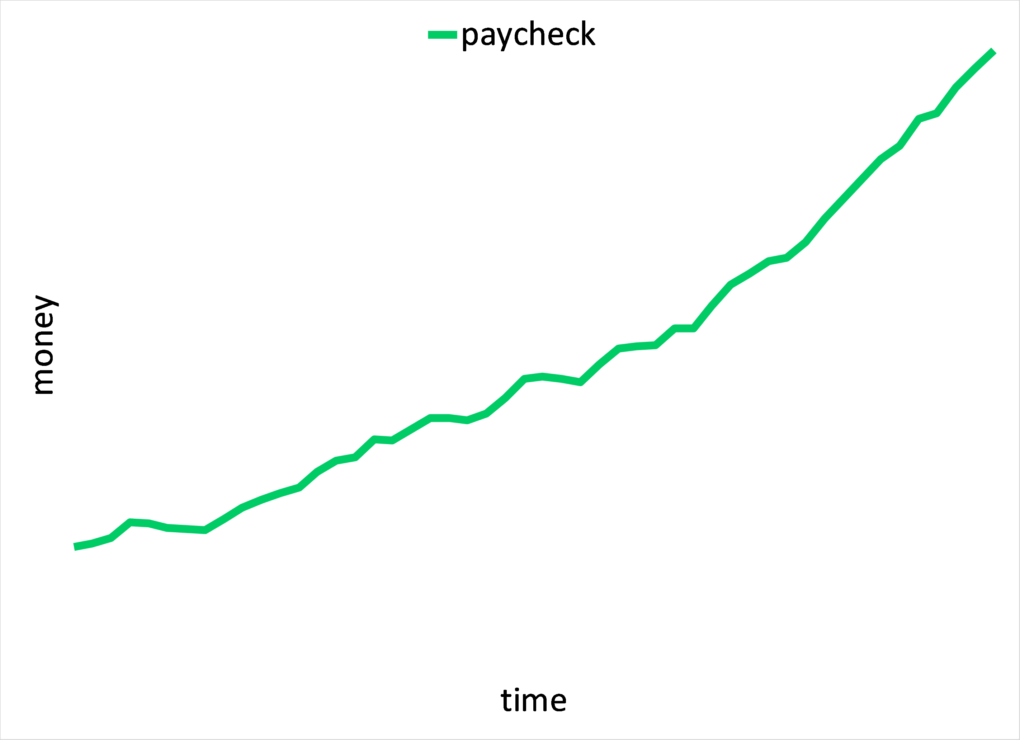

Say this is your income trajectory since the time you started working…

Nothing spectacular. Your paycheck rises with the rise in cost of living (inflation). But a big chunk of your paycheck rising will come from you honing your craft in a field that the economy values. I didn’t say what the society values because if that were the case, teachers would make the most but that unfortunately is not reality.

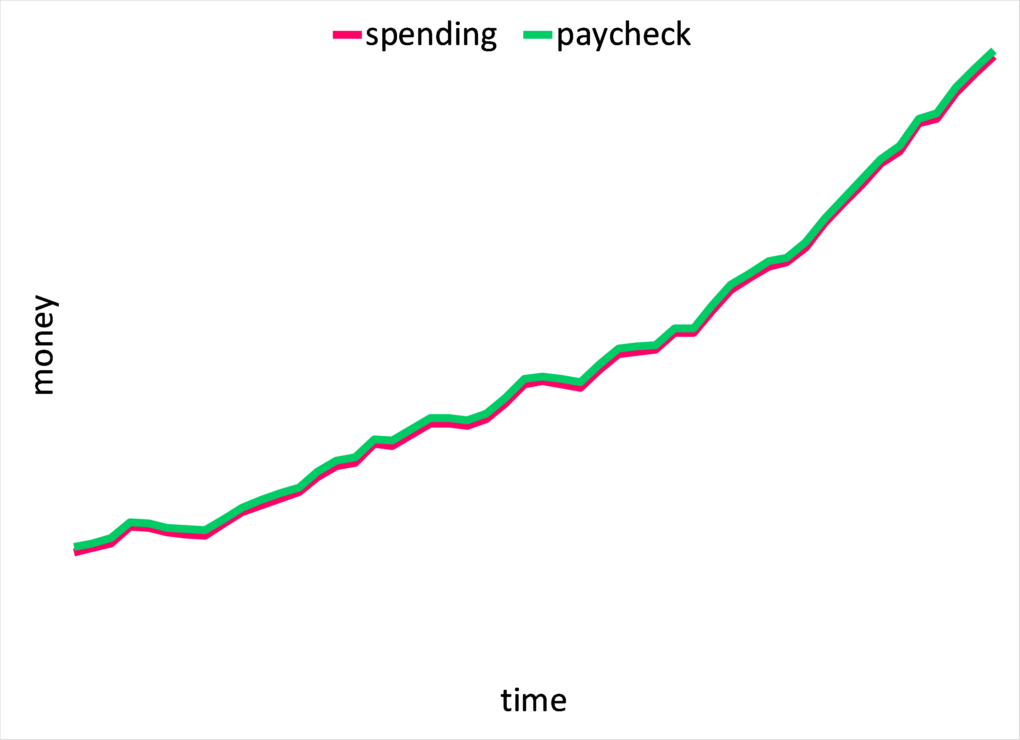

Not to digress, to the paycheck trajectory, we now add spending…

As you earn more, you spend more. That is classic lifestyle inflation. You are living by your means even though you are a paycheck away from disaster.

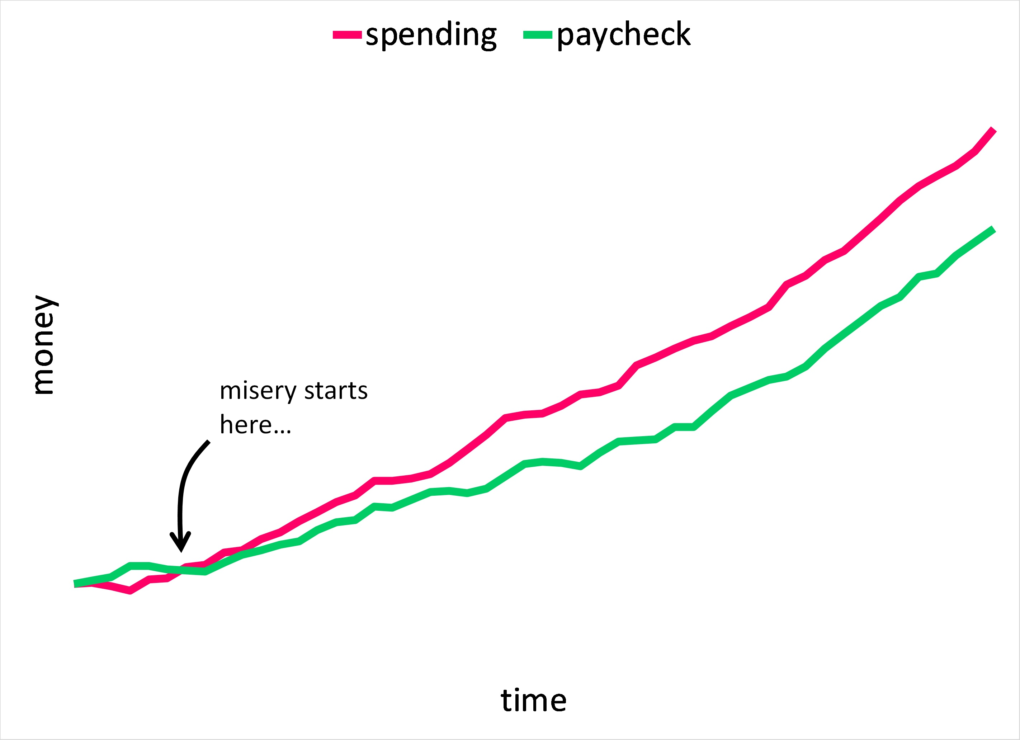

And it is seductively easy to raise standards of living as paycheck income rises but if that rise were to ever stop, this is what we get…

Good life is hard to give up on.

Sonja Lyubomirsky in her book, The How of Happiness describes a widely cited pie chart that breaks down the differences in happiness between people…

- 50% is due to genetics. Some of us are naturally wired as happy.

- 10% is circumstantial. The environment we are born into has some influence.

- The remaining 40% is in our hands.

Though there is some contention around the methodology used to arrive at those conclusions, there is a good deal of contextual evidence that supports this happiness construct. Hence, it is no surprise to find folks who appear to have it all and yet are miserable. And then there are some who barely have anything and yet are some of the happiest people around.

Daniel Kahneman, winner of the 2002 Nobel prize in economics, contends that happiness and life satisfaction are distinct. Happiness is a momentary experience that arises spontaneously and is fleeting. Whereas satisfaction is a long-term feeling, built over time and based on achieving goals and building the kind of life you admire. So from the perspective of the happiness construct we were discussing, if we look at it from Kahneman’s perspective and the happiness he is And this is not about momentary spurts of happiness. It is about lasting happiness. It is that looking back with gratitude at all that you’ve achieved in life.

So, back to that happiness construct, we cannot do nothing about our genes. We are what we are. Circumstantial situations like where and when we are born, the make-up of our families etc. cannot be changed either.

What remains in our reach and what leads to lasting happiness is having a sense of control. And our ability to control our time is the biggest aspect of that control. And this is where your habits with money come in.

Charlie Munger once said that like Buffett, he had a considerable desire to get rich and not because he wanted Ferraris or mansions. He just desired independence. He wanted to control his time the way he wished. That is what drove him to get rich.

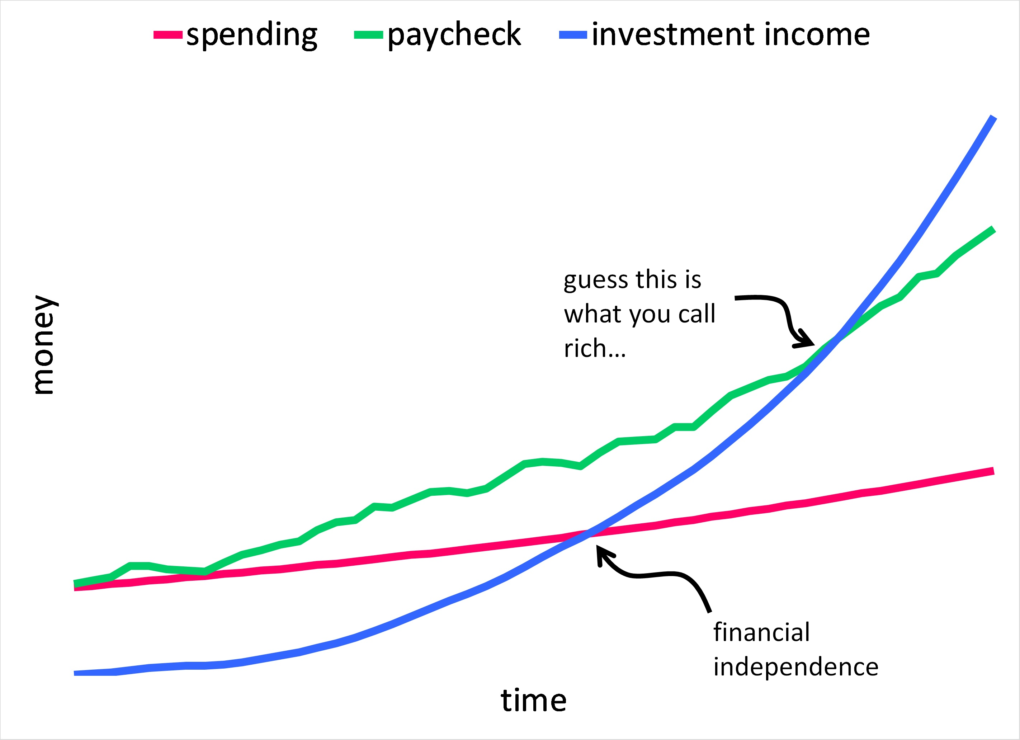

There is this tiny movement of die-hard minimalists who want to bag work in their 40s. They go by the acronym FIRE or Financial Independence, Retire Early. They are sort of in the same camp as Munger, though not as Munger-rich. They did not come into any windfall though they do tend to work in professions that pay well.

That plus living on way less than what they make is what sets them free early in life.

You can choose to retire and become a beach bum but folks who have the drive to get financially independent early are not the types into bumming. It is just that they now get to choose on what they want to work on. So leaving the retire early part out from FIRE, the FI part is completely doable for many.

And that even with taking a good deal of lifestyle inflation into account as with the gradual climb in spending shown by the red curve above.

What you don’t want are dramatic ups and downs in spending as your income changes. That it a stressful way to live and brings along with it a whole lot of issues, especially for kids growing up in that environment.

So, where is the most difference you can make in terms of spending? Housing of course takes up the lion share. Then cars and then comes the other itty-bitty stuff.

Personal finance experts love to rail against spending on things like buying coffee that in the grand scheme of things is inconsequential while the biggest boondoggles of the monthly spend remain unaddressed.

And pretty much all of it comes down to being able to differentiate between needs versus wants.

Let’s go back to housing for example. In 1950, the average new home in these United States was 1,000 square feet. By 1970, that home size grew to 1,700 square feet and these days, it is around 2,600 square feet. All this while, the average family size dropped from 3.54 in the 1950s to 2.53 today.

So, we have less people living in almost 3x the living space. And that doesn’t even count all the extras of the more we pay on everything – taxes, insurance, electricity, water plus all that time spent on cleaning and maintaining that extra space.

And bigger homes mean more stuff. So, a perpetual drain on our wallets from multiple angles.

And most of the needless spending we get seduced into doing is all due to our attempts at keeping score. We want to live, drive and dress better than our neighbors or whoever we get into this comparison game with.

Comparison is the death of joy.

Mark Twain

Carol Graham in The Pursuit of Happiness talks about what constitutes the economics of happiness. Stable marriage, good health and enough (but not too much) income is what it takes to be happy.

What? What’s the deal with not too much income? Why would making more money not make us happier?

That’s because the relationship between money and life satisfaction is not linear. Income matters to individual well-being only up to a point. Beyond that, other things like the incomes of others start to matter more. So, a rise in other people’s income hurts our happiness. That of course is stupid.

The truth is that folks with enduring personal finance success are inclined to not give a damn about what others think about them. And this is where our focus in life should be if happiness is our goal.

On the surface, personal finance looks like a field that helps you optimize money. Once you peel back the layers, you see that it’s actually a field that helps you optimize happiness. Money is simply the tool it uses to do so.

Morgan Housel

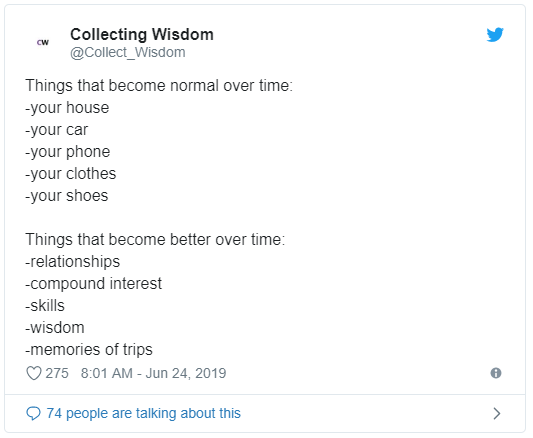

And finally, this tweet. It says in a few words that I’ve been meaning to say all along.

So, a big part of happiness is reaching FI (financial independence) and FI is basically a function of being happy with what you have, spending less than you make and time. Plus, relationships, experiences etc. etc. but never things.

That does it. Thank you for your time.

Cover image credit – Pixabay