A widely known way to value a stock is its price to earnings ratio. It tells us what investors are willing to pay for each dollar of profit a business behind that stock earns.

The other way to look at that same information is by flipping that ratio upside down. That is, earnings divided by price or the earnings yield.

That is your yield today when you own that stock.

That earnings yield must be greater than a similar duration but safer investment or else why would you invest in that stock?

Stocks as we know are ownership stakes in businesses and their aggregate value depends upon profits and the growth rate of those profits.

And profits are unpredictable. They may come. They may never come.

So, there are risks with stock ownership and you want to get compensated for taking on those risks. And hence the equity risk premium.

But premium over what?

Stocks are long duration assets which means you must wait a while for profits to flow back to you on your investment.

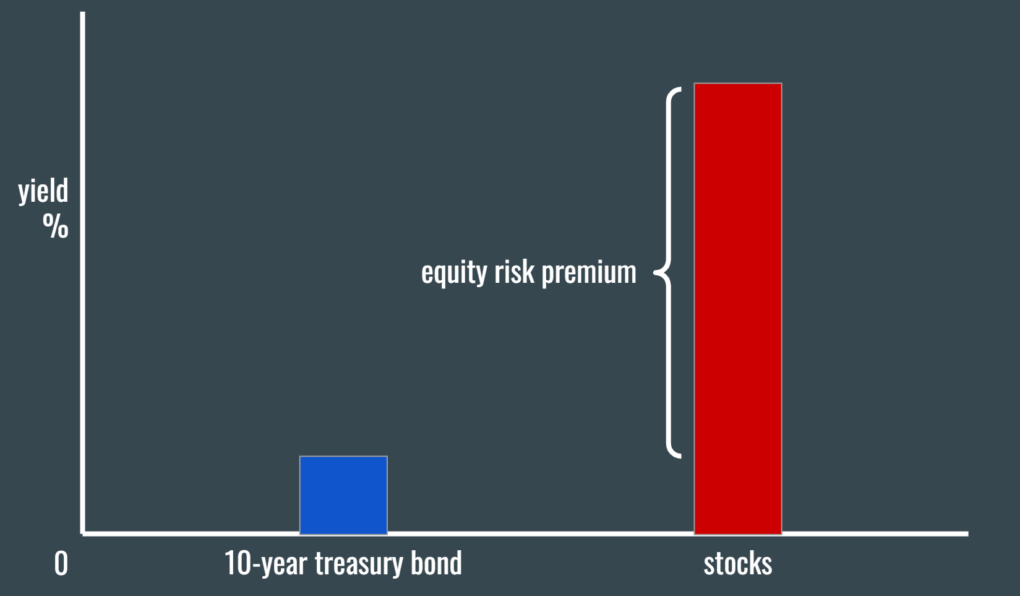

So, when you decide to invest in stocks, you’d want to compare that against a similar duration and of course a safer benchmark investment. And the safest of them all that matches an aggregate stock market’s approximate duration is the 10-year Treasury bond.

So, you’d want to compare the yield on the 10-year Treasury bond with the earnings yield of your stock or better yet, a basket of stocks.

That extra yield that stocks earn over bonds is the equity risk premium you expect to earn. That is the market compensating you for taking on the risk of investing in businesses.

And depending upon what is going on in the economy at any given time, that risk premium can change.

Coming out of traumatic economic times and you’ll see some of the widest risk premiums and the best of times to invest.

When everyone is fat and happy, stupidly making money is when the risk premiums are the narrowest. And those usually are the worst times to invest.

But come to think of it, everything and anything to do with making investment decisions, almost everything boils down to that 10-year Treasury bond yield. It is like a linchpin that guides all capital allocation decisions – in your home, at your business and with your investments.

The lower that yield, the lower the discount rate. The lower the discount rate, the lower the hurdle rate and the more bloated everything becomes.

And when that yield changes to the upside, everything gets a reset…to the downside.

Keep that yield in sight, always.

Thank you for your time.

Cover image credit – Jinto Mathew, Pexels