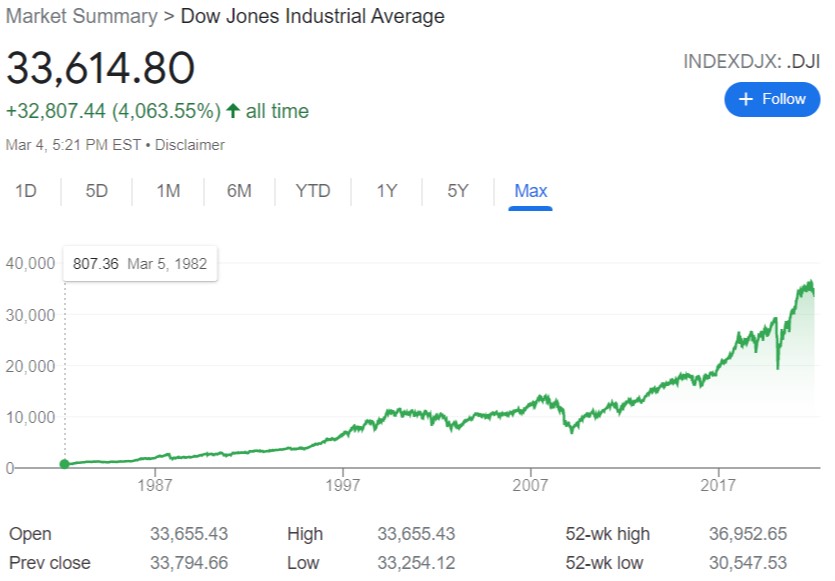

A wise woman once said that when in doubt, zoom out. So zoom out I did. This is what a 40-year chart of Dow Jones Industrial Average looks like…

Add in reinvested dividends and we are looking at an easy double of that.

Or if you want to get exotic, here is what the Indian stock market did in a typical investor’s lifetime.

There are peaks and valleys and sometimes those valleys don’t recover for years. That is the nature of the game.

You can control the depth of those valleys by including bonds. The ride will be smoother, yes, but it will cost you in returns.

That may be okay for you but if you can afford the volatility and you measure your time horizon in decades, a big tilt towards stocks is what you need.

So, some perspectives the next time markets show their usual manic-depressive side…

– If you’ve owned stocks since the 2000s or since the nineties or the eighties and if you hung on, you did well. Just peek at what your portfolio has done over the very long-term. That outsized gain you see is the very reason you were investing in the first place.

– And of course, you can’t dance your way in and out of the markets. Because you know how absolutely crushing the impact on your wealth would be if you’d miss just a few of the market’s best days. If you still insist on abandoning everything and going to cash when times get rough, how would you know when to get back in?

– Your goals don’t change that often and nothing about any short-term events changes the fundamentals of capitalism. There is a reason why you own a heavy dollop of stocks. Volatile as they are but the equity risk premium stocks deliver over other investments in the long run is what is going to get you to your goals.

– Not everyone can take the heat, of course. And maybe you are one of them. But think about what else are you going to do with your savings. When you own stocks, you own cash-flowing businesses. The world runs on businesses.

– But if you still can’t take the heat, you’d have to restructure your investments for a less volatile portfolio. But then you’ve got to be prepared to save an ungodly sum of money to sustain the quality of life you desire through a very, very long retirement.

Your best defense against doing anything rash with your money is know what you own and why you own it. Once you gain conviction, blissful ignorance is your next best bet.

And who would not want to own a piece of this?

My litmus test for whether the world economy will create value over time is asking the question – Did more people wake up this morning seeking to solve problems and make life better for others than do the opposite? And the answer is still firmly “yes”.

Morgan Housel, Collaborative Fund

This is a decades long game. Sticking to our plans in times of turbulence is our only option.

What am I doing? I am buying. I am always buying.

My daughters are buying. And they’ll always be buying.

So should you.

Thank you for your time.

Cover image credit – Wendel Moretti