Crypto is not an investment. It can never be an investment. The United States dollar is not an investment. The Japanese yen is not an investment. The Euro is not an investment. None of these are investments. They are all currencies.

The latter ones at least are.

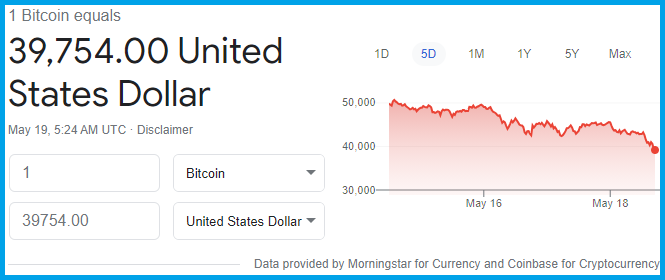

Crypto is not even a currency. Anything that does this…

…with one tweet from Elon Musk can never be a currency.

That’s on bitcoin. And of course, the hate from the cultists follow.

Most cults end badly, especially the ones that involve money.

It’s amazing to watch something come out of nowhere and get to a point where bitcoin trades at today. Because it’s a work of complete fiction. There are no cash flows with bitcoin. There is no intrinsic value.

And there apparently are thousands of such cryptocurrencies as of the date of this writing1.

https://coinmarketcap.com/all/views/all/

So, what is to say that something better would not come along and replace the ‘utility’ that bitcoin supposedly provides today. There is no proven utility of bitcoin yet in its decade-plus years of existence.

Cryptos could become a medium of exchange someday but mediums of exchanges are not investments.

Bitcoin is the epitome of survivorship bias. We all know about it because it is the most popular and the most ‘successful’ of all cryptocurrencies.

But just because bitcoin has done whatever it has done does not mean it was a good investment. It was never an investment.

And there is no reason why it could not have turned out like this…

From hundred dollars to zero in weeks.

All cryptocurrencies will eventually find a similar fate. They are literal Ponzi schemes. There is nothing justifying their prices except that you must find a Greater Fool who’ll buy them from you at prices higher than what you paid for them.

Cryptocurrencies only seem to “work” when prices are going up. On the way down, nothing functions as it should – a trait common to Ponzi schemes throughout history.

Lionel Laurent, Crypto’s Chainsaw Massacre Bloodies Digital Exchanges, Bloomberg Opinion, May 12, 2022.

And the heartaches and the agonies that unfortunately follow the implosions of Ponzi schemes…

At their height, luna and UST had a combined market value of almost $60 billion. Now, they’re essentially worthless.

The entire episode has laid bare the advantages of experienced large-scale investors over retail investors gambling on hope.

One person posted on Reddit that they didn’t think they would have enough money to pay for their next semester at school after losing money on luna and UST. Another investor affected by the crash tweeted that she and her husband sold their house and bet it all on luna, noting that she was still trying to digest whether it was actually happening or just a nightmare.

Others are contemplating suicide after losing all they’ve got.

“I’m lost, about to commit suicide in a chair,” one commenter posted to Reddit. “I lost my life savings in the investments of (LUNA UST) the worst thing is that 3 weeks ago I proposed to my girlfriend. She doesn’t know anything, I lost 62 thousand dollars. I’m here I don’t know what to do.”

MacKenzie Sigalos, Some investors got rich before a popular stablecoin imploded, erasing $60 billion in value, CNBC, May 29, 2022

The linked CNBC piece above is a must read if you want to know what truly goes on behind the scenes. While the trying-to-get-rich-quick John Q public was loading up on Luna, the schemers and the promoters were quietly dumping their wares on to them – a classic pump and dump scheme with tattoos and all.

And Do Kwon, the main schemer behind the creation of cryptocurrency Luna weeks before the collapse…

Can you ever imagine a Buffett or a Bogle behaving like this?

And if crypto is your investment thesis to get you from where you are to your goals, there is no thesis. It’s a gamble. It’s Vegas money without the Vegas fun.

Don’t sleep-walk through life playing these random games and hoping things will pan out. Because soon you’ll be 60 and wondering where your time and money went.

And did I make it clear that cryptocurrency is a giant Ponzi scheme? Maybe I didn’t but Sohale Andrus Mortazavi writing for Jacobin surely did.

Thank you for your time.

Cover image credit – Markus Spiske, Pexels

1 May 21, 2022