Alice Schroeder in her book, The Snowball describes how Warren Buffett acquired shares in the Coca-Cola company. Buffett had been wanting to buy Coca-Cola shares for quite some time but couldn’t because they never got cheap enough for his taste. The 1987 stock market crash gave him that chance.

The world, though, knew who Buffett was so if the news of him buying Coca-Cola shares leaked out, the stock price would jump and he’ll be sad.

Plus, he wasn’t the only one buying. The Coca-Cola company itself was buying back its shares as it was such a great deal. A company buying back its shares and retiring them is an indirect form of dividend payment to the shareholders that remain. It increases the ownership stake in the company for the existing shareholders which then gets reflected in a higher share price.

So Buffett was buying shares and so was Coca-Cola. And they kept buying in as hush-hush a manner as possible for months.

Buffett, through Berkshire, now owns 10% of the Coca-Cola company. Berkshire receives $750 million in dividends from Coca-Cola each year. That’s the total amount he paid for the shares. That’s getting the original investment back in cash dividends each year, literally forever.

Buying some of the world’s best businesses as a forever hold while letting them do their thing is how you win. Where is the money for you then? The money is in the direct (cash) and indirect (share buybacks) dividends that ultimately flow to you as a shareholder. Dividends are an outcome of profits and businesses are in the business of making profits.

And you are not in this game to exchange pieces of paper with each other. You are in this game to own great businesses for the long-term and partaking in the profits these businesses deliver in the form of dividends.

And you’d want to pay as little as possible for those profits. I mean if you are getting to buy a business at 20 times their annual profits, would you be happy if the price of that business doubles while profits remain the same? No you won’t be because any new money you invest in buying shares of that business, you are paying double the price for the same dollar of profits. No sane business owner would want that.

So imagine getting excited with rising stock prices. Because unless you are done investing forever, that’s the last thing you’d want.

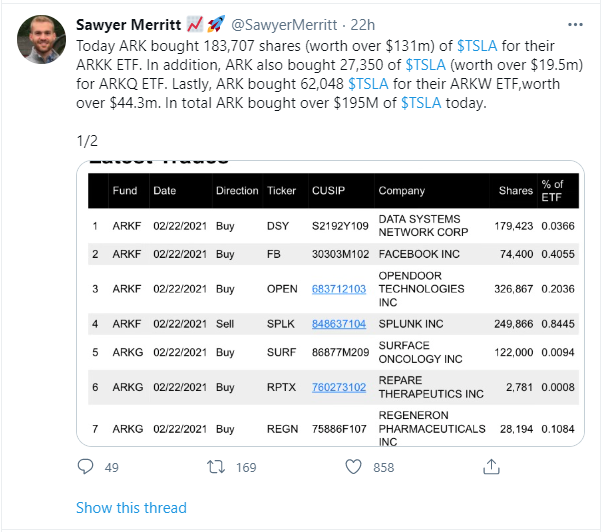

What then explains this cultish behavior we sometimes see around us, highlighted in the tweets below? I mean why would you want to tell the world about a business you own that it is such a great deal? That is not investing. That is implying a Ponzi-type setup where the poster wants to profit off of short-term price changes on someone else’s dime.

Ownership-oriented investors don’t care what a big institution has to say or does…

And if you thought that was cultish, the crypto world is another level cultish.

Bitcoin has a price but it has no value. The whole of crypto has no value. It is a heist. But if I thought bitcoin was so great, I wouldn’t be telling the world about it.

Real investing is not trading in and out of investments. Real investing is not investing in fads, cults and literal Ponzi schemes (crypto).

And real investing is definitely not whatever this is…

Real investing is about long-term business ownership. Real investing is about profits and dividends. Anything less is a waste of your time, your money and your life.

Thank you for your time.

Cover image credit – Anete Lusina, Pexels