Robert Stock earned a bachelor’s degree in physics from Princeton university and a doctorate from Carnegie Mellon. He spent nine years working as a researcher in the Directed Energy Group at MIT’s Lincoln lab where he performed simulations of high-energy laser systems for missile defense.

He later switched careers to money management and ran the Spruce Alpha fund. The fund’s investment philosophy…

The Spruce Alpha Fund seeks to generate high alpha, low beta, and low correlation returns by identifying daily-resetting, highly-levered ETFs experiencing volatility decay, and shorting them in bull and bear pairs.

Clear? Not to me. I could dig a bit deeper, but I do not have the patience. I do not want to have the patience.

In less than a month, the fund went from being operational to going belly-up. Mr. Stock has since moved on and is doing just fine. Investors in the fund though lost bigly.

James Cordier, CEO of the now defunct OptionSellers.com ran a $150 million hedge fund. He was a long-time proponent of using ‘naked’ options to trade in the volatile energy market. In several articles and in a book, he touted the potential rewards of his investment strategy in producing consistent returns. He had this to say in one of the interviews …

We target 25% return per year. In 2015, which just ended, we achieved 28% return for our clients (net of fees). Which is good considering the stock market returned about 2% and most of the hedge fund guys had a lousy year.

A mere months later, this headline…

Wiped-out hedge fund manager confesses he lost all his clients’ money in emotional video on YouTube

The reason Mr. Cordier lost all his investors’ money…

After months of relatively subdued price action, volatility in U.S. natural gas futures returned with a vengeance last week, surging as much as 20 percent on Nov. 14 for their biggest intraday gain since 2010. The price swings in gas, as well as in oil, were a “rogue wave” that “likely cost me my hedge fund.”

Who knew selling naked options can turn catastrophic? These schemes work well until they don’t, just like this story below…

When William Mark decided to get back into investing after the 2008 financial crisis, he looked past stocks and bonds. Needing to play catch-up with his retirement portfolio, the piping engineer decided to bet on a complicated product he hoped would deliver double-digit annual returns.

It worked so well—earning him 18% a year in dividends, on average—that he eventually poured $800,000 into the investments, called leveraged exchange-traded notes, or ETNs. When the coronavirus pandemic hit, he lost almost every penny.

“I’m 67 years old and I’m basically bankrupt in just two weeks,” Mr. Mark said.

‘Bankrupt in Just Two Weeks’—Individual Investors Get Burned by Collapse of Complex Securities by Akane Otani & Sebastian Pellejero, The Wall Street Journal, June 1, 2020

Alliance Structured Alpha funds managed tens of billions of dollars for pension funds and endowments. They ran a complicated option-selling strategy, purported to produce stock-like returns with low risk.

The hedge fund blew up spectacularly during the Covid crash. It turned out they weren’t hedging much when their mandate was to hedge.

The stories can go on and on. And the folks running these schemes are no dummies. They are the best in their class.

But these supremely overconfident gunslingers are precisely the folks that should frighten you. These Type A money managers use complexity as a mirage to mask their Vegas-style investment strategies. They will double your money in a year and then suddenly you lose it all.

Takeaways, hence…

- Easy money-making opportunities are seldom real. Because if they were real, they would be exploited out of existence in a split-nanosecond by an army of some of the world’s best and brightest.

- Claims of returns significantly exceeding bond yields with little to no risk is a fairytale you will be told to sell you on overly complex investments with non-transparent sources of returns. Don’t believe any of that. Ask questions, be skeptical. Do not assume that just because brand-name firms or authority figures are involved that all is well.

- You cannot build conviction in things you do not understand. All investments go through good times and bad. And when you do not understand what you own, you will not know if those bad times are temporarily bad or forever fatal. Losing conviction then is when you make big mistakes; like selling when you should instead be buying.

- It is easy to assume that investing is hard and because it is hard, you need to make it complex. But the more complex you make it, the more risks of the unknown kind you invite. Those unknown risks are what causes portfolios to go poof.

- It is not the end of the world if you are late to the investing game. But shortcuts to lost time are few and far between. There are knobs you can tweak that offer outcomes with far more certainty but attempting to fast-track the process is a fool’s errand.

- Ninety percent of investing is managing yourself and not your money. Once you build a good-enough plan, what matters, and what will always matter, is a commitment to that plan – next month, next year, for life.

Thank you for your time.

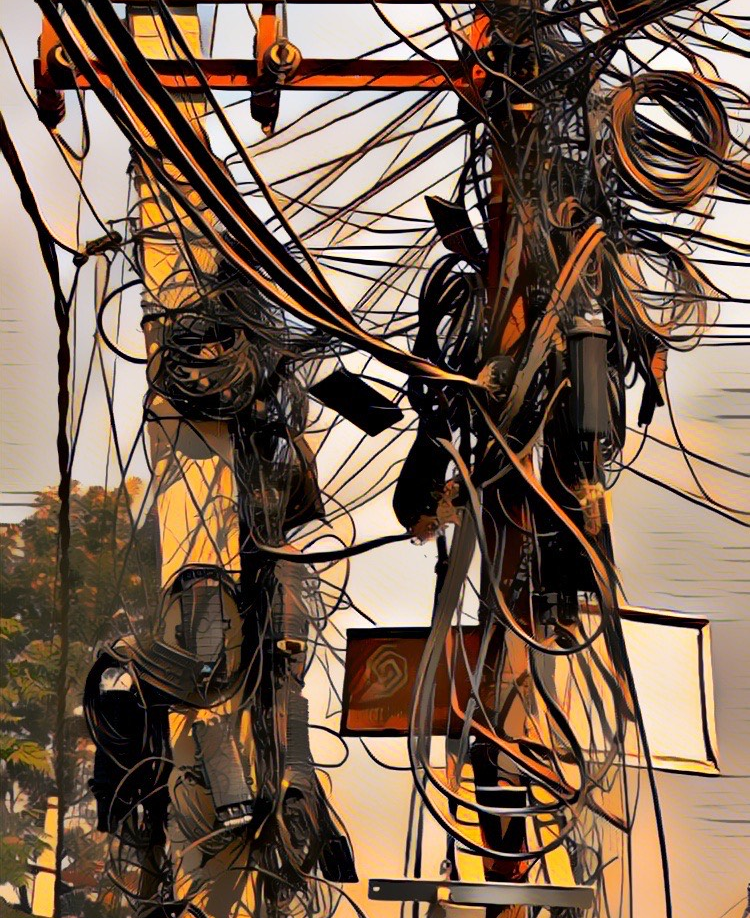

Cover image credit – Rabin, Pexels