Post-World War II retirement planning was easy. We had pensions. There was income from Social Security. And we had our own savings. Those three things made up for a sturdy three-legged stool that took us though a worry-free retirement.

Pensions have all but gone the way of the dodo bird. The Social Security situation is not looking as hot. All we are left with is our personal savings. How good of a job we do preserving and growing our savings is what will count.

Charles D. Ellis et al talk a lot about these things in their book, Falling Short.

Just 30 years ago, most American workers were able to stop working in their early sixties and enjoy a long and comfortable retirement. This “golden age” of retirement security reflected the culmination of efforts that started more than a century ago when employers first set up pensions. Gradually, over decades, we built an effective system with Social Security and Medicare as the universal foundation and traditional pensions – where the employer was responsible for all the saving and investment decisions – providing a solid supplement for about half the workforce. The increasing provision of retirement support allowed people to retire earlier and earlier. This brief golden age is now over.

Pensions allowed us to pool life expectancy risk with our fellow plan participants, which meant not needing to save as much. And with professional money managers at the helm of these plans meant no thinking about retirement planning, ever. They did their job, and we did ours.

401(k)s replaced pensions. That was never the intent though. But here we are, and things will never be the same again.

The unique structure of the 401(k) can be attributed to the fact that, when 401(k) plans began to spread rapidly in the 1980s, they were viewed mainly as supplements to employer-funded defined benefit pension and profit-sharing plans. Since participants were presumed to have their basic retirement income needs covered, they were given substantial discretion over key 401(k) choices, including whether to participate, how much to contribute, how to invest, what to do when changing jobs, and when and in what form to withdraw funds during retirement. Today, 401(k)s still operate largely under these same rules even though they are now the primary plan for most workers. As a consequence, workers have almost complete discretion over investment and savings choices, bear all the market risks, and face the risk of either overspending and outliving their retirement savings or spending too cautiously and consuming too little.

The three-legged stool of the past was in fact quite generous. We rarely had to dip into our savings.

During the 1980s and 1990s, Social Security benefits took households a long way toward meeting the 75 percent income replacement goal. At that time, the replacement rate from Social Security for the typical earner at 65 was about 40 percent. If that earner had a nonemployed wife, the Social Security benefit rose to 60 percent. Add any employer-sponsored pension income to that base and the total replacement rate would match or exceed the 75 percent target.

Social Security is not going to fall apart but a fix is needed. It is just too important a deal.

By law, Social Security cannot spend money it does not have. Therefore, if nothing is done before the trust fund reserves are exhausted in 2033, Social Security benefits would be cut by about 25 percent to match benefits going out with taxes coming in. The replacement rate for the typical worker aged 65 would drop from 36 percent (today) to 27 percent (starting 2033) – a level not seen since the 1950s.

And a fix is needed because the current state of retirement does not look as hot. I know this is not my audience, but this is the average Joe.

And let me explain why the situation does not look as hot. The median wage for a 64-year-old about to retire, based upon government data is $64,000. Add spouse’s wage and that takes it to $100,000.

A 75 percent income-replacement goal in retirement means $75,000 that’s needed to support the same pre-retirement lifestyle.

Say half of it comes from Social Security which means another $37,500 must come from personal savings. Safe money to retire on is 25 times the income you need in your first year of retirement. That is 25 x $37,500 which is almost a million dollars.

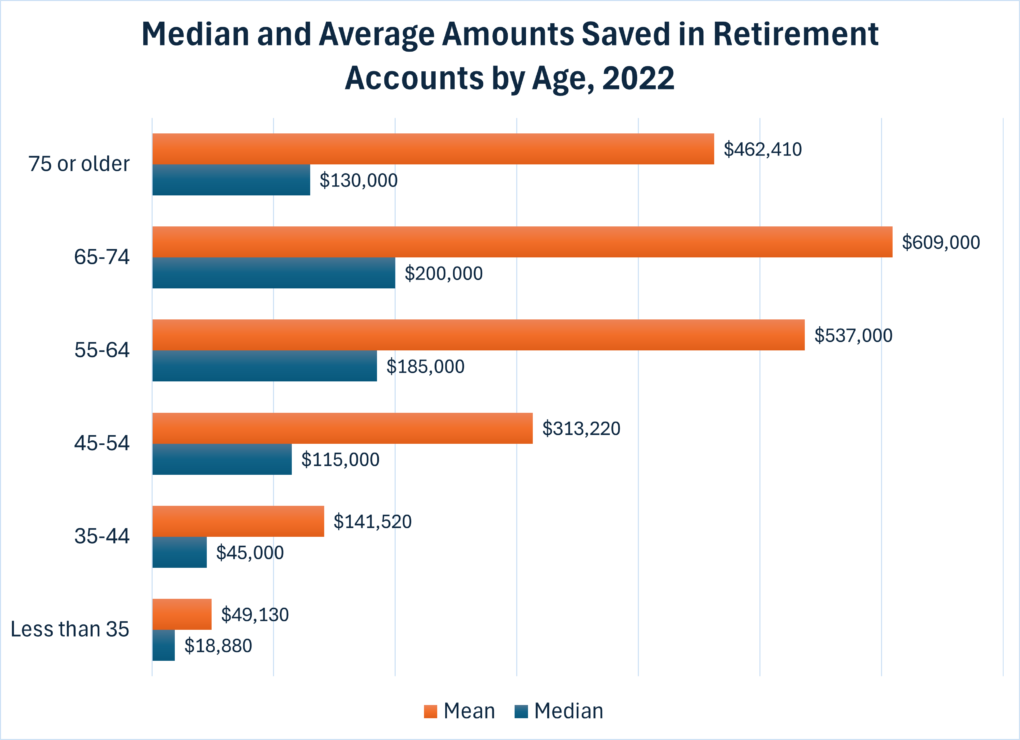

The median amount saved though is $185,000. And we are talking median households which implies half of us are doing way worse.

So, what do you do if you find yourself in this situation? It’s a hard pill to swallow but delaying Social Security benefits to age 67 and preferably to age 70 helps bigly. That may mean working longer but some amount of purposeful work is not going to be the end of you.

In fact, it might keep you around longer and happier.

But people who fare the best in retirement find ways to cultivate connections. And yet, almost no one talks about the importance of developing new sources of meaning and purpose.

One participant, when asked what he missed about being a doctor for nearly 50 years, answered: “Absolutely nothing about the work itself. I miss the people and the friendships.”

An 85-year Harvard study on happiness found the No. 1 retirement challenge that ‘no one talks about’ by Marc Schulz, CNBC, March 10, 2023

And to the young folks starting out, if you want a life of choices, you got to get on a plan like right now. The difference between starting to save at age 25 to get to that same 75 percent income replacement goal in retirement means you have to save only 12 percent of your income. That instead of having to save 35 percent of your income if you wait till age 45. Imagine saving 35 percent of your paycheck while raising a family.

Thank you for your time.

Cover image credit – Karolina Grabowska, Pexels