I wish we would see a day when a majority women are at the helm of our businesses and the markets. I wish child-rearing, toddler-totting mothers someday rule Wall Street and investment houses across the globe.

Consider me biased being a dad to two beautiful daughters but there is plenty of anecdotal evidence that corroborates the fact that women not only are more judicious risk-takers, but that trait also helps make them better investors. They make for better business leaders because they focus more on sustainable, long-term profit maximization instead of the usual gun-slinging, macho-capitalistic, short-termism that is the norm in today’s male-dominated world.

Plus, the protective, nurturing instincts women bring to the table would undoubtedly make the world a better place while reducing systemic risks and the associated savagery the world has endured since time immemorial, mostly again due to male domination in business, politics and the markets.

Case in point, Iceland, a country that right up until 2008 was rated by the United Nations Human Development Index as the best place to be a human being on this planet earth.

And then it almost went bankrupt when three of its largest banks collapsed, holding debts more than 10 times the size of that country’s GDP and in turn impinging a lot of grief and misery on its generally happy citizens.

The country’s almost entirely male-run banks levered up big and gambled customers’ savings into ‘can’t lose’ investments that turned out to be so complex that no one had any clue what they owned.

And no one cared to ask the hard questions because all parties involved were making money hand over fist in the years leading up to the collapse. The only financial company that survived and remained profitable throughout that episode – Audur Capital, an almost all-women run firm.

Iceland’s doing fine now because the country learned its lessons and put in place a set of laws requiring that the system be adequately represented by the fairer sex at all levels of government and businesses. A segment from this Der Spiegel link sums that episode well.

“The crisis is man-made,” claims banker Halla, 40, who like all Icelanders, is only addressed by her first name. “It’s always the same guys,” she says. “Ninety-nine percent went to the same school, they drive the same cars, they wear the same suits and they have the same attitudes. They got us into this situation — and they had a lot of fun doing it,” she says. Halla criticizes a system that focuses “aggressively and indiscriminately” on the short-term maximization of profits, without any regard for losses, that is oriented on short-lived market prices and lucrative bonus payments. “It’s typical male behavior,” says Halla, who compares it to a “penis competition” — who has the biggest?

That brings us to this aptly titled paper, Boys Will Be Boys by Brad M. Barber and Terrance Odean of UC Berkeley’s Haas School of Business. It concludes that men in general, trade their portfolios 45 percent more than women and earn annualized risk-adjusted returns that are 1.4 percent less than those earned by women. These differences are more pronounced between single men and single women; single men trade 67 percent more than single women and earn annualized risk-adjusted returns that are 2.3 percent less than those earned by single women.

And I know the reasons why. Some of us are compulsive gamblers and cannot help ourselves. Others think that they are in this race, and they must beat this other guy at this ‘game’. Why worry about the long-term when you get to brag about the killing you just made on this one stock with no mention about the rest of the losers you own in your portfolio?

The problem though is that this is widespread. I see it all the time. Why are you holding so much cash? Oh, I thought the market was going down, so I cashed out my 401(k).

Really? That was the reason you sold? When you sold, someone else bought. Who do you think that someone else is?

But then when the market eventually recovers, which it invariably does, they remain stuck. That one blunder sets them back years if not decades.

And we all know who makes most of these market-timing calls? Almost exclusively the men in the households.

And if you see what I see out there with the portfolios I encounter, it makes me wonder if they would have been better off locking their money off in annuities and junky whole-life policies. At least they wouldn’t be able to touch their savings without encountering stiff withdrawal penalties. And I can almost bet that most would do better with these egregiously inferior products than what they currently do with their investments.

But enough talking about the folks who appear to know what they are doing and let us talk about the folks who should have known what they were doing. They had seemingly cracked the code to endless profits with never a loss in sight.

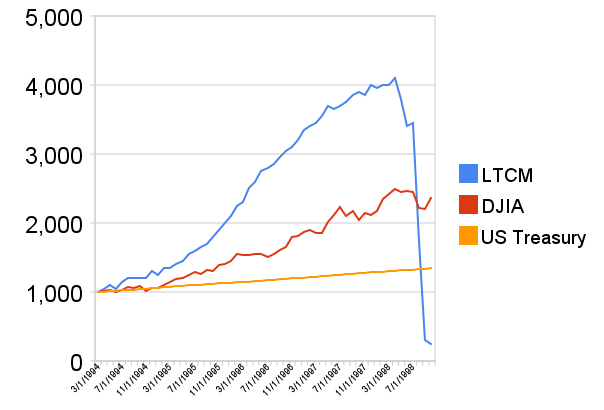

And all Nobel-laureates at that and of course all men, who started Long Term Capital Management (LTCM), a hedge fund that tried to capitalize on bond mispricing and to really make a killing, they levered up 25 to 1.

It worked like a charm until it didn’t, and poof went all the money – literally overnight.

This is just one example of many of the supposedly best in the business and almost exclusively all overconfident men at the helm running people’s life savings into the ground.

But back to why I think women are genetically predisposed to be better at investing is because we know they’ll approach this entire process from the safety-first angle.

Many of the great financial disasters we’ve seen have been failures to foresee and manage risk.

Howard Marks

That overconfidence, that self-delusion is seldom found amongst women. They are more likely to ask questions, seek help when needed and in general, don’t tend to go near the “too hard to understand” pile.

That is the general theme around how I invest my own money and the money our client families entrust us with. I am waiting for the day where I can build a portfolio of mostly women-led businesses that offers me just the right amount of diversification. And I bet when that portfolio eventually rolls around, it’ll beat the pants off of any other portfolios you could find.

That day is not here yet, but it is coming and we should all welcome it because in this fight between testosterone and estrogen, we want estrogen to win. Our future is riding on it.

And a message to the wives, the mothers and the daughters out there, you need to get involved with what is happening with your household finances. This is supposed to be a family affair after all, and for the clients we serve, we intend to keep it that way.

Thank you for your time.

Cover image credit – Jonathan Borba, Pexels