Businesses make capital allocation decisions such as expanding factories or investing in new tech with the intent of recouping their investment over timeframes that span years and decades. Not all capital allocation decisions pan out but the process that is followed is with the intent of getting as high a return on investment as possible.

And the capital that a business needs can come from reinvestment of profits back into the business and if that is deemed inadequate, raising capital from the capital markets.

And raising capital from the capital markets can mean issuing shares or borrowing through banks or the bond market.

So, imagine a bank lending you money to help you buy your home and then turning around and asking for their money back the very next day? Banks of course can’t do that by law, but you see how absurd that sounds.

So why should we approach the allocation of our savings any differently? Because believe it or not, structurally we are making the same kind of capital allocation decisions as a business or a bank makes – long-term, risk-optimized, goal-oriented.

And just like how a business won’t expect a return on their investment right away, you shouldn’t either. Exchanging pieces of paper (overtrading your portfolio) with your next-door neighbor or far worse and likely more plausible, with Goldman Sachs, is not how you get rich.

You get rich through long-term ownership of businesses while receiving a portion of the profits those businesses in aggregate generate in the form of dividends and share buybacks and letting the businesses reinvest the profits that remain, back into their respective businesses. That last part by the way is where the true magic lies, not just for you but also for society.

We have it so good these days that we forget how far we have come in a mere span of a century where the poorest of the poor in most advanced economies live far richer lives than John D. Rockefeller, the richest man alive of the time. There were no TVs back then. There was no internet, no air-conditioning, no airplane travel, no mobile phones and not even penicillin1.

Free-market capitalism, with entrepreneurs and businesses constantly working to find new ways to profitably invest and reinvest into their businesses to serve their customers and ultimately their shareholders is what made widespread access to all these wonders possible. We want that machine to continue churning out the good stuff but that takes time and that is not possible with a short-term mindset.

But we are unfortunately hardwired to think in the short-term.

Human nature desires quick results. There is a peculiar zest in making money quickly…compared with their predecessors, modern investors concentrate too much on annual, quarterly and even monthly valuations of what they hold, and on capital appreciation.

John Maynard Keynes

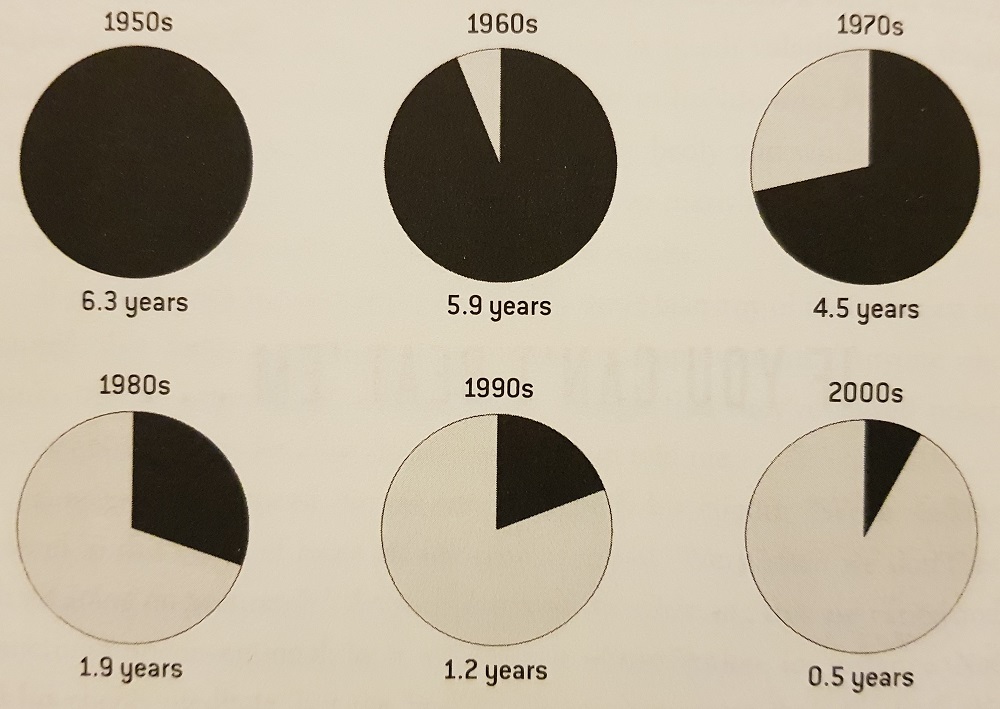

And the data proves it.

The Signal and The Noise by Nate Silver

Plus, the gamification of the investing process these days with instant access and micro-second level updates to what is happening to our money of course does not help. It incentivizes us to act thinking that doing something helps.

But this bias towards action is rat-poison for your money. And to the game of soccer. What?

Michael Bar-Eli, et al. in a paper published in the Journal of Economic Psychology, highlights how this action bias amongst elite goalkeepers hurts a team’s chance with scoring goals. Soccer as we know is a low scoring game (about 2 goals on average) where a penalty kick is a big, big deal. A team that earns it has an 80 percent chance of scoring a goal.

The stakes hence are high and pretty much all the burden of preventing a goal from being scored comes down to how the goalkeeper acts. The authors of the study analyzed data on 311 penalty kicks and found that the direction of the kicks was roughly evenly distributed between the left, center and the right quadrants of the goal box.

But the goalkeepers displayed a distinct action bias by diving to the left or to the right 94 percent of the time instead of choosing to remain in the center. Because had they done that, they could have saved 60 percent of the kicks aimed at the center, a far higher number than they did by diving to the left or to the right. The goalkeepers however stayed in the center only 6 percent of the time.

So knowing that, why would they still dive rather than stand in the center? Because they wanted to appear as if they were making an effort even though making an effort was clearly disadvantageous.

Similarly, this bias towards action in investing makes us feel better, thinking that at least we are making an effort. But that is precisely the wrong thing to do and you are likely going to do that at precisely the worst possible times.

Investing should be dull. It shouldn’t be exciting. Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas, although it is not easy to get rich in Las Vegas, at Churchill Downs, or at the local Merrill Lynch office.

Paul Samuelson

Your money is like a bar of soap – the more you handle it, the less you’ll have.

Eugene Fama

But this preferred bias towards inaction does not mean you don’t do nothing. There are still things that you have to get right, and they pertain more to learning how to not act than act. It is an evolutionary process that comes with time through continuous refinement until you get to a point where you are more likely to subtract and simplify than to add and complicate your money.

The outcome of the process then becomes a three-stage exercise:

- Defining a portfolio’s purpose, ideally based upon the foundation of a solid financial plan.

- Building a structure that supports that purpose. That is where asset allocation and a glidepath towards optimizing that allocation over time come into play.

- Finding products that fulfil that structure.

You only mess with the last stage if the products you chose have drifted away from their intended role or if any aspect of the first or the second stages change.

Let the rest of the world waste their lives chasing hot stocks and watching CNBC. You work on getting the process right while continuing to refine at the margins and you’ll not only be at peace with your plan, but you’ll also be at peace with your work, your family and your life.

Cover image credit – Kuiyibo Campos, Pexels

1 David Henderson. “Richer than Rockefeller“, Econlib. February 8, 2018.