Let me introduce you to Jason. He retires in the year 1969 with the year 2022 version of a million dollars. That is, he retires in the year 1969 with an amount of money that has the same purchasing power as what million dollar buys in the year 2022.

And he knows a thing or two about the ravages of inflation and hence, to preserve his purchasing power, he has his entire retirement kitty invested in the stock market.

And he has also heard about the 4% rule. That is, if he were to draw 4% from the starting value of his portfolio and adjusts that amount in the subsequent years to match inflation, he in theory would never run out of money for a planned 30-year long retirement.

Bella on the other hand, retires a year later (1970) with the same million dollars in 2022 purchasing power. Her retirement portfolio is invested just like that of Jason‘s in the stock market.

And she expects to draw the same 4% from her portfolio and inflation-adjust that amount each year for the same 30-year long retirement.

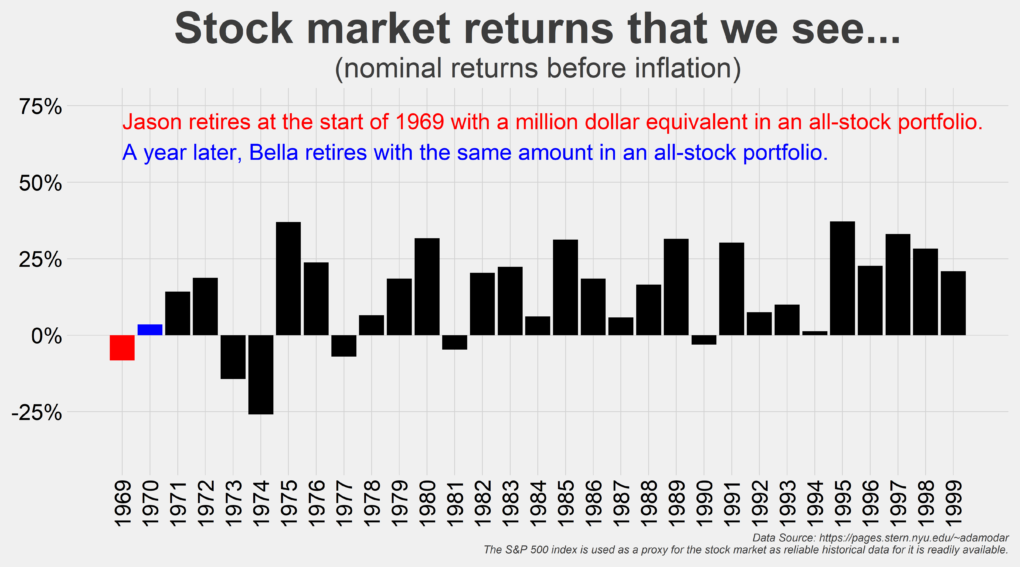

And these are the portfolio returns each one of them experience.

Jason‘s retirement starts on January 1, 1969 and ends on December 31, 1998. That is a 30-year span of drawing inflation-adjusted income that we talked about.

Bella retires on January 1, 1970 and is done retiring by December 31, 1999. That again is the same 30-year span of drawing inflation-adjusted income from her portfolio.

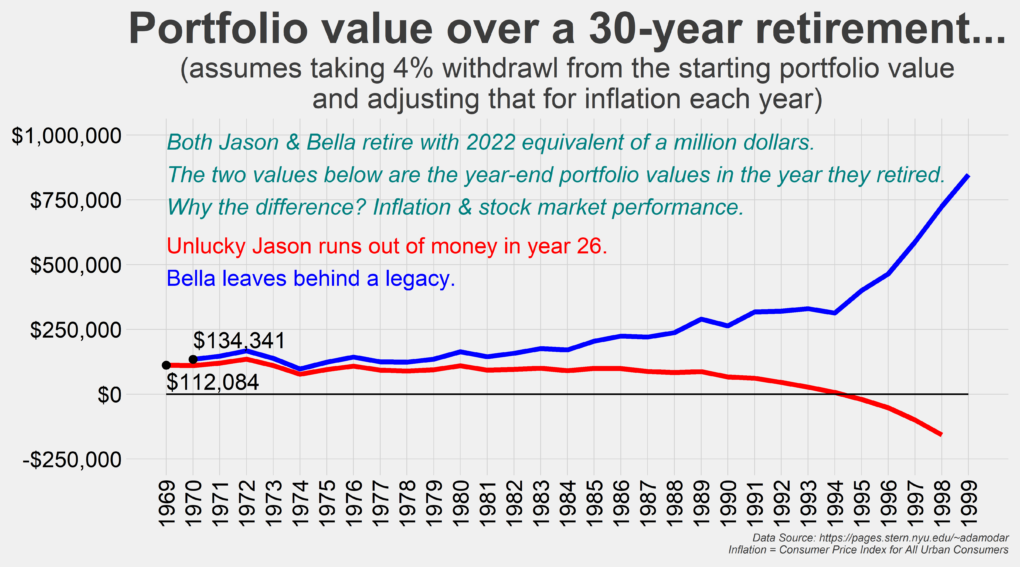

So where is the big deal? I mean you don’t expect to see much difference between the two scenarios, right?

But there happens to be a world of difference between the two. Jason exhausts his portfolio in the 26th year of his planned 30-year retirement.

Bella on the other hand, leaves behind a sizable chunk as legacy.

Maybe that was not her goal but the fact that her portfolio is able to deliver on the income she planned while leaving behind that kind of money is striking. And that is just because she retired a year later.

And the money that Bella left behind are in 1999 dollars. If that money were to be left invested in the same portfolio, it would easily surpass $3 million today.

So, what made all that difference? Inflation and the starting year stock market performance.

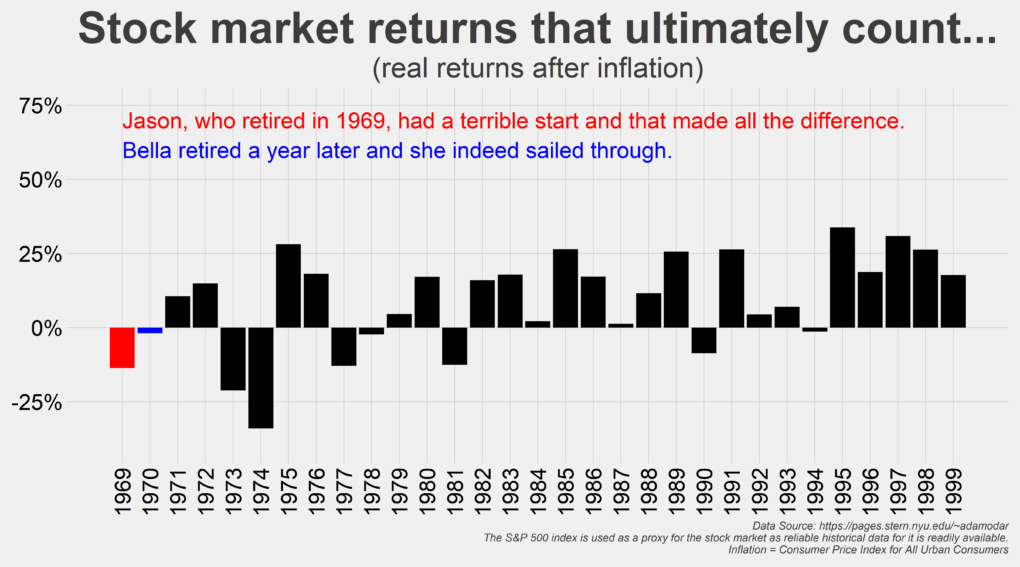

The real, after inflation returns for both are as shown below.

Jason‘s money took a big hit right off the gate while Bella‘s didn’t suffer as much. Jason, hence, was drawing income from a smaller portfolio value than that of Bella‘s and that made all the difference.

So, some takeaways…

- Jason likely just got unlucky. Out of the 66 periods of 30-years each (starting in 1928), there were only five such periods where one could have run out of money following the 4% guideline. And remember, this timeframe accounts for the world enduring depressions and recessions, World Wars and oil embargos, inflationary and deflationary times, bubbles and busts and yet only five such periods. That’s not to say that we should be complacent because future market returns could be lower but again, not as dire a situation as I probably made it sound.

- Most retirement portfolios, as one nears the point to start drawing income, would not be holding all stocks. And even if they did, they would or should not be holding stocks in one market, exposed to one type of investments so the chances of a retirement outcome like that of Jason can be further mitigated by diversifying right.

- No living soul that the world knows off will watch the inflation index and adjust his or her spending precisely in line with what the latest numbers show. I talked about the retirement spending smile before and most normal earthlings won’t spend what they think they’ll spend as they are in the thick of their respective retirements. And I am especially talking about the types that got this far into reading stuff like this.

- And if leaving behind a chunky legacy is your goal, you might want to ratchet down that safe withdrawal rate from 4% to say 3% of your portfolio value. Folks (and their inheritors) who are truly in a catbird seat are the ones who can live a great life on 2% of their money. They can completely ignore what the markets do because if done right, their money at that withdrawal rate will last forever and beyond.

- But that is not to say that we ignore doing some of this number-crunching. Life expectancies are on the rise and planning for a mere 30-year long retirement is increasingly going to be a thing of the past, especially if you retire early.

Thank you for your time.

Cover image credit – Ron Lach, Pexels