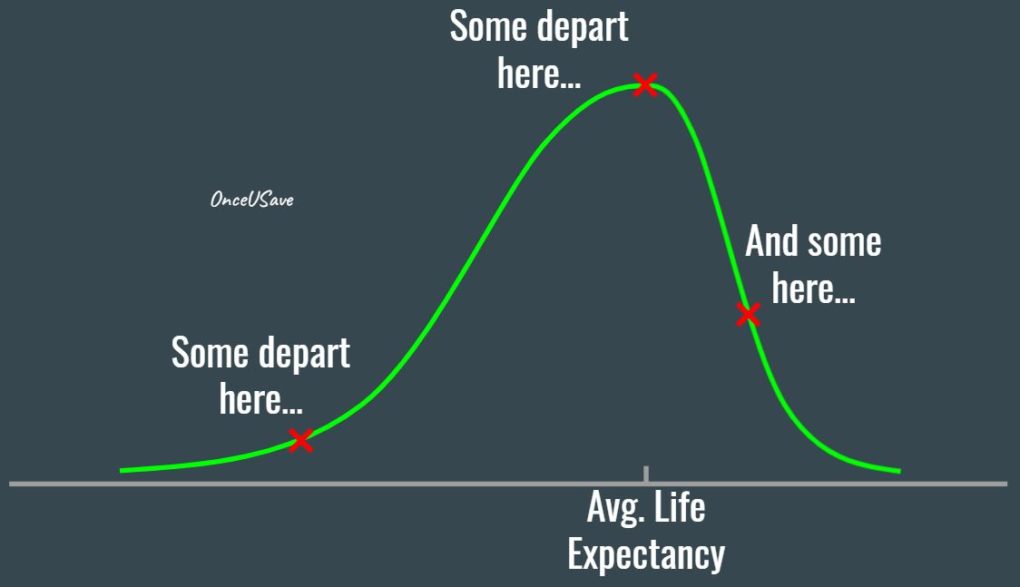

How long are you going to live? Average life expectancy today for a typical American is about 80 years.

And it is somewhat distributed like this…

It is skewed left because some unlucky few will lie on the extreme left of the distribution, a major chunk will live close to the average and some to the right of that average. That is today and this distribution will shift right over time as life expectancies continue to rise.

So, if you are planning your own retirement, what life expectancy would you assume? Because that is the holy grail. You know that and the rest is easy.

But we do not know that and that is why retirement planning is so tricky.

That was not always the case though.

Most employers offered something called a defined benefit pension plan. A pension plan fundamentally is a risk-reduction setup, designed to guarantee that no one who participates in that plan goes without income during retirement.

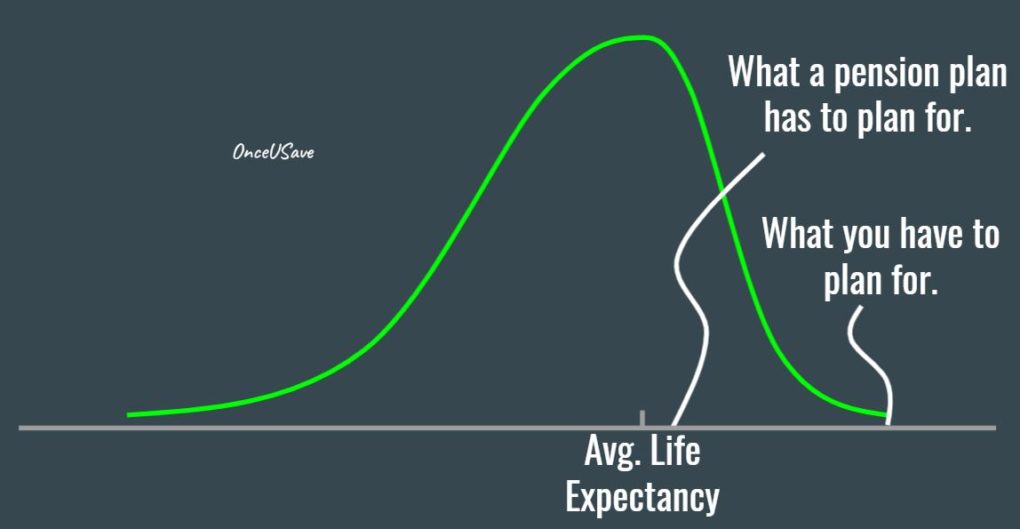

And because life expectancy risk gets pooled in a pension plan means that we did not have to save as much. Folks dying early paid for those who lived longer. All that was required of the plan to remain solvent was to have enough assets to cover life expectancies up to just to the right of the average life expectancy to accommodate for some buffer.

And not just that, the employers we worked for hired the best number crunchers money could buy to design a plan that lasts. You didn’t have to lift a finger. You needn’t need to know what the markets or the economy were doing at any given time. You just did your life’s work and the rest fell in place.

But pensions plans have gone the way of the do-do bird. The businesses who offered these plans do not want anything to do with them. Why would or should a company in the business of making widgets take on this added burden and mostly, a liability of financial planning for their employees?

And who sticks around long enough to avail themselves of a pension these days anyway?

So, for all these reasons, you now must design your own pension plan. Not only do you have to invest right during your accumulation years, but you also must take the money out rightly from the many accounts you’ll own through your life in your distribution years.

But how long do you need to make your money last? Unlike a traditional pension plan, you now need to account for the fact that you could be a demographic outlier. That is, you might live way beyond what life expectancy tables show.

So, you have to design your own pension plan and because there is no pooling of life expectancy risk, you have to save more, much, much more than what you would have had to if you had access to traditional pensions.

But all is not lost in this game because unlike traditional pensions, your one-participant plan does not need to generate income till you retire. Your portfolio, hence, can afford more risk than what a traditional pension plan can. That then helps reduce the amount you need to save each year by some factor.

Plus, if you do happen to save more than you will ever be able to spend, the leftover assets are there to bequeath as you please.

That is not the case with traditional pensions because you depart from this planet and your pension departs with you. There are no assets to bequeath.

So that is all good but then many of us still invest by the seat of our pants. Markets sell-off and we panic. Markets ride high and we get euphoric. Most do not invest with a pension like discipline and structure. For this and many other reasons, I wish we could somehow go back to the retirement savings system of the past.

Because if you read what I read on how ill-prepared we are as a country on the retirement savings front, you’d be depressed. Because it will be a burden and the ill-prepared are going to bear the brunt of it.

Thank you for reading.

Cover image credit – Pedro Ribeiro Simões, Flickr