Annuities are insurance products. And insurance is an expense. It is never an investment.

What do you get for that expense? Risk reduction (definition of insurance) but above all, peace of mind.

You buy life insurance to protect your loved ones from financial ruin in case you unexpectedly pass away. There is an insurable need there because you do not want your grieving family to have one more thing to deal with after you are gone.

There always must be an insurable need before you go near any insurance product. Your kids do not need life insurance as no one is financially dependent on them.

Yet they are still sold; the dumbest thing you can do with your money. It is like buying car insurance for your 5-year-old daughter.

That brings us back to annuities. We can make them as complex as complex can get but annuities quite simply are income guarantee plans.

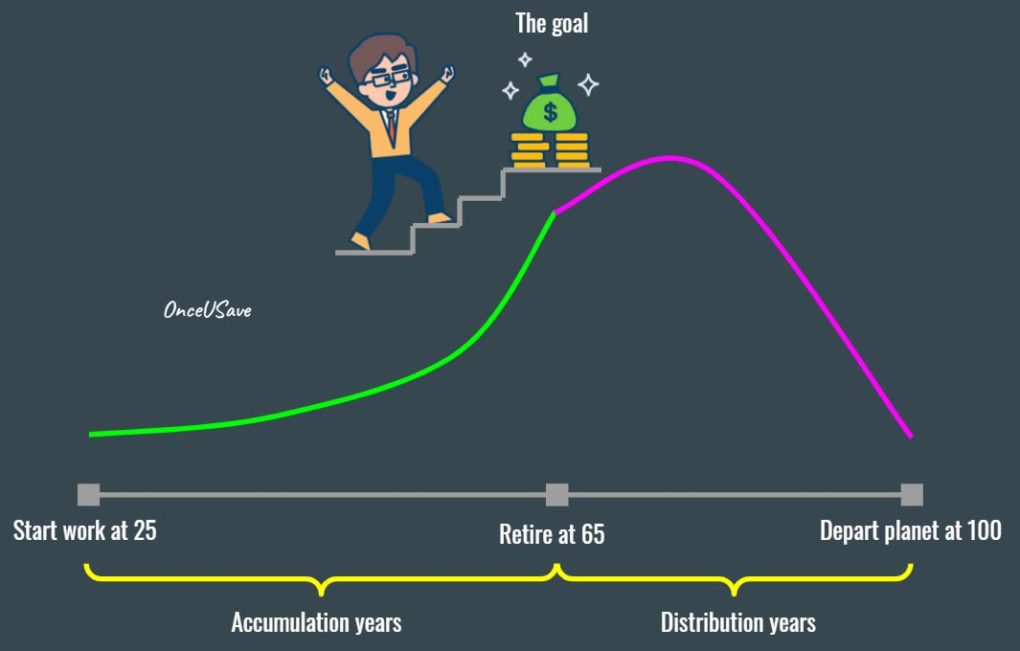

This below is a timeline of a typical saver…

There are accumulation years and distribution years. Accumulation years are when you set aside money in a portfolio of investments to help you reach your retirement goal. You then trickle out of those investments each year to live on until you depart this planet. Trickling out of your accumulated savings is the same thing as annuitizing or pensionizing your savings.

When you reach your goal, you have a decision to make. You can pensionize your savings on your own or you can give those savings to an insurance company and purchase say a Single-Premium Immediate Annuity (SPIA).

You’d then be guaranteeing yourself a certain fixed amount of income for life. No worrying about the markets or the economy. As long as the insurance company is around, you’d get your “paycheck”.

What does the insurance company do with your savings? They pool your cash with cash from say a million other customers and invest in a portfolio of investments that outearns what they have to pay out. They must outearn what they pay out because insurance businesses are not in the business of losing money. If the markets do not deliver as expected, the insurance company gets that money from you through increased costs for their products.

But if you die the day after you buy that annuity, life’s tough. That money is gone because you are indirectly paying for someone who happens to be in the same insurance pool and lives to be one hundred years old.

So quite naturally, you’d never want to do this with all your money. You would want to annuitize, if at all, say a tiny portion of your money that guarantees a bare subsistence level of income through the end of your life. The rest should be invested like you otherwise would.

But if the job of planning is done right through your accumulation years, there is seldom a need for this product – especially if you want to leave an inheritance behind.

And if it were me and if I had to choose, this is the only kind I’d buy.

That is mostly it for annuities, but we’ll continue along to learn more about the types you should maybe consider buying and the real insidious ones that you should never go near. Because the only kind that are sold are the insidious ones so it’s good to know about them.

There is a flavor of annuity I just described and that’s Single-Premium Deferred Annuity (SPDA), also called longevity annuity. You buy this at say age 65 but defer annuitizing it (collecting income) to say age 85. This costs you less because you don’t touch the money for twenty more years, but it serves the same purpose of protecting you against running out of money in case you live much longer than planned.

But if you die at say age 84, again, that money is gone. Not necessarily a problem as it served an insurable need.

I am still not a fan of these unless a better product comes along for reasons cited below:

- You are taking a big inflation risk with them because these annuities make nominal payouts (not inflation-adjusted). You buy them for longevity insurance but guess what, 30 years of inflation will turn those dollars you’ll receive into funny money so that so-called income protection benefit fades away.

- That risk is even bigger with a deferred annuity because you are not getting paid for many, many years. That payout might look good today but when it does come, you might be sorely disappointed with its purchasing power.

- Also, you are taking a huge credit risk. These are all commercial products and though they have state guarantees, they (guarantees) are funded by the insurance industry. Most states have much lower caps on the amount that is protected and even those guarantees can fail when the insurance company fails. Just google the collapse of Executive Life Insurance.

Yet they are still all right if you truly need them, but these are not the ones ever sold. The ones you’ll be pitched are the ones that combine the accumulation and the distribution phases of a typical saver’s timeline into a single product.

And these are the ones you should stay away from. The first of its kind is an indexed annuity.

The stock market as we know is a volatile beast. It goes up and down like a yo-yo. We all love the ups but cannot deal with the downs.

So along comes this insurance salesperson, who pitches something so amazing that you cannot believe it could possibly exist. But it does.

You are going to get the up of the stock market but if the market goes down, you won’t lose money. That is the promise, and it is pushed hard every day because there is a lot of money to be made…from you.

Fancy vacations, tickets to high-profile sporting events etc. are some of the perks insurance companies shower on their agents selling these hugely profitable products. But these are the petty things.

The real money is made in commissions and the investment expenses they cleave out of your savings by the truckload at every chance they get.

Because this thing that is supposed to be an absolute grand slam for your wallet is actually a windfall for the broker and the insurance company selling it to you.

And that promise of you reaping the benefits of the stock market when it is up is never entirely true. Because what the insurers do in the contract you sign is that you get the upside of the market, but that upside is capped at a much lower number. That is disclosed deep down in their brochure in mice-type legalese that even a Harvard-trained lawyer cannot decipher.

I get these marketing materials clients send me when they are pitched these products, and they all look great on paper. But I know that is mostly fluff and the real truth only comes out once you buy them.

So yes, you get the upside but a much smaller upside.

And if you have been a stock market investor, you know that besides the gains in the value of your investments, dividends and reinvestment of dividends is where the real magic happens.

But with these products, you do not get the dividends. Who gets those dividends? You guessed it.

The second part of the promise is that you won’t lose money if the market declines. You won’t lose money only if you use the product exactly as written and stay in it for a decade.

If you need YOUR money before then, you lose the downside protection.

And then to add salt to that horrific wound, if you find out that you made a mistake and want out, you get hit with massive, gigantic, extreme penalties known as surrender charges. It is like Hotel California that you can check out of, but your money cannot leave.

The other main kind that is sold is a variable annuity and with these, the insurance company invests your money in a portfolio of investments just like you’d do in your 401(k).

Again, same sets of problems. Lots of fees and commissions up to a point where you would be better off investing your savings in Treasury bills.

So, the right kind of annuities are conditionally all right, but the wrong ones will rob you blind. Don’t do them.

Thank you for your time.