Johnny Depp was one of the highest paid actors in the world. He was worth $650 million at one point.

In 2017, Depp filed a lawsuit1 against his former business managers, accusing them of stealing all his wealth and leaving him bankrupt with a $100 million tax bill.

His business managers countersued2, claiming that Depp blew through $2 million a month to maintain his lavish lifestyle that included spending $500,000 on rental fees for storage warehouses, $200,000 for private jets and $30,000 a month on wine.

So as is evident, no amount of money is enough when the expense side of the equation remains out of whack. And his, unfortunately, is not the only story.

Bringing this discussion back into the real world, say $50,000 is all you need each year to live on during retirement after factoring in income from Social Security.

And say you’ve got $2.5 million in savings (I know, I know but hear me out) that you diligently saved through your working life. Is there a reason why you should own anything but stocks?

Standard retirement planning advice states that as you get closer to retirement, you should decrease exposure to stocks and increase exposure to bonds because as they say, stocks tend to give ulcers from time to time. That’s the basic premise of most target date funds we find in our 401(k)s.

And that’s because a portfolio of stocks mixed with bonds is expected to be less volatile, hence making systematic withdrawals possible without the risk of running out of money.

A 4% portfolio withdrawal rate has come to become a de-facto gold standard so you save up to 25 times (1/0.04 = 25) the withdrawal rate in portfolio’s value and you are technically done.

Dividend yield on stocks is around 2% so clearly, an all-stocks portfolio will run the risk of running out of money at a 4% withdrawal rate. Stocks are volatile and when you draw income when stocks are down, you won’t have much juice left when they eventually recover.

Hence you mix in bonds that usually yield (interest income) more than stocks (dividends) to smoothen out the ride.

But that’ll cost money, big money as you’ll end up with far less towards the tail end of your life…if that matters.

You end up with far less money when you add bonds to a portfolio because interest income from bonds are a cost to a business issuing those bonds. So that business needs to earn more than its input costs or else it goes extinct.

The simplest way to think about it is with how the banking system works. Banks are in the business of lending money. They take our deposits and pay us interest. They then turn around and invest our deposits to earn more on that than the interest they pay us.

And if they don’t earn more than the interest they pay us, they cease to exist. The same logic applies to businesses who go out in the bond market and borrow money. If they don’t out-earn their interest expense, they cease to exist. Hence, it is sort of structural for stocks to outperform bonds in the long run.

But say you’ve designed your happy life on $50,000 a year after accounting for income from Social Security and you’ve got $2.5 million in savings, do you then ever need to own bonds?

You don’t because $50,000 is 2% of $2.5 million that you can safely expect as dividends each year from an all-stocks portfolio.

Plus dividends grow over time. In fact, the growth rate in dividends is designed to exceed inflation. Dividends are a portion of the profits that come back to you as a shareholder of the businesses you own and businesses are not in the business of losing money.

So when input costs for a business rise due to inflation, it has two choices – either absorb those costs without raising prices for the stuff they sell and slowly wither away or pass down those costs to their end customers while preserving their profit margins.

Businesses in aggregate tend to do the latter and hence dividends continuing to outpace inflation in the long run makes sense. And the data proves that3.

But an all-stocks portfolio is going to be crazy volatile but that only matters if you make it matter.

Risk and return are inextricably intertwined. In almost every country where economists have studied securities returns, stocks have had higher returns than bonds. Further, if you want those high stock returns, you are going to have to pay for them by bearing risk; this is a polite way of saying that in the course of earning those higher returns, your portfolio is going to lose a truckload of money from time to time. Conversely, if you desire perfect safety, then resign yourself to low returns. It really cannot be any other way.

William Bernstein

But what about real estate? First, you’ve got plenty exposure to real estate if you own your home.

Second, by being owners of corporations that make up the stock market, you already have a sizable implicit exposure to real estate through real estate investment trusts and through direct ownership of physical real estate these corporations own. Take McDonald’s for example. A fifth of its market value is derived from the physical ownership of real estate that it leases to its franchises.

And last, just like interest on bonds, the rent or the mortgage you pay is also an indirect cost to the businesses you own through the stock market. The company has to pay you enough in paycheck to enable you to live wherever the company decides to create that next job and still clear profits.

If it can’t, it’ll not be creating that job which then reduces demand for real estate, eventually denting prices.

So back to drawing income from your savings, if the size of your savings can help you sustain a 2% withdrawal rate, you can choose to own an all-stocks portfolio and depart this planet with lasting generational wealth.

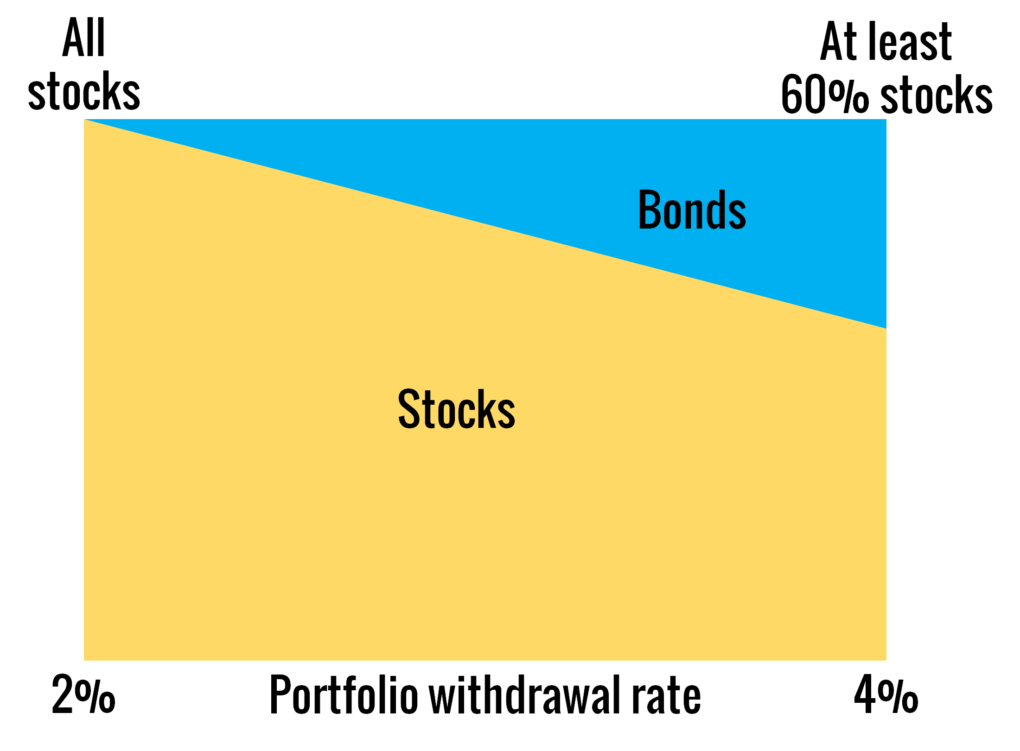

But if you need more income, then you’ll need to own bonds. Income from Social Security is literally like owning an inflation-indexed annuity (guaranteed income for life) so I wouldn’t go overboard with bonds. The guideline below is what I recommend and of course, it’ll vary based on individual circumstances.

So in short, if you are rich, you are set 🙂 – rich not just in terms of having great possessions but rich in terms of having fewer wants.

Thank you for your time.

Cover image credit – Tima Miroshnichenko

1 Stephen Rodrick. “The Trouble With Johnny Depp“, MarketWatch. June 21, 2018.

2 Eriq Gardner. “Johnny Depp Settles Blockbuster Lawsuit Against Business Managers“, The Hollywood Reporter. July 16, 2018.

3 Mark Hulbert. “You need to pay more attention to dividends — this math shows why they beat inflation“, MarketWatch. April 23, 2022.