You know the end of working for a paycheck is coming but when you are in your 20s, that end seems so far away that it might not as well come. Plus, life has a way of getting in the way.

But then you wake up one day when you are 45 and you start to get stressed. So, here’s a plan on how to get de-stressed.

The first thing you’d want to know is how much of your pre-retirement paycheck needs replacing. You won’t need the whole thing because most expenses would be done by the time you retire. Expenses like…

- Income taxes

- Mortgage payments

- Paying for college

- Saving for retirement (yes, that was an expense while you worked)

Plus, you’ll have income from Social Security which regardless of what you hear, is going to be there.

So, say that plus $50,000 a year in income is all you need.

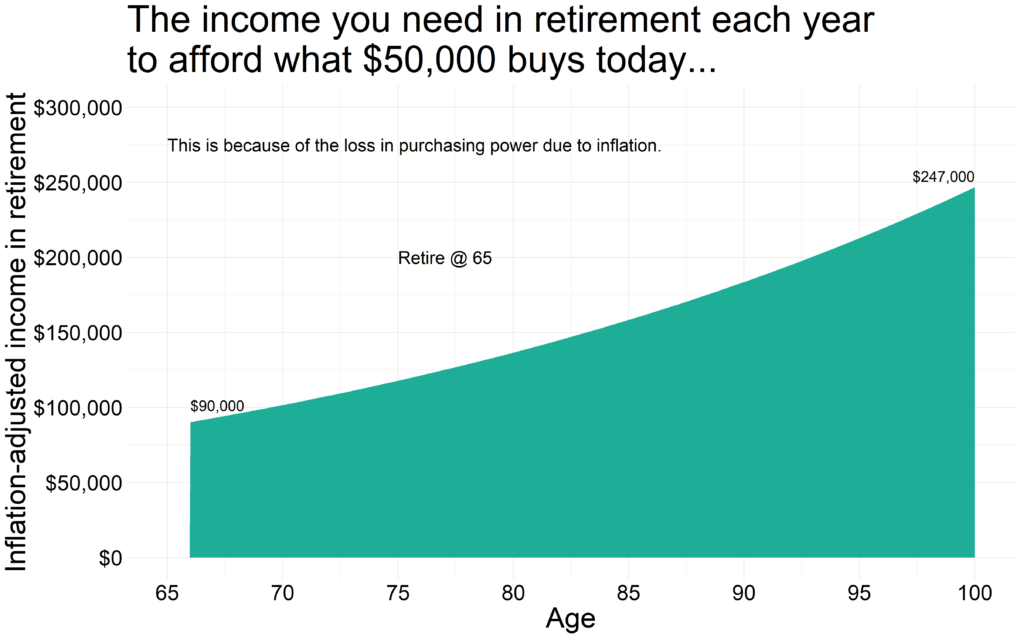

But that is in today’s dollars when you are closing out on 45. You’ll need to inflation-adjust that to when you retire, say at age 65.

So, this is what today’s $50,000 will look like when you retire 20 years from now, at age 65 and through retirement.

This is planning for a 100-year life expectancy which you might think is long but then it is not. You might not be around, but your partner might.

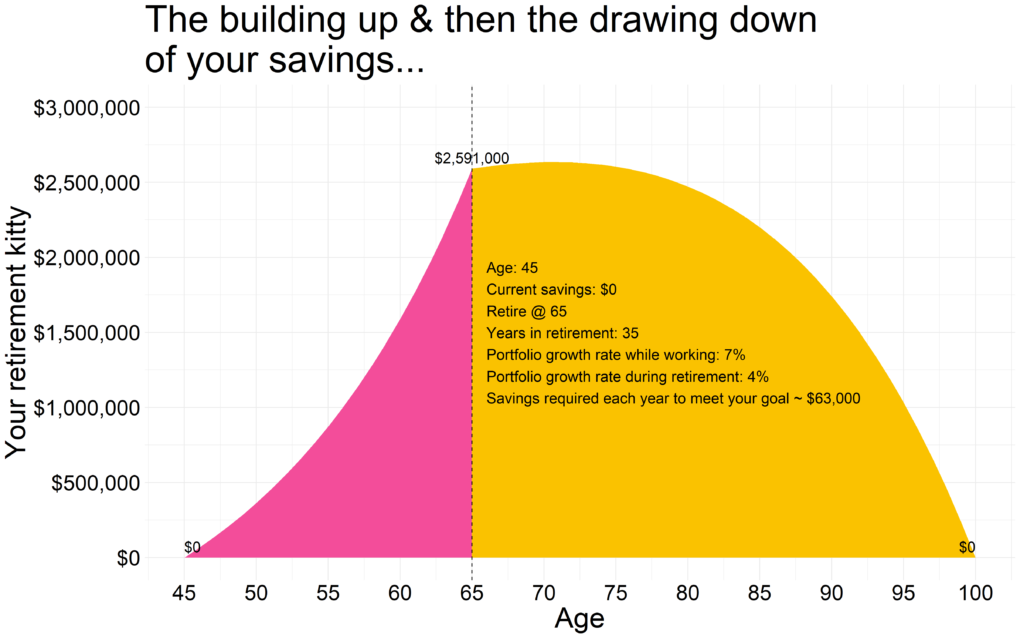

So, to recap, you are 45, just getting started with a plan to retire at 65, with a plan to draw $50,000 a year in income in today’s dollars from your savings for 35 years in retirement.

How much would you have to realistically set aside each year from now till you retire?

$63,000 😮 .

We find that number through standard annuity math that we can find in any corporate finance textbook.

And with those savings deployed into a decent portfolio of investments, this is how you’d build up and draw down your wealth…

But $63,000 is a lot of money to set aside each year but that unfortunately is the implication of lost time. And the fact that you are reading this means you are likely not starting out with zero savings so that helps lessen that burden which we’ll see later below.

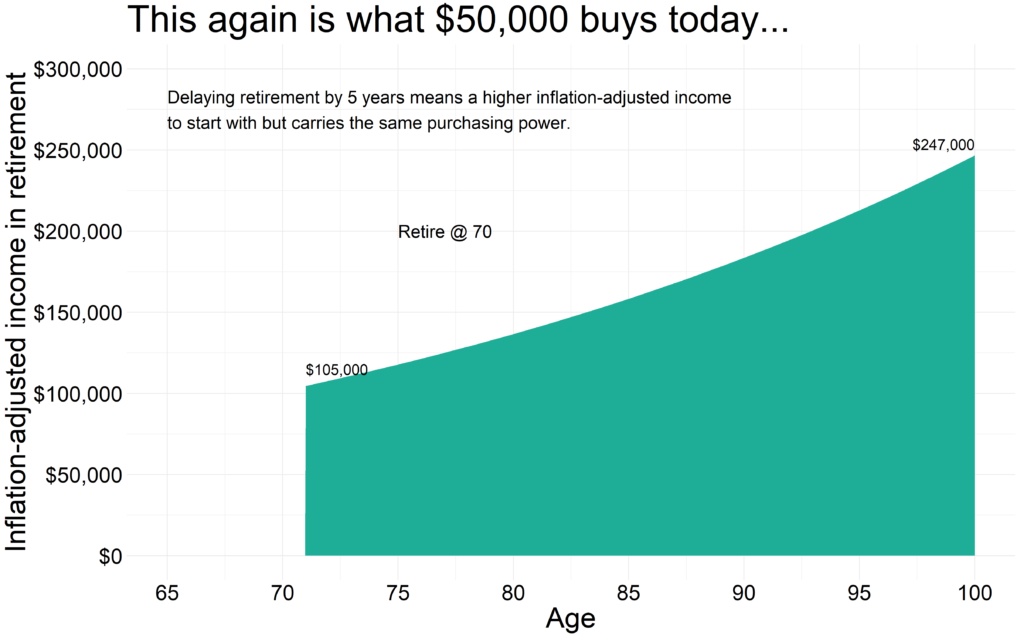

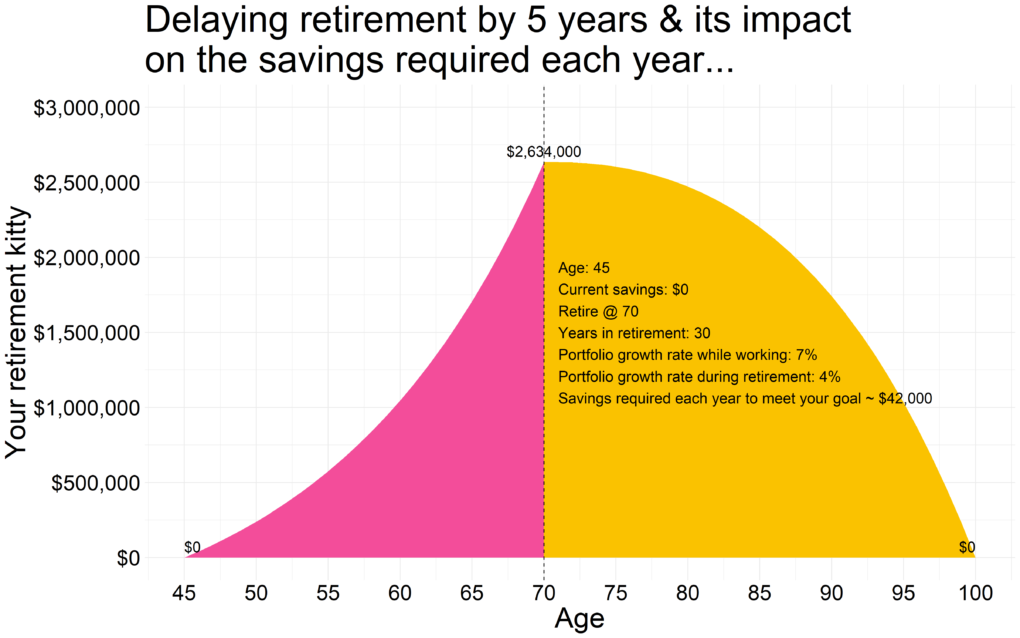

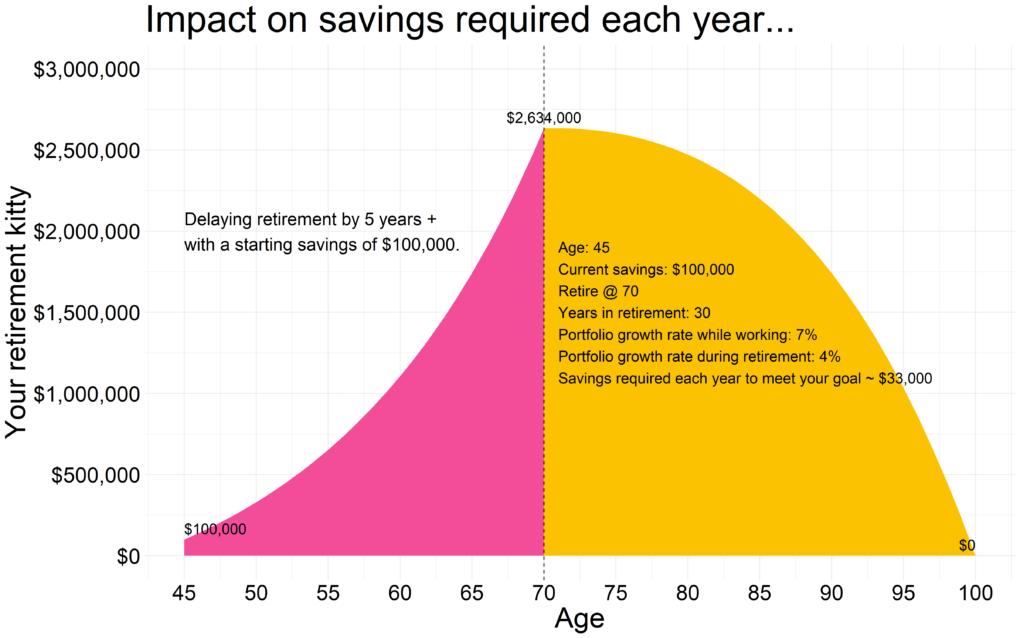

But back to the original discourse, say you could somehow delay retiring for another 5 years. That pushes your retirement age to 70 so now you only have to pay for 30 years in retirement.

This is what that same $50,000 a year in purchasing power looks like with that delayed retirement…

And the amount you need to now save drops to $42,000, a bit more manageable sum than before.

Working longer has many other benefits besides just making our finances easier. Work keeps us engaged and thinking which helps stave off diseases that mess up our brains. And if we’ve found our life’s work, we’d be happier and healthier long into old age. I say never retire but that’s me.

But back to the discourse, again, say you have been doing some savings here and there and were able to stash away $100,000 by age 45.

And with a delayed retirement to 70, the amount you need to now save each year further drops to $33,000.

That is manageable on many fronts including the fact that you can do a good chunk of it in your retirement plan at work.

So that’s a bit on how to plan for any goal, not just retirement. We can play around with the inputs but time, as we all know, coupled with systematically investing our savings into a reasonable plan sets us on easy street. And the earlier the start, the easier that street gets.

Starting late is never fun but it is what it is. Overreaching for yield to compensate for lost time is not the solution though. We control what we can and that is how much we save, how much we spend and how long can we delay the start of that spending cycle.

Thank you for your time.

Cover image credit – Andrea Piacquadio, Pexels